Key Takeaways

- Consumer-led innovations and sustainability efforts are set to bolster revenue growth and align with market trends.

- Strategic acquisitions and cost efficiencies aim to enhance market presence and boost profitability.

- Significant green coffee inflation and currency depreciation in key markets may pressure margins and impact revenue, alongside challenges in pricing strategies and digital engagement.

Catalysts

About JDE Peet's- Provides various coffee and tea products worldwide.

- JDE Peet's is focusing on consumer-led innovations, such as introducing recyclable coffee packs and launching new product ranges, which are expected to drive future revenue growth by aligning closely with consumer preferences and sustainability trends.

- The acquisition and successful integration of Maratá and Caribou, with contributions aligned to business plans, are expected to enhance revenue streams and improve profit margins as these additions bolster the company's market presence.

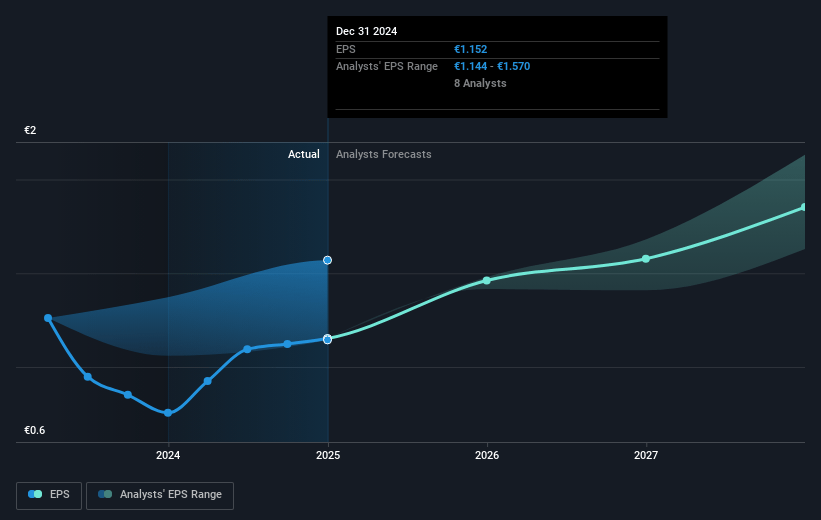

- JDE Peet's has initiated a multiyear share buyback cycle of up to €1 billion by 2028, starting with €250 million in 2025, which is anticipated to boost earnings per share by reducing the number of outstanding shares.

- The company is emphasizing cost efficiencies, particularly in SG&A and manufacturing, to fund brand investments and improve net margins, driving stronger profitability and long-term growth.

- JDE Peet's intends to sharpen resource allocation, concentrating on high-growth opportunities, which should enhance gross profit and earnings as these targeted investments generate higher returns.

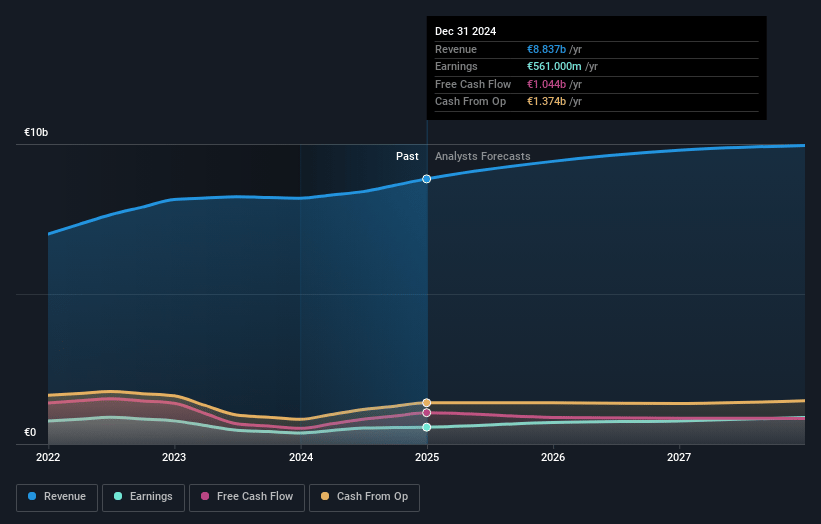

JDE Peet's Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JDE Peet's's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.3% today to 9.0% in 3 years time.

- Analysts expect earnings to reach €892.3 million (and earnings per share of €1.84) by about March 2028, up from €561.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, down from 15.7x today. This future PE is greater than the current PE for the NL Food industry at 13.7x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.78%, as per the Simply Wall St company report.

JDE Peet's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces significant green coffee inflation, with prices having more than doubled compared to the previous year, which could negatively impact gross profit if price increases do not adequately offset these costs. This may pressure net margins if not effectively managed.

- The ongoing product pricing negotiations with European retailers have resulted in delistings at major grocery chains, which could result in short-term volume declines and affect revenue.

- The company's coffee shop operations are under review due to lower profitability compared to company averages, indicating potential inefficiencies and suboptimal resource allocation, which can impact overall earnings.

- The depreciation of currencies in key emerging markets like Brazil and Turkey has negatively impacted revenues due to foreign exchange effects, adding to financial unpredictability.

- The company recognizes that it has lagged in digital marketing and consumer engagement, which could hinder branded revenue growth if not addressed promptly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €22.155 for JDE Peet's based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €28.5, and the most bearish reporting a price target of just €17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €9.9 billion, earnings will come to €892.3 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 4.8%.

- Given the current share price of €18.0, the analyst price target of €22.15 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives