Last Update 13 Dec 25

TWEKA: Stable Margins And Modest Multiple Expansion Will Support Share Performance

Analysts have modestly raised their price target on TKH Group to €49.40 from €49.00. This reflects slightly higher assumed discount rates and earnings multiples while maintaining broadly unchanged expectations for revenue growth and profit margins.

Valuation Changes

- Fair Value: Unchanged at €49.40 per share, indicating no revision to the intrinsic value estimate.

- Discount Rate: Risen slightly from approximately 8.52 percent to 8.60 percent, reflecting a marginally higher implied risk profile.

- Revenue Growth: Effectively unchanged at around 4.43 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin: Remains broadly stable at roughly 7.43 percent, indicating no material shift in profitability assumptions.

- Future P/E: Increased slightly from about 17.08x to 17.12x, pointing to a modestly higher valuation multiple on forward earnings.

Key Takeaways

- Successful plant resolutions and manufacturing efficiency are set to drive volume, revenue, and margin recovery in Smart Connectivity and Vision segments.

- Surging demand for energy cables and innovation in high-margin tech position TKH for recurring revenue growth and long-term margin expansion.

- Operational inefficiencies, shrinking margins, dependence on cyclical markets, rising debt, and unreliable guidance threaten earnings stability, profitability, and investor confidence.

Catalysts

About TKH Group- Develops and delivers smart vision, smart manufacturing, and smart connectivity systems in the Netherlands, rest of Europe, Asia, North America, and internationally.

- Successful resolution of the Eemshaven plant's operational issues and improvements in manufacturing efficiency are expected to drive substantial volume increases in Smart Connectivity during the second half of 2025 and beyond, leading to higher revenue and margin recovery as utilization normalizes.

- The accelerating rollout of renewable energy and grid infrastructure, especially in the Netherlands and broader Europe, is translating into surging demand for specialized onshore and offshore energy cables-a trend that is expected to fill capacity and potentially "sell out" TKH's onshore energy cable factories through 2026, boosting recurring revenue and supporting margin expansion.

- Heightened digitalization, automation, and the proliferation of smart vision solutions for applications such as defense, industrial quality control, and urban security are resulting in strong organic growth and margin expansion within TKH's high-tech Vision segment, positively impacting both top-line growth and profitability.

- The consolidation and restructuring of fiber optic and digitalization activities (closure of legacy Dutch and Chinese plants, fully ramping up Polish operations) are projected to bring these segments to operational breakeven in H2 2025 and profitability in 2026, enhancing earnings consistency and supporting future margin improvement.

- Ongoing product innovation (notably the UNIXX technology in high-end tire manufacturing) and strategic customer wins position TKH to capture higher-margin, service-based, and recurring revenues in both manufacturing and connectivity, supporting long-term operating leverage and higher net margins.

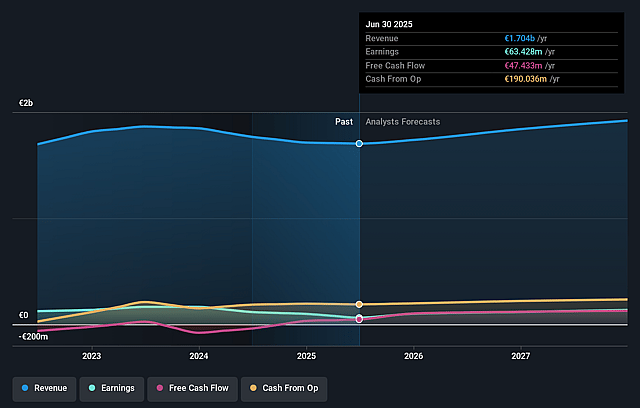

TKH Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TKH Group's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 7.1% in 3 years time.

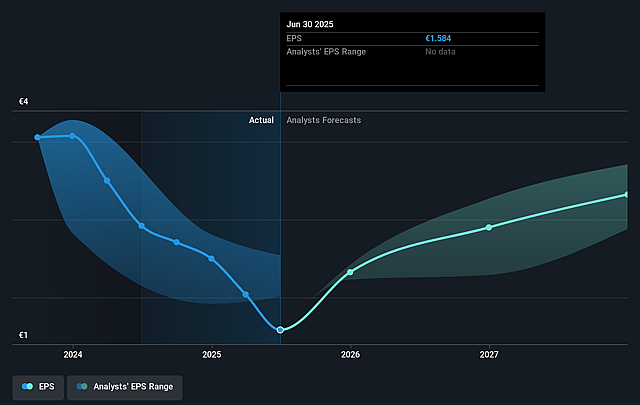

- Analysts expect earnings to reach €139.3 million (and earnings per share of €3.47) by about September 2028, up from €63.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €156.3 million in earnings, and the most bearish expecting €114.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 21.3x today. This future PE is greater than the current PE for the GB Electrical industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

TKH Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant operational challenges and production inefficiencies, particularly at the Eemshaven cable plant, have caused substantial margin pressure and highlight ongoing execution risk during ramp-up phases, risking future revenue, net margin, and earnings stability if not fully resolved.

- Recent years have seen a persistent decline in margins within the Smart Connectivity division-from 10% to 1%-suggesting structural industry price pressure, commoditization risk, and a heavy reliance on successful cost reduction and future project execution to recover profitability, which could weigh on earnings if not addressed.

- Exposure to cyclical end markets such as tire manufacturing and European infrastructure (the latter still providing over half of total group revenues) makes TKH vulnerable to downturns in these sectors, with evidence shown by the sharp drop in Smart Manufacturing orders and order book reductions, thus impacting revenue predictability and cash flow.

- Delays, cost overruns, and restructuring expenses (including plant closures and asset write-downs in digitalization/fiber optics) have materially increased the company's working capital needs and debt levels, which-if not managed alongside organic growth-could further compress net margins and limit strategic flexibility.

- The company's guidance reliability is weakened by past over-optimism and unforeseen setbacks in project execution, and increasing customer/analyst skepticism could result in lower investor confidence, potentially dampening share price appreciation even if the fundamental outlook remains positive.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €44.3 for TKH Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €53.5, and the most bearish reporting a price target of just €40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.0 billion, earnings will come to €139.3 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of €33.8, the analyst price target of €44.3 is 23.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TKH Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.