Key Takeaways

- Inability to innovate digitally and diversify geographically exposes KFH to competitive threats, economic shocks, and younger customer attrition.

- Regulatory tightening, ESG capital shifts, and integration challenges may suppress profitability and restrain both credit and earnings growth.

- Expansion into new markets, digital innovation, strong financials, ESG leadership, and supportive economic policies collectively position KFH for resilient growth and enhanced earnings potential.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking products and services in the Middle East, Europe, and internationally.

- The accelerating shift toward digital-first financial products, including increased competition from fintechs and decentralized finance, poses a structural threat to KFH's traditional revenue streams. If KFH cannot keep pace with rapid technological innovation and consumer expectations for seamless digital experiences, it will risk losing younger and urban customers, ultimately leading to sustained pressure on revenue growth and deteriorating fee income.

- The global emphasis on ESG and sustainability is redirecting capital flows away from fossil-fuel-dependent economies like Kuwait, increasing the risk of slower macroeconomic growth. This trend could result in weaker deposit growth and reduced lending opportunities for KFH, limiting expansion of the loan book and restraining long-term earnings growth.

- Persistent overexposure to the Kuwaiti market, despite recent cross-border acquisitions, leaves KFH vulnerable to domestic economic or political shocks. Any material downturn or instability in Kuwait may result in increased revenue volatility, higher credit impairment charges, and impaired earnings stability.

- Challenges in fully realizing operational synergies and risk management improvements from the Ahli United Bank merger may continue to drive up integration costs and suppress net margins, particularly if cost saves are not captured as projected, directly impacting future profitability.

- Higher-for-longer global capital requirements, the prospective implementation of Basel IV, and ongoing regulatory tightening in Sharia-compliant finance could constrain KFH's credit growth and increase compliance costs, resulting in compressed returns on equity over the coming years.

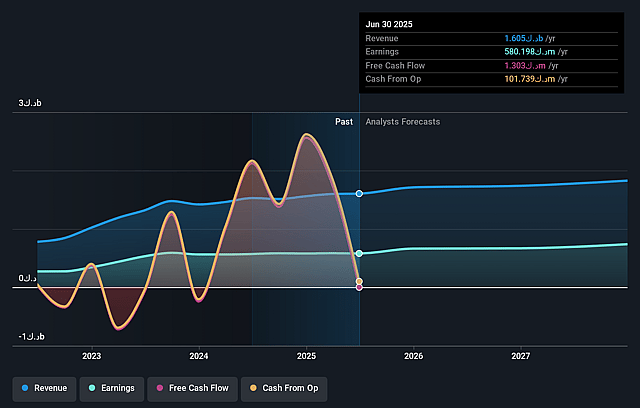

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kuwait Finance House K.S.C.P compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 36.6% today to 37.9% in 3 years time.

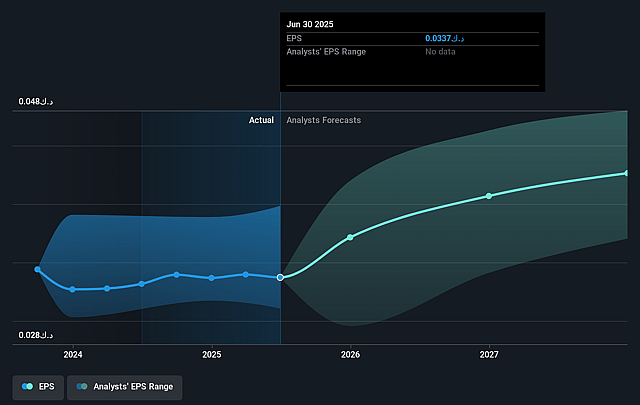

- The bearish analysts expect earnings to reach KWD 671.6 million (and earnings per share of KWD 0.04) by about July 2028, up from KWD 584.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 23.6x today. This future PE is lower than the current PE for the KW Banks industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.44%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing regional expansion and diversification, including KFH's presence in Bahrain, Turkey, Egypt, UK and Germany, as well as potential future inorganic growth in GCC markets, support resilience and create new revenue streams that could drive both income and reduce dependence on the Kuwaiti economy, positively impacting long-term revenue and earnings.

- Ongoing innovation in digital banking, cybersecurity and AI technology, along with continued development of proprietary fintech solutions and an increasing share of CASA deposits, could improve customer experience, reduce operating costs and enhance net margin expansion over time.

- Robust financial performance in 2024, with record net profits, stable asset quality, and high capital adequacy and coverage ratios, suggests a foundation for sustainable earnings and the capacity to withstand macroeconomic volatility, which can support shareholder value.

- Leadership in green finance, ESG initiatives and sustainable banking, highlighted by inclusion in notable indices and awards, strengthens KFH's franchise with ESG-focused clients and investors, potentially leading to increased fee income, brand premium and long-term revenue growth.

- Continued government-led infrastructure development, economic diversification beyond oil, and possible passage of the mortgage law in Kuwait, could create new lending and fee business opportunities for KFH, sustaining loan growth and increasing earnings over the coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kuwait Finance House K.S.C.P is KWD0.27, which represents two standard deviations below the consensus price target of KWD0.66. This valuation is based on what can be assumed as the expectations of Kuwait Finance House K.S.C.P's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be KWD1.8 billion, earnings will come to KWD671.6 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 19.4%.

- Given the current share price of KWD0.8, the bearish analyst price target of KWD0.27 is 196.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.