Last Update01 May 25Fair value Decreased 0.67%

Key Takeaways

- Successful integration with Ahli United Bank and strategic Sukuk issuance are key initiatives for enhancing revenue and earnings growth.

- Aggressive investment in green Sukuk and potential mortgage law enactment could boost net margins and loan portfolio growth.

- Strategic monetary policies, economic diversification, and mergers enhance KFH's financial resilience, revenue prospects, and operational growth potential despite economic fluctuations.

Catalysts

About Kuwait Finance House K.S.C.P- Provides Islamic banking products and services in the Middle East, Europe, and internationally.

- KFH achieved a successful integration with Ahli United Bank, increasing its operating income and potentially leading to further synergies in 2025. This is expected to enhance revenue growth.

- The issuance of USD 1 billion senior unsecured Sukuk is part of KFH’s strategic efforts to boost long-term financing sources, which could lead to lower financing costs and support earnings growth.

- KFH has aggressively increased its investments in green Sukuk by 162.3%. The move aims to capitalize on the growing ESG market, potentially increasing investment income and enhancing net margins.

- With potential future enactment of a mortgage law in Kuwait, KFH’s significant market share could benefit the bank, leading to growth in the loan portfolio and an increase in revenues.

- KFH plans to maintain mid-to-high single-digit loan growth in 2025 despite past challenges, which reflects confidence in expanding the asset base and improving future earnings.

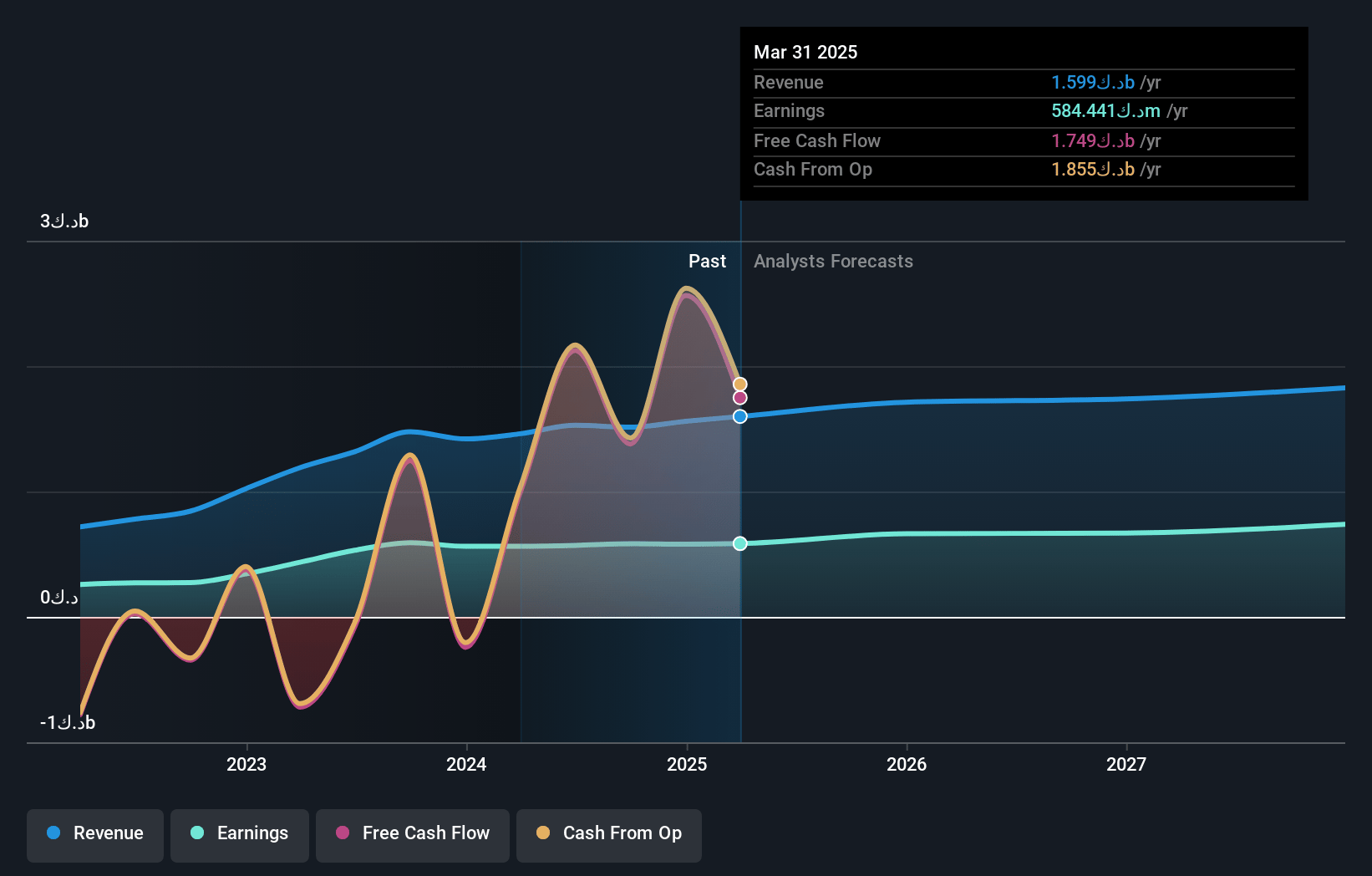

Kuwait Finance House K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kuwait Finance House K.S.C.P's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 36.6% today to 40.2% in 3 years time.

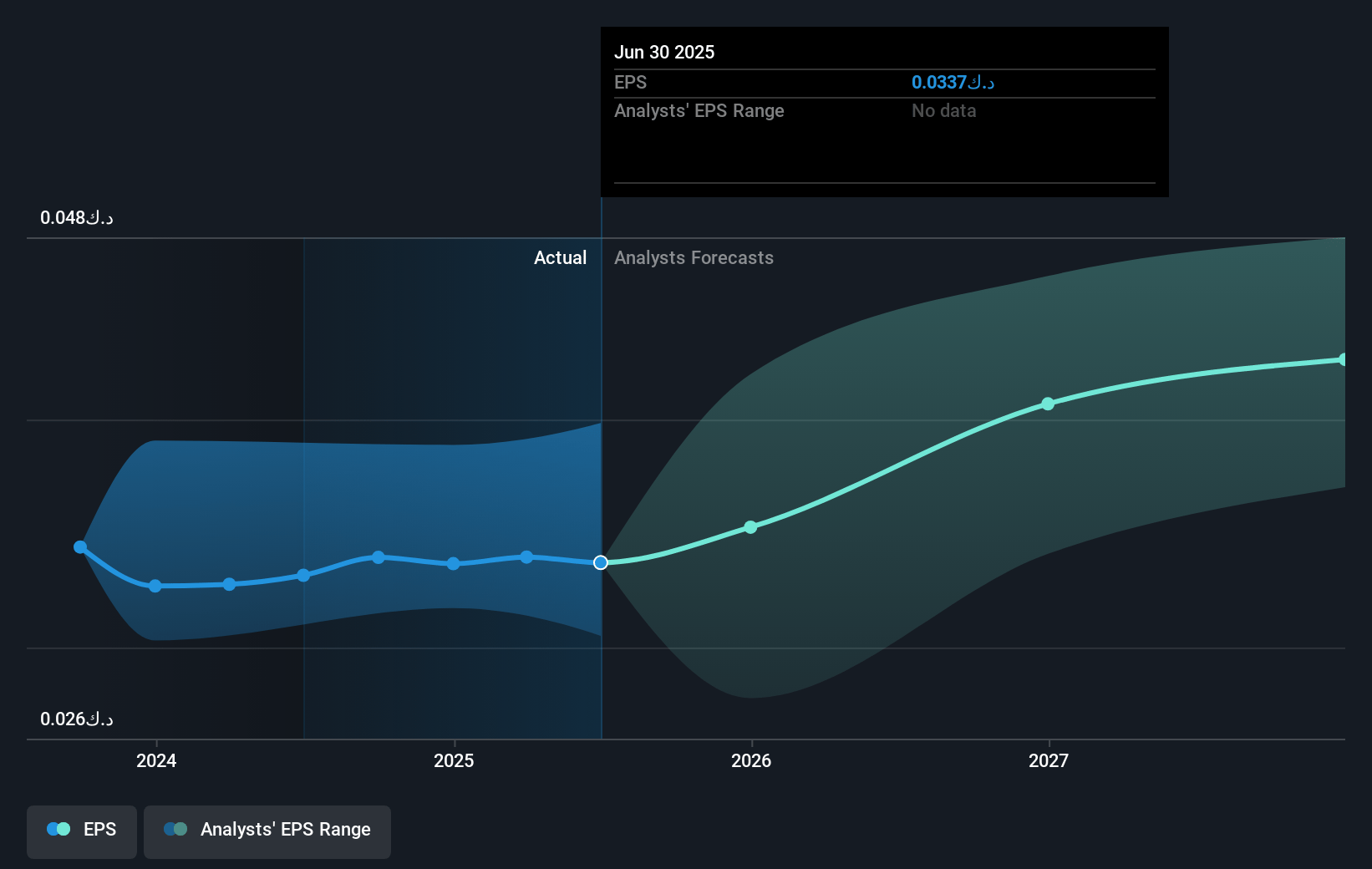

- Analysts expect earnings to reach KWD 745.8 million (and earnings per share of KWD 0.04) by about May 2028, up from KWD 584.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting KWD850 million in earnings, and the most bearish expecting KWD650 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, up from 21.3x today. This future PE is greater than the current PE for the KW Banks industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.31%, as per the Simply Wall St company report.

Kuwait Finance House K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Central Bank of Kuwait's monetary policy adjustments, including the reduction of the discount rate, aim to foster macroeconomic stability and promote sustainable growth, which could enhance KFH's revenue prospects in a conducive economic environment.

- Kuwait's strategic focus on economic diversification and infrastructure investments, including the promotion of sectors like finance and technology, could lead to increased financial activity and revenue streams for KFH.

- KFH's strong asset quality, abundant liquidity, and diversification across global markets could safeguard and potentially enhance its net margins even amidst economic fluctuations.

- The bank's success in a major merger and strategic cross-border acquisitions, including the integration of Ahli United Bank, suggests significant operational and revenue growth potential from synergies.

- KFH's strong financial performance, including growth in net financing income and a well-managed cost-to-income ratio, indicates robust earnings potential and financial resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KWD0.636 for Kuwait Finance House K.S.C.P based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KWD0.8, and the most bearish reporting a price target of just KWD0.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KWD1.9 billion, earnings will come to KWD745.8 million, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 19.3%.

- Given the current share price of KWD0.72, the analyst price target of KWD0.64 is 13.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.