Catalysts

About KRAFTON

KRAFTON is a global game developer and publisher focused on building and operating large scale online franchises across PC, console and mobile.

What are the underlying business or industry changes driving this perspective?

- Although India is rapidly emerging as a high growth mobile gaming market with BGMI positioned as a national title, the still low ARPU relative to global users and heavy reliance on one flagship game could cap monetization uplift and slow revenue diversification if new India focused titles underperform expectations, which could weigh on top line scalability.

- While regulatory clarity in India around social gaming and the ban on real money gaming reduce some structural risk, future updates to online gaming rules and taxation, combined with seasonal demand volatility, may limit the pace at which paying users and net margins can expand in this market.

- Although the PUBG IP continues to show robust traffic and record revenues even eight years after launch, intensifying competition from high quality shooters and the risk that new modes in PUBG 2.0 fail to recreate the current engagement levels could drive gradual user erosion and pressure long term earnings resilience.

- While AI first restructuring and large scale internal foundation model development promise productivity gains, execution risk around integrating AI into live service operations and new game production could delay content pipelines. This could push out revenue from new IPs and raise development costs that compress operating margins.

- Although the expanding pipeline of proprietary projects such as Subnautica 2, Palworld Mobile and India focused cricket games is intended to create new growth engines, clustering of launches around 2026 to 2027 heightens the risk that delays or underperformance in a few major titles would materially impact consolidated revenue growth and profitability.

Assumptions

This narrative explores a more pessimistic perspective on KRAFTON compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

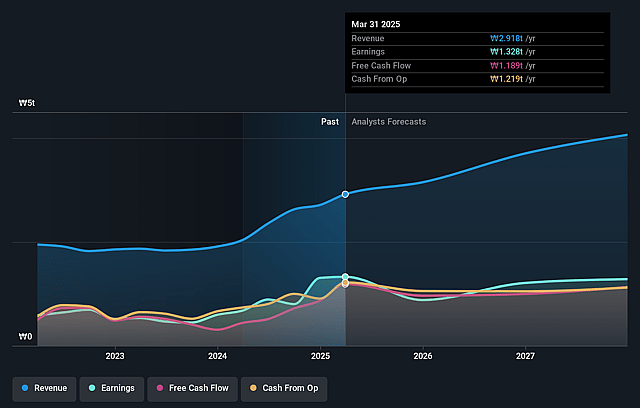

- The bearish analysts are assuming KRAFTON's revenue will grow by 3.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 41.2% today to 29.3% in 3 years time.

- The bearish analysts expect earnings to reach ₩987.4 billion (and earnings per share of ₩19967.81) by about December 2028, down from ₩1246.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₩1559.1 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from 8.6x today. This future PE is greater than the current PE for the KR Entertainment industry at 13.3x.

- The bearish analysts expect the number of shares outstanding to decline by 1.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.21%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- India's gaming market, while growing over 15% annually, is still about one fifth the size of Korea and roughly one thirtieth of the U.S. or China. If ARPU remains less than half that of global PUBG Mobile users, monetization in this key strategic market could stay structurally lower for longer and constrain long-term revenue and earnings growth.

- The reliance on a small number of flagship franchises such as the PUBG IP, BGMI in India and Peacekeeper Elite in China leaves KRAFTON exposed to competitor launches and shifting player tastes. If traffic and paying user growth slow or fail to recover as expected, live service revenues and consolidated operating margins could come under pressure.

- The AI first strategy and large scale investment in a 500 billion parameter foundation model may not translate into meaningful productivity gains or differentiated game experiences. If execution lags, escalating R&D and personnel expenses could outpace incremental revenue, compressing net margins over the medium term.

- The plan to build new growth engines from titles such as Subnautica 2, Palworld Mobile, India focused cricket games and the broader pipeline of 11 proprietary projects depends on timely, successful launches from 2026 to 2027. Delays, quality issues or poor player reception could leave KRAFTON overly dependent on aging franchises and limit future revenue diversification and earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for KRAFTON is ₩312459.51, which represents up to two standard deviations below the consensus price target of ₩418346.15. This valuation is based on what can be assumed as the expectations of KRAFTON's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩530000.0, and the most bearish reporting a price target of just ₩310000.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₩3366.8 billion, earnings will come to ₩987.4 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 9.2%.

- Given the current share price of ₩241500.0, the analyst price target of ₩312459.51 is 22.7% higher. Despite analysts expecting the underlying business to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on KRAFTON?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.