Key Takeaways

- Heavy reliance on licensed IP and history of asset impairments creates revenue instability and risk of further write-offs, threatening long-term earnings.

- Intensifying global competition and regulatory scrutiny, combined with saturated user growth and rising costs, may pressure profitability and limit future expansion.

- Diversified global game portfolio, strategic cost controls, and successful live operations position Netmarble for more stable earnings and improved long-term profitability.

Catalysts

About Netmarble- Develops and publishes PC, mobile, and console games in South Korea and internationally.

- Despite modest revenue growth, the company's heavy dependence on licensed intellectual property such as Marvel and BTS, alongside a history of asset impairments (especially with SpinX and Kabam), exposes Netmarble to significant revenue volatility and the risk of further write-offs, which could undermine both net income and long-term earnings stability.

- While management emphasizes genre and platform diversification, the global mobile device market is increasingly saturated, and slowing population growth in key markets like North America and East Asia will likely hinder further expansion of Netmarble's addressable user base, dampening prospects for sustained top-line growth.

- Intensifying international regulatory scrutiny relating to gaming content, data privacy, and digital consumer protection presents a rising risk of increased compliance costs and potential operational disruption, which could pressure margins and profitability for Netmarble as it relies heavily on overseas revenue streams.

- Persistently high development and marketing expenses, as evidenced by recent quarters, undermine the operating leverage supposedly gained through cost-saving measures, especially when new title launches or ongoing major updates fail to deliver hit status or achieve expected user traction, leading to lower EBITDA and squeezed margins.

- Competition is set to escalate further as Chinese and Western gaming giants, better equipped with proprietary technology and deeper user ecosystems, continue to gain share in both Netmarble's domestic and international markets, likely eroding Netmarble's market share and constraining its future revenue and operating income growth trajectory.

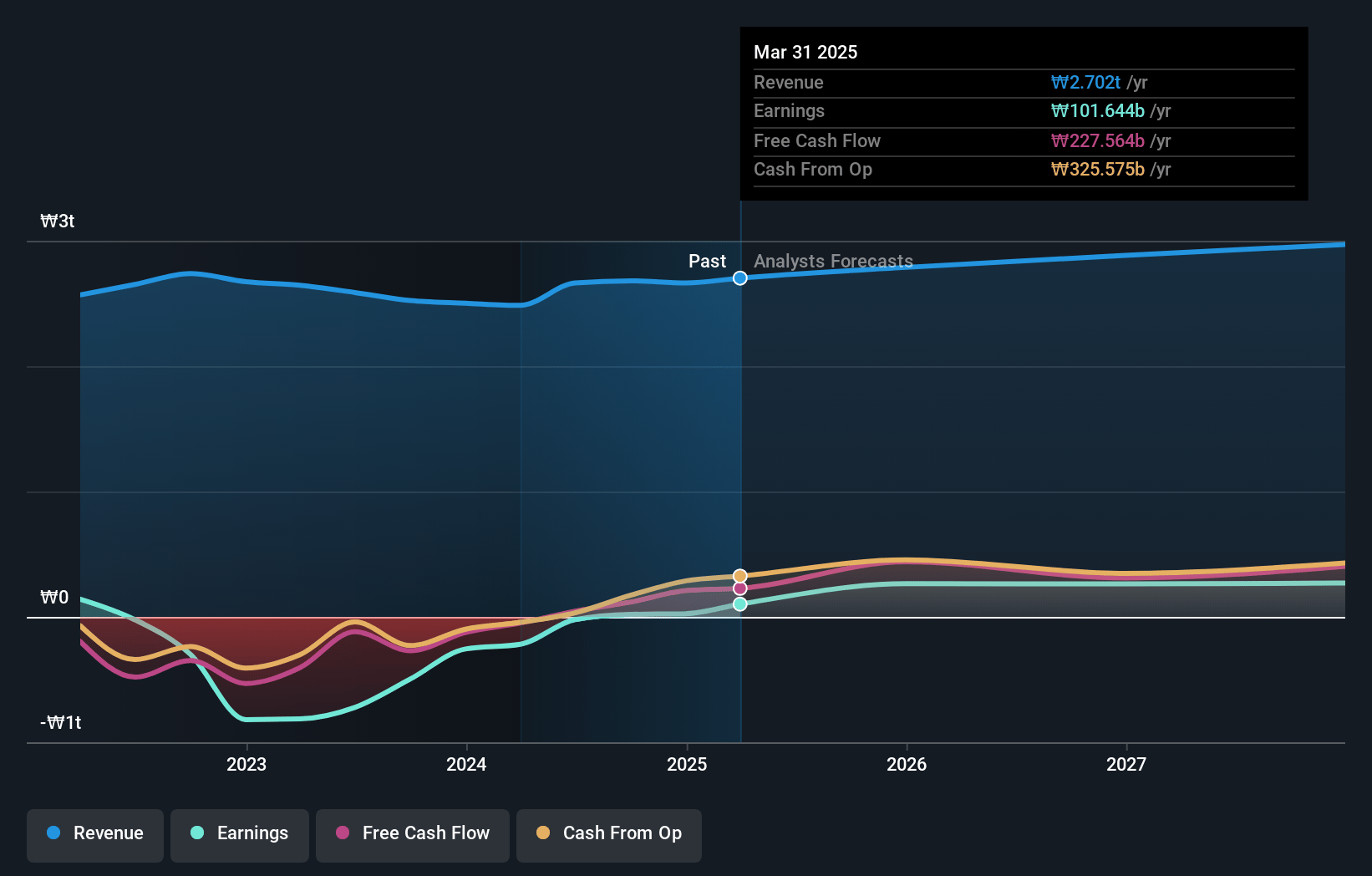

Netmarble Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Netmarble compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Netmarble's revenue will decrease by 3.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.8% today to 7.1% in 3 years time.

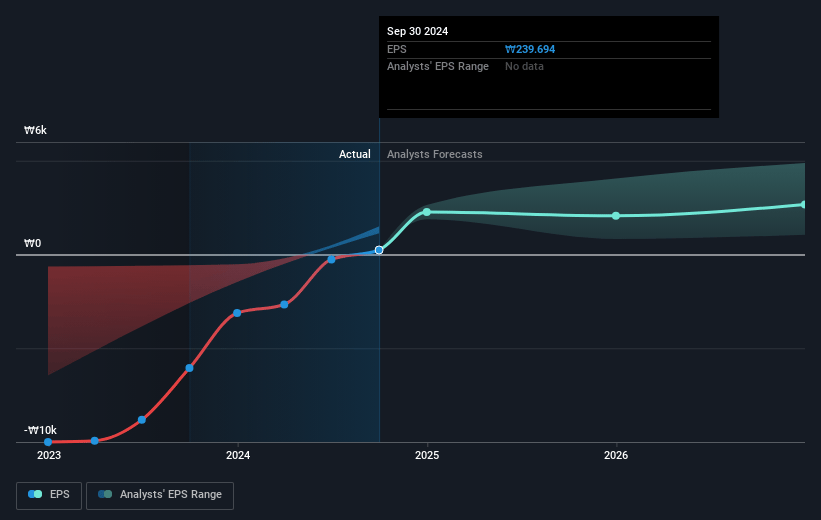

- The bearish analysts expect earnings to reach ₩169.9 billion (and earnings per share of ₩1980.71) by about July 2028, up from ₩101.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.4x on those 2028 earnings, down from 50.2x today. This future PE is greater than the current PE for the KR Entertainment industry at 18.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.21%, as per the Simply Wall St company report.

Netmarble Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Netmarble's rapid expansion of its game pipeline, including nine new titles and a strong emphasis on multi-platform launches, positions the company to capture a wider global audience and drive future revenue growth if any of these titles achieve hit status.

- Diversification of Netmarble's game portfolio by genre and platform, as well as a significant international revenue mix (83% of sales from overseas markets), lowers dependency on any single region or game, which could help stabilize earnings and mitigate regional risks.

- Ongoing cost-saving efforts, particularly through reductions in app commissions and efficient management of personnel and marketing expenses, may lead to higher operating leverage and improved net margins over time.

- Evidence of recent turnarounds, such as the recovery of key performance indicators and revenue for titles like Solo Leveling:ARISE following major content updates, suggests that Netmarble's investments in live operations and user engagement could considerably enhance recurring revenue streams.

- Decreasing impact from past impairments related to SpinX and expectations of lower amortization expenses in the future may reduce non-operating costs and stem net losses, thereby boosting profitability and company earnings in the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Netmarble is ₩32000.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Netmarble's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩84000.0, and the most bearish reporting a price target of just ₩32000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩2406.1 billion, earnings will come to ₩169.9 billion, and it would be trading on a PE ratio of 20.4x, assuming you use a discount rate of 10.2%.

- Given the current share price of ₩62300.0, the bearish analyst price target of ₩32000.0 is 94.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.