Catalysts

About NHN

NHN is a diversified digital services company with core operations across gaming, payments, cloud and AI driven enterprise collaboration tools.

What are the underlying business or industry changes driving this perspective?

- The large scale GPU build out for government AI projects risks locking NHN Cloud into capital intensive infrastructure contracts where pricing power shifts to public sector clients as AI compute becomes more commoditized. This could cap long term revenue growth and compress operating margins.

- While generative AI integration into Dooray and other tools expands the product suite, escalating model access, network and telecom costs combined with intense competition from global collaboration and AI platform providers may outpace pricing gains. This may limit earnings leverage from this segment.

- The pivot toward government and education workloads in cloud and AI heightens regulatory, procurement and renewal risk at a time when operating expenses are rising. Any slowdown or rebid losses in these projects could quickly erode revenue visibility and profit stability.

- Gaming growth remains dependent on a narrow portfolio of IP driven titles and event based collaboration boosts. As user acquisition and marketing costs increase in mature Japan and Korea markets, hit concentration risk could weigh on top line expansion and depress net margins in weaker launch cycles.

- The transition of commerce and content businesses to new models and geographies introduces execution and restructuring uncertainty. If these initiatives fail to scale as planned, they may continue to drag on consolidated revenue and dilute overall earnings improvement.

Assumptions

This narrative explores a more pessimistic perspective on NHN compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

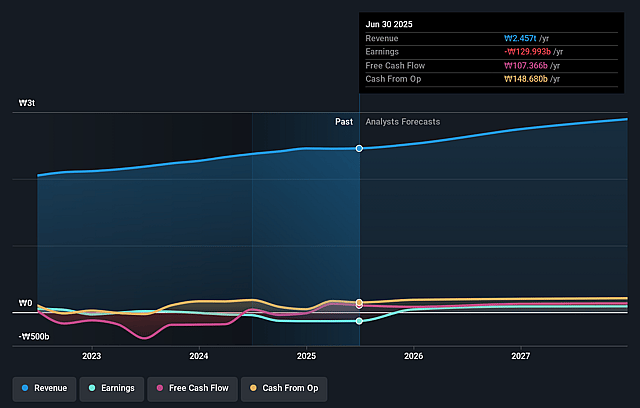

- The bearish analysts are assuming NHN's revenue will grow by 5.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.8% today to 2.5% in 3 years time.

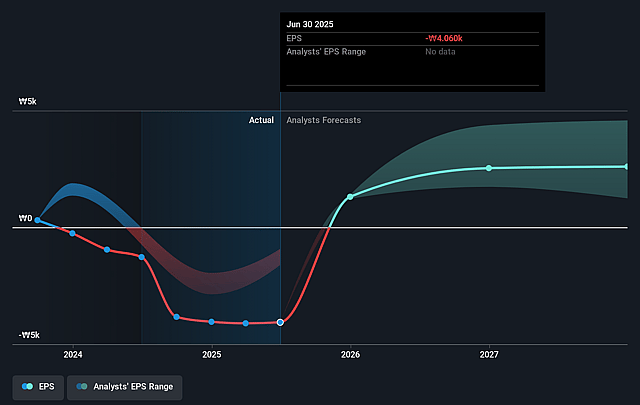

- The bearish analysts expect earnings to reach ₩73.3 billion (and earnings per share of ₩2116.18) by about December 2028, up from ₩-45.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₩236.5 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from -20.5x today. This future PE is lower than the current PE for the KR Entertainment industry at 13.4x.

- The bearish analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.03%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The new shareholder return policy that commits 15% of prior year consolidated EBITDA to dividends and buybacks, alongside ongoing share cancellations, could support valuation multiples and investor demand, limiting downside for the share price through stronger earnings based capital returns and higher earnings per share.

- Sustained growth in core franchises such as Hangame webboard titles and the successful rollout of new games like ABYSSDIA, Darkest Days and Project STAR across Japan, Korea and other markets could drive higher long term game revenue and scale benefits that support operating margins.

- NHN Cloud's selection to deploy more than 7,000 B200 GPUs and its participation in multiple government AI initiatives, together with public sector cloud migration wins, may entrench it as a key AI infrastructure provider and create recurring, higher margin tech revenue and improved consolidated earnings over time.

- Improving performance in payments, evidenced by NHN KCP's transaction volume growth and PAYCO's sharply reduced cumulative losses, together with new initiatives like stable coin infrastructure, could steadily enhance the profit structure of the payments segment, lifting group net margins.

- Restructuring in commerce and content, including Comico's pivot toward high growth Japan and external distribution with strong content revenue expansion, suggests that streamlined platforms can return this segment to growth and margin improvement, supporting consolidated revenue and operating profit.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for NHN is ₩22000.0, which represents up to two standard deviations below the consensus price target of ₩30975.0. This valuation is based on what can be assumed as the expectations of NHN's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩36000.0, and the most bearish reporting a price target of just ₩22000.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₩2892.8 billion, earnings will come to ₩73.3 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 10.0%.

- Given the current share price of ₩30000.0, the analyst price target of ₩22000.0 is 36.4% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NHN?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.