Key Takeaways

- Kakao's AI integration and super-app strategy position it for dominant market share, deeper user engagement, and exponential growth in platform monetization across multiple sectors.

- Expansion into regional and global markets, along with its unique content and payment ecosystem, offers the potential for sustained high-margin revenue and industry leadership.

- Heavy reliance on its core app, uncertain AI monetization, volatile content earnings, macro headwinds, and rising regulatory risks all threaten sustainable profit and revenue growth.

Catalysts

About Kakao- Operates mobile and online platforms in South Korea.

- Analyst consensus sees expanded AI integration and the introduction of the Discovery section as means to lift engagement and ad revenue, but this view understates the potential for Kakao to become Korea's indispensable daily AI-powered super-app, dramatically increasing platform stickiness, average revenue per user, and share of wallet as AI-driven personalization and automation unlock new habitual use cases and deeper monetization across communication, commerce, media, and payments, leading to exponential top-line growth and significantly higher net margins.

- While analysts broadly expect new AI-powered ad formats from Discovery to drive double-digit ad revenue growth, the creation of a content ecosystem blending user-generated and AI-generated media-uniquely anchored in Kakao's social identity-could enable Kakao to seize dominant share in mobile discovery, fostering a creator economy and premium ad inventory that rivals or surpasses major global platforms, greatly accelerating recurring revenue growth in advertising and branded content.

- Kakao's strategic AI collaboration with OpenAI, combined with its orchestration of best-in-class global and proprietary AI models, positions it to deliver localized and hyper-personalized AI agents that no other Korean or Asian platform can match, setting the stage for Kakao to export its unique model across Asia and become a regional leader in consumer AI services, which would substantially boost earnings and expand addressable market size well beyond Korea.

- As mobile lifestyles proliferate and digital payments/fintech adoption rises, Kakao's deep integration of commerce, payment, and financial services into a unified super-app will drive cross-platform network effects and higher transaction volumes, supporting stronger fee-based income and meaningfully enhancing operating profit and margin stability over the long term.

- The global Hallyu Wave and surging demand for Korean webtoons, music, and digital IP provide Kakao's content businesses with a once-in-a-decade opportunity for international expansion, subscription growth, and franchising, allowing for durable high-margin recurring revenues that will drive sustained earnings outperformance as monetization models mature outside Korea.

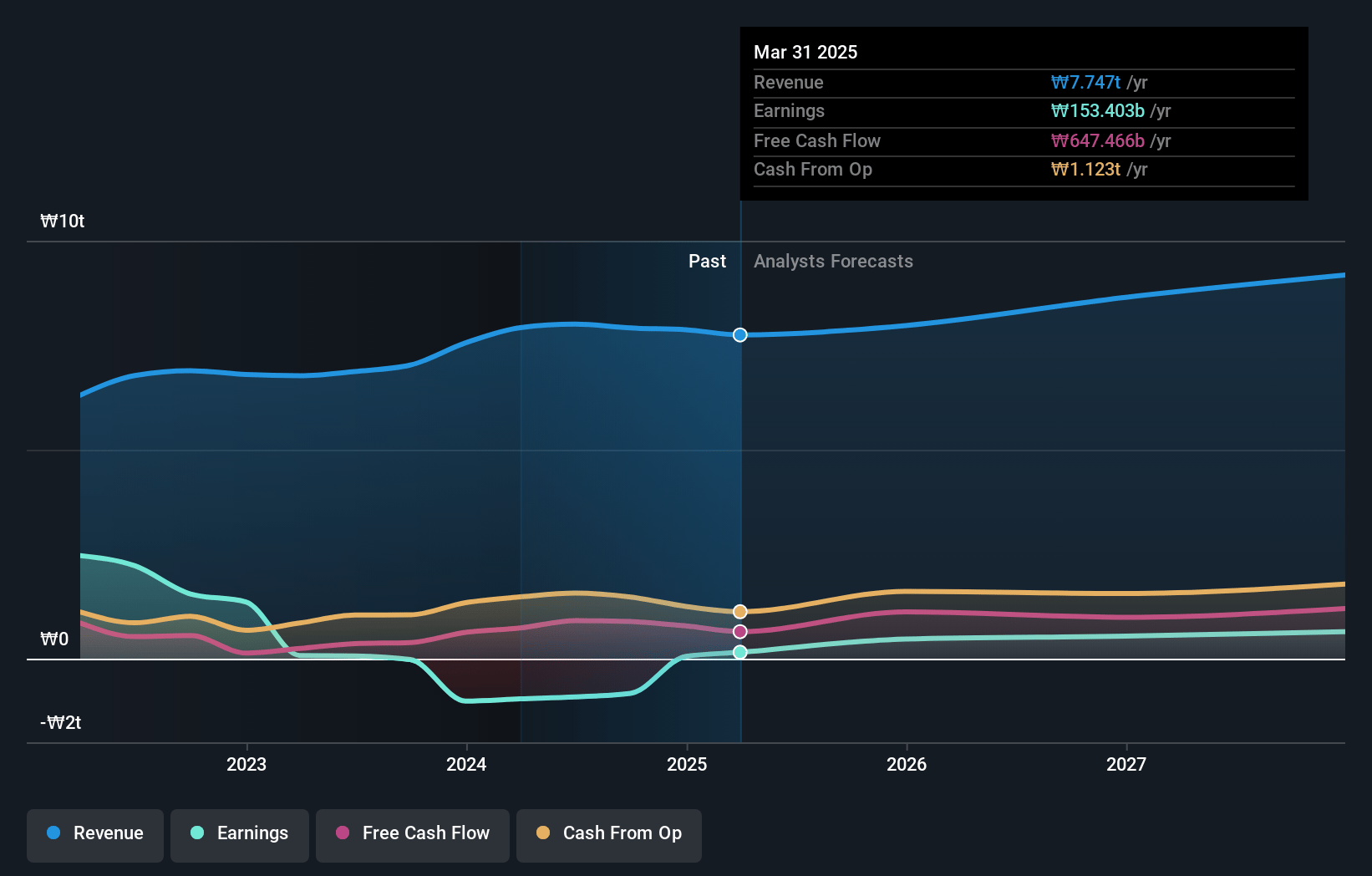

Kakao Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kakao compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kakao's revenue will grow by 8.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.0% today to 11.7% in 3 years time.

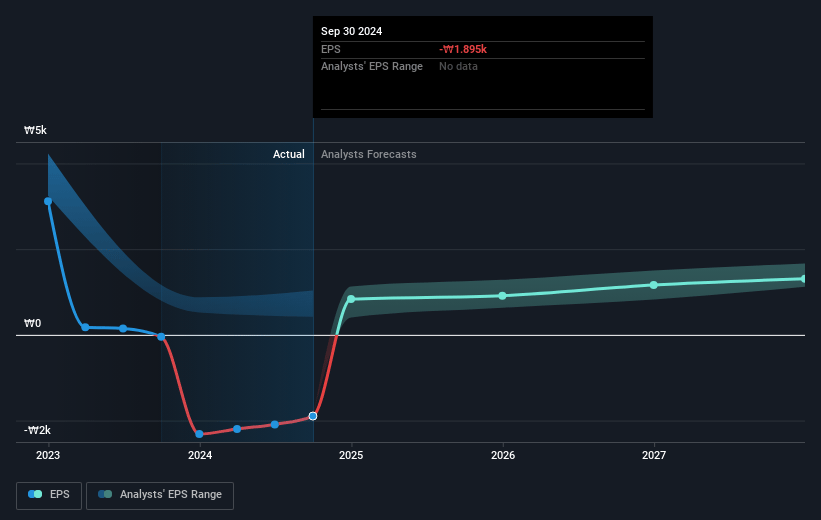

- The bullish analysts expect earnings to reach ₩1175.3 billion (and earnings per share of ₩2660.29) by about July 2028, up from ₩153.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 38.1x on those 2028 earnings, down from 171.1x today. This future PE is greater than the current PE for the KR Interactive Media and Services industry at 20.7x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.54%, as per the Simply Wall St company report.

Kakao Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kakao's core user engagement and growth are heavily dependent on its messaging app, and management highlighted persistent structural limitations and slowing growth, which could cap future advertising and subscription revenue expansion and dampen consolidated top-line growth.

- Increasing investments in AI and new content-driven features add large fixed costs, but the monetization of AI-powered B2C services is unproven globally, and management acknowledged the challenge of developing sustainable monetization, raising the risk of further margin compression and subdued net profit growth.

- The company's entertainment and content divisions have suffered from IP cycle downturns and large goodwill impairments, with management expecting continued uncertainty and difficulty in achieving reliable box office hits, which threatens earnings stability and increases net income volatility.

- Kakao's ambitions for ramping up new ad solutions and commerce offerings face headwinds from weak macroeconomic conditions and consumer sentiment in Korea, as management described only moderate anticipated growth and high market cyclicality, limiting potential for robust topline expansion and operating leverage.

- Global and domestic regulatory scrutiny around data privacy, platform dominance, and digital payment ecosystems remain secular headwinds, and compliance costs in these areas could increase significantly, impacting net operating margins and Kakao's ability to cross-monetize its user base across business lines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kakao is ₩80000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kakao's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩80000.0, and the most bearish reporting a price target of just ₩40000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩10008.2 billion, earnings will come to ₩1175.3 billion, and it would be trading on a PE ratio of 38.1x, assuming you use a discount rate of 8.5%.

- Given the current share price of ₩60000.0, the bullish analyst price target of ₩80000.0 is 25.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.