Key Takeaways

- Overreliance on a stagnant domestic market and regulatory pressures constrain Kakao's ability to expand revenue and innovate effectively.

- Rising competition and digital decentralization threaten user engagement and market share, further pressuring margins and growth potential.

- Kakao's AI-driven expansion, diversified content strategies, and disciplined cost management position it for stronger user engagement, resilient ad revenues, and more stable long-term profitability.

Catalysts

About Kakao- Operates mobile and online platforms in South Korea.

- Intensifying regulatory scrutiny on big tech and online platforms globally, together with growing privacy concerns and the potential tightening of data protection laws, will likely raise compliance costs and restrict Kakao's ability to innovate, reducing both revenue growth and net margins over time.

- Demographic stagnation and an aging population in Korea are set to lead to structural headwinds, resulting in slower user acquisition and diminished engagement on core platforms such as KakaoTalk, which would undermine both future revenue and ARPU expansion.

- Kakao's persistent overreliance on the saturated domestic Korean market, despite ambitions for international growth and new revenue streams, exposes it to severe growth runway limitations and a heightened risk of stagnating revenues.

- Intensifying competition from global giants like Meta, Google, and Apple in messaging, payments, and content distribution is likely to erode Kakao's market share, drive up customer acquisition costs, and compress net margins as Kakao is forced to spend more to maintain relevance.

- The accelerating trend of creators and users bypassing aggregators via decentralized digital platforms and Web3 technologies is poised to reduce engagement and advertising effectiveness on Kakao, pressuring both top-line and bottom-line over the long term.

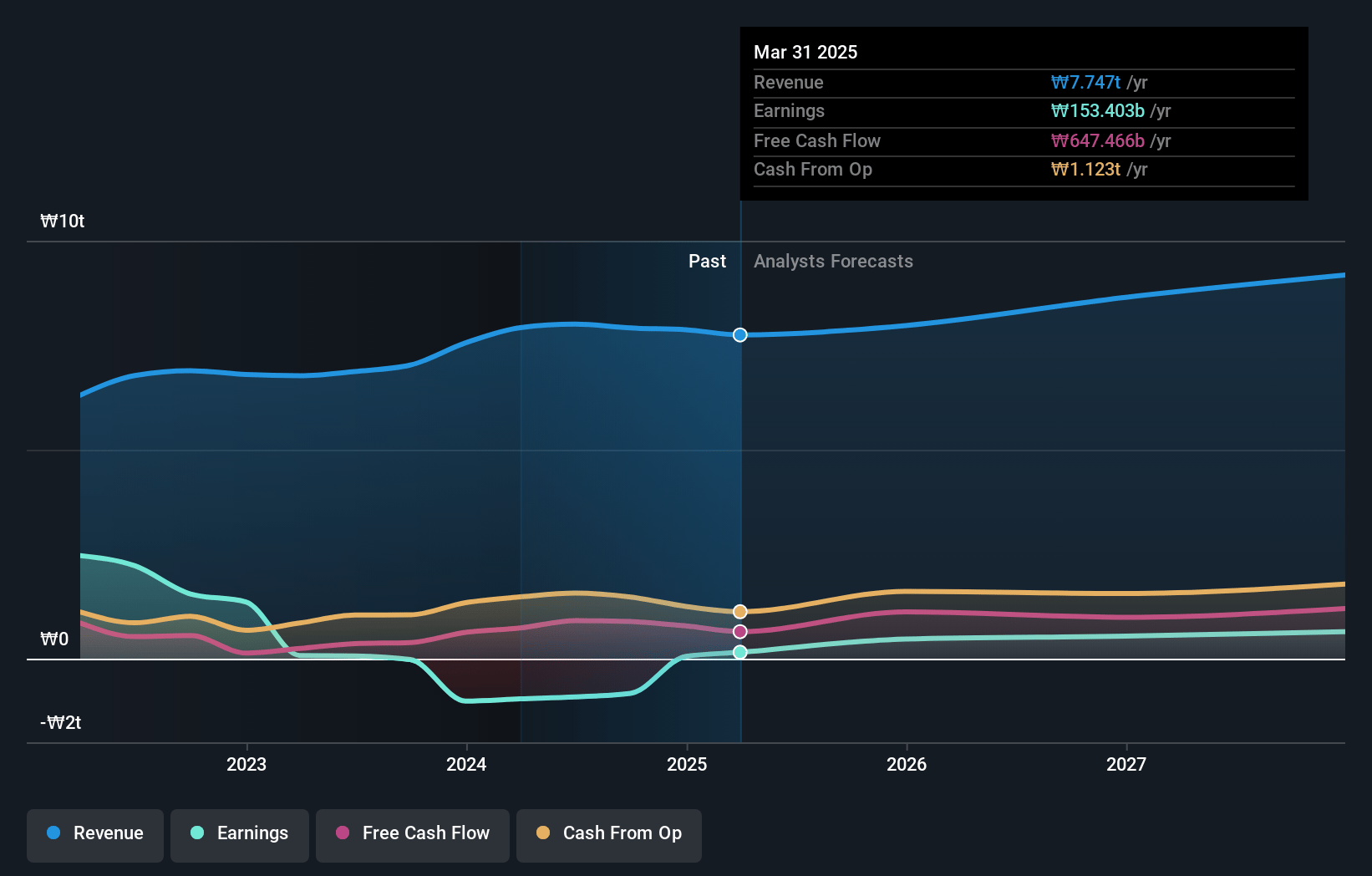

Kakao Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kakao compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kakao's revenue will grow by 3.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.0% today to 6.3% in 3 years time.

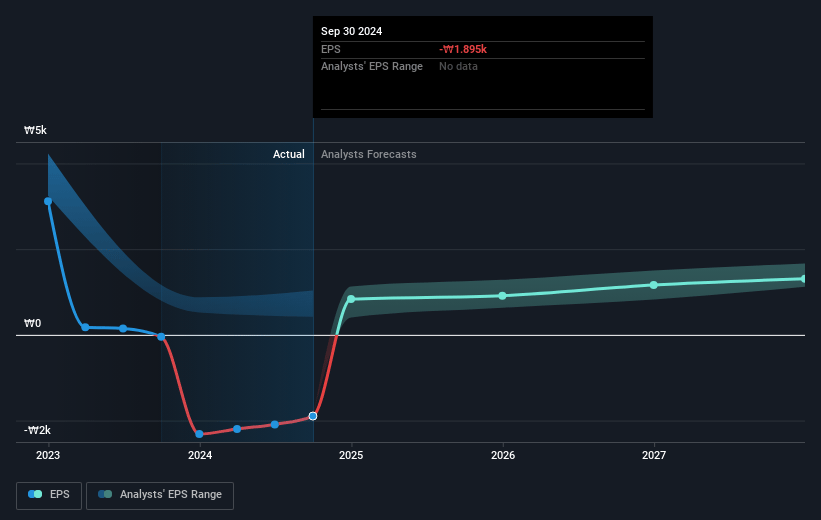

- The bearish analysts expect earnings to reach ₩537.4 billion (and earnings per share of ₩1216.44) by about July 2028, up from ₩153.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 41.7x on those 2028 earnings, down from 159.9x today. This future PE is greater than the current PE for the KR Interactive Media and Services industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Kakao Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kakao is aggressively integrating generative AI capabilities, including partnerships with OpenAI and a unique multi-model orchestration strategy, which may drive higher user engagement and support long-term revenue and margin expansion if successful.

- The company's focus on expanding content discovery and supporting user-generated as well as professional content within KakaoTalk could overcome past structural limitations, leading to increased user time spent and unlocking diversified monetizable traffic that can benefit both top-line growth and advertising revenue.

- Kakao continues to generate robust double-digit growth in its Business Message segment, with strategic enhancements in targeting and creative ad formats that may allow Talk Biz revenue to remain strong and potentially outperform the broader online ad market, supporting sustainable growth in core business revenues.

- Asset-light strategies and personalized AI-powered commerce tools have already driven higher conversion rates and average basket sizes, suggesting that if these initiatives scale further across the platform, commerce GMV and associated profit margins could benefit in the medium to long term.

- The company has kept operating costs under control while making targeted investments in AI and infrastructure, and with goodwill impairments and other non-operating losses largely addressed, future earnings volatility may decrease, setting the stage for stable or improving net income and return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kakao is ₩40000.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kakao's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩80000.0, and the most bearish reporting a price target of just ₩40000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩8561.5 billion, earnings will come to ₩537.4 billion, and it would be trading on a PE ratio of 41.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of ₩56100.0, the bearish analyst price target of ₩40000.0 is 40.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.