Key Takeaways

- Generative AI adoption, regulatory pressures, and demographic trends threaten NAVER's core business, constraining growth and compressing margins.

- Growing competition and high AI infrastructure costs challenge NAVER's market share, pricing power, and free cash flow sustainability.

- Expanding AI integration, growing commerce and UGC platforms, diversification via enterprise solutions, and disciplined spending are driving higher user engagement, new revenue streams, and operating profitability.

Catalysts

About NAVER- Provides online search portal and online information services in South Korea, Japan, and internationally.

- The accelerating adoption of generative AI and new user interfaces, such as chatbots and AI-powered assistants, poses a direct threat to the relevance and profitability of traditional search platforms like NAVER, potentially undermining core advertising revenues and reducing long-term engagement growth.

- Intensifying regulatory scrutiny around data privacy and digital platform monopolies-especially as NAVER expands AI, big data, and cross-border initiatives-could significantly drive up compliance costs and limit diversification, leading to persistent pressure on net margins.

- Ongoing demographic shifts, including a rapidly aging population and stagnant user growth in South Korea, will structurally limit the addressable market for digital advertising and e-commerce in NAVER's core domestic segment, stalling revenue expansion despite product enhancements.

- Global tech giants such as Google, Meta, and ByteDance are increasing their focus on Korea and Southeast Asia. Their scale and technological advantages are likely to erode NAVER's market share and pricing power, increasing customer acquisition costs and suppressing operating income growth.

- Sustained high capital expenditures for AI infrastructure-including GPU and data center investments-are expected to outpace revenue growth in the near to mid-term. This could compress free cash flow and delay margin expansion, especially if new AI services and monetization models do not deliver rapid and substantial returns.

NAVER Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NAVER compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NAVER's revenue will grow by 7.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 16.5% today to 14.9% in 3 years time.

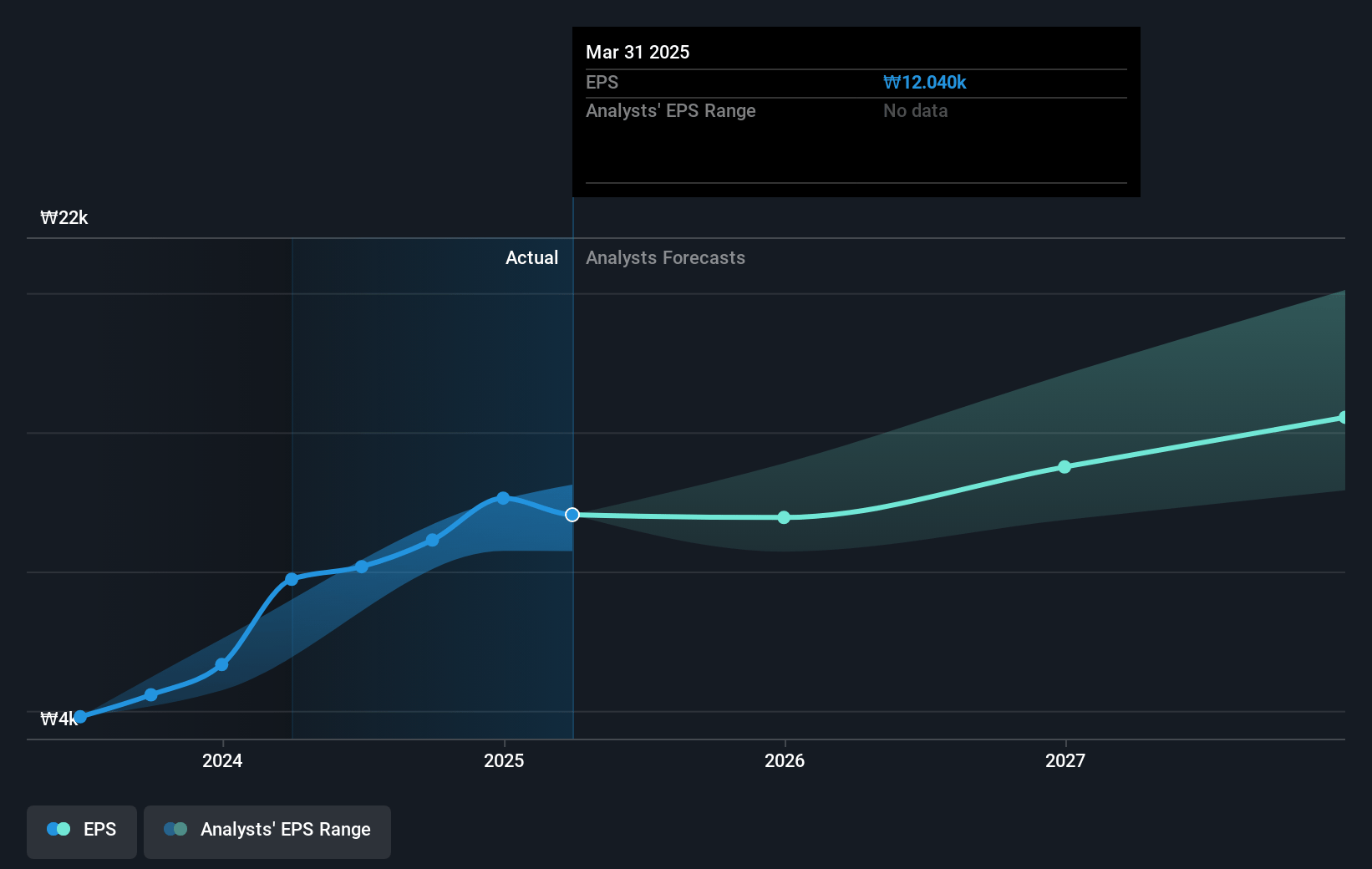

- The bearish analysts expect earnings to reach ₩2027.3 billion (and earnings per share of ₩13478.26) by about July 2028, up from ₩1816.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 20.5x today. This future PE is lower than the current PE for the KR Interactive Media and Services industry at 20.5x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.43%, as per the Simply Wall St company report.

NAVER Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NAVER is rapidly advancing and integrating AI technologies across its search, commerce, fintech, and enterprise services, which is already yielding higher user engagement, improved ad efficiency, and provides a strong foundation for long-term operating efficiencies and margin expansion.

- The company's commerce ecosystem-including Smart Store, the NAVER Plus Store stand-alone app, and partnerships such as with Kurly and Netflix-continues to show double-digit growth in gross merchandise value and memberships, supporting sustained revenue and earnings growth over the long term.

- NAVER is benefitting from the secular trend of increasing digital content creation and consumption, with its UGC platforms (like Blogs and Clip) seeing expanding daily activity, more creators, and growing synergy with other NAVER services, enabling new monetization streams and boosting top-line revenue.

- Its B2B and enterprise businesses, particularly through LINE WORKS and the rollout of specialized AI-powered solutions (including winning notable contracts in the financial sector), are diversifying NAVER's revenue base and establishing new international and high-margin growth avenues, enhancing future earnings stability.

- Despite rising CapEx due to AI infrastructure investments, NAVER's strong cash flow, growing high-margin digital ad and fintech businesses, and disciplined cost control measures are translating into improving EBITDA margins and operating profits, which can drive share price appreciation as earnings compound over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NAVER is ₩222297.37, which represents two standard deviations below the consensus price target of ₩296496.55. This valuation is based on what can be assumed as the expectations of NAVER's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩380000.0, and the most bearish reporting a price target of just ₩210000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩13574.7 billion, earnings will come to ₩2027.3 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 8.4%.

- Given the current share price of ₩250000.0, the bearish analyst price target of ₩222297.37 is 12.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.