Key Takeaways

- Advanced AI integration and ecosystem synergies are poised to accelerate user engagement, loyalty, and monetization, establishing NAVER as a global leader across multiple verticals.

- Strategic investments in AI, fintech, and open-sourcing will enable superior platform lock-in and high-margin recurring revenues, positioning NAVER for industry-leading growth and profitability.

- Regulatory, competitive, and market shifts threaten NAVER's growth, profitability, and core business, while heavy infrastructure and AI investments heighten risk if monetization lags.

Catalysts

About NAVER- Provides online search portal and online information services in South Korea, Japan, and internationally.

- Analyst consensus expects sustained commerce and advertising growth from AI integration and personalization, but this likely understates the potential for step-change network effects as AI-driven user experiences, content creation, and conversion rates directly accelerate both GMV and high-margin ad revenues at a pace exceeding current projections.

- While analysts broadly believe that the NAVER Plus Store app will drive incremental user and commerce growth, the combination of advanced AI-powered recommendations, exclusive member benefits, and deep integration across NAVER's super-app ecosystem is positioned to transform user engagement and loyalty, creating a platform with retention and monetization dynamics approaching those of global category leaders and meaningfully expanding net margins.

- NAVER's open-sourcing of its HyperCLOVA X LLM and strategy to target major verticals with specialized AI solutions is set to place NAVER at the center of Korea's enterprise AI adoption, enabling outsize B2B revenue growth as more domestic and global firms pivot to local AI, driving recurring cloud and platform revenues.

- With Asia's rapid expansion of mobile-first super-app and digital payment ecosystems, NAVER's fintech platform is uniquely positioned to capture a growing share of consumer payments and financial services, allowing for cross-selling, ecosystem lock-in, and structurally higher take rates and net earnings quality versus global peers.

- The platform's aggressive investments in first-party data, creator-driven UGC, and AI-powered advertising are set to capitalize on the global convergence of commerce, content, and social networking, establishing NAVER as a dominant multi-vertical super-app and leading to superior long-term growth in both revenue and operating leverage.

NAVER Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NAVER compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NAVER's revenue will grow by 14.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.5% today to 17.1% in 3 years time.

- The bullish analysts expect earnings to reach ₩2809.1 billion (and earnings per share of ₩21033.23) by about July 2028, up from ₩1816.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.1x on those 2028 earnings, up from 19.0x today. This future PE is greater than the current PE for the KR Interactive Media and Services industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

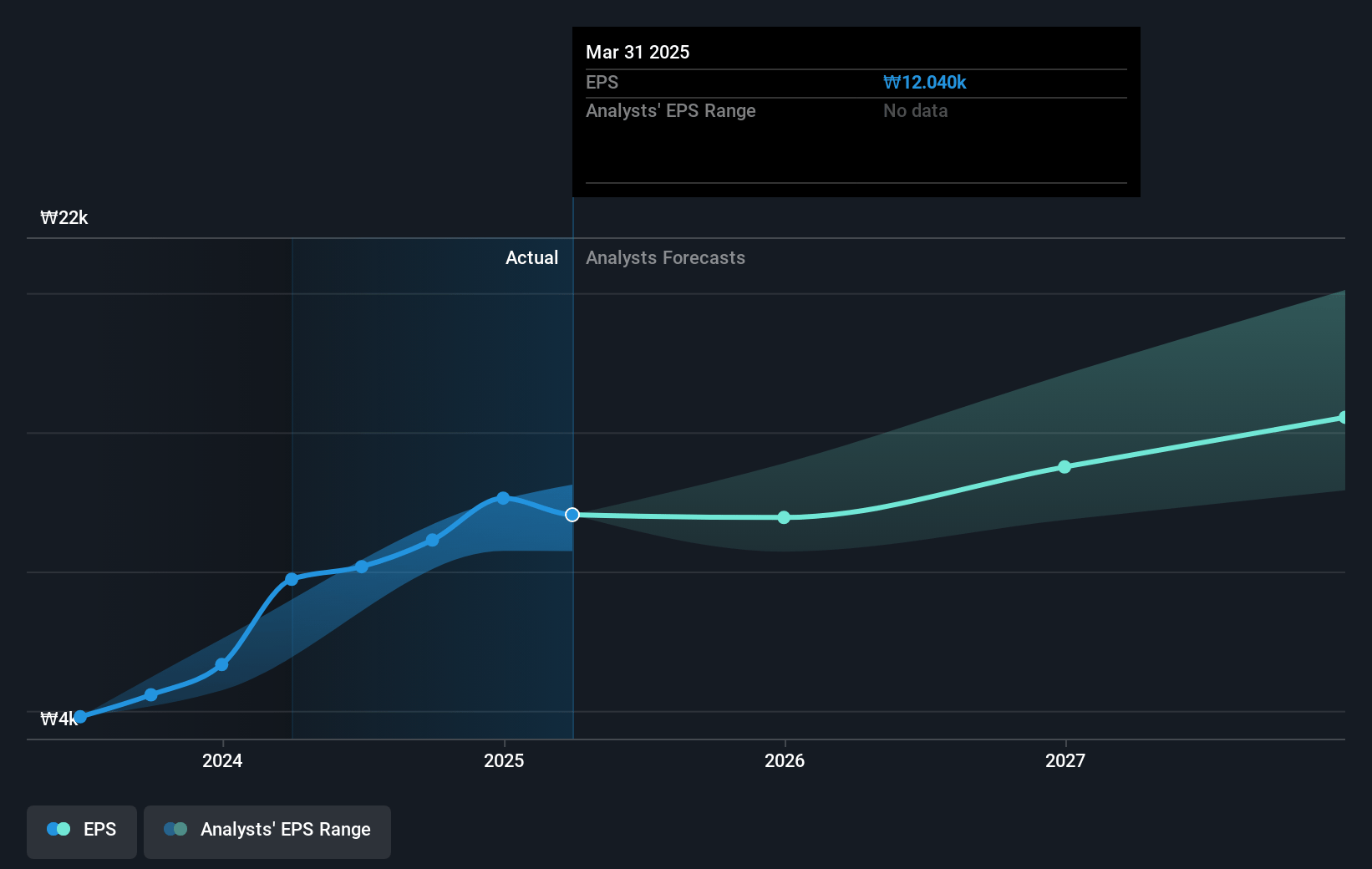

NAVER Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying regulatory scrutiny, privacy mandates, and antitrust risks globally could restrict NAVER's expansion plans, raise compliance and operational costs, and limit platform-based monetization, which would put sustained pressure on both revenue growth and operating margins over the long run.

- Consumer preferences are shifting from traditional search portals towards generative AI-powered assistants, chatbots, and superapps, a trend that may erode NAVER's core user engagement and advertising business, eventually reducing NAVER's top-line revenues as ad demand wanes.

- NAVER's history of underperformance in overseas markets and ongoing heavy reliance on the maturing Korean market increases vulnerability to saturation and external shocks, which could dampen future revenue expansion and make margin improvement harder to achieve.

- Rapidly escalating infrastructure investments and AI-related capital expenditures, particularly for GPUs and large language models, risk outpacing revenue gains and could compress net margins, especially if monetization efforts from new AI solutions or cloud offerings do not ramp up as anticipated.

- Heightened competition from local and global players in digital advertising, e-commerce, fintech, and content-as well as increasing fragmentation of media consumption-may erode NAVER's market share, lead to pricing pressures, and slow earnings growth, impacting both future revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NAVER is ₩370746.55, which represents two standard deviations above the consensus price target of ₩299255.17. This valuation is based on what can be assumed as the expectations of NAVER's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩380000.0, and the most bearish reporting a price target of just ₩210000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩16441.1 billion, earnings will come to ₩2809.1 billion, and it would be trading on a PE ratio of 24.1x, assuming you use a discount rate of 8.4%.

- Given the current share price of ₩231500.0, the bullish analyst price target of ₩370746.55 is 37.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.