Key Takeaways

- Heightened regulatory risk, shifting gamer preferences, and dependence on aging franchises threaten engagement, audience growth, and future revenue stability.

- Rising development and labor costs, along with persistent project delays, are expected to erode margins and challenge consistent profitability.

- New flagship game launch, ongoing franchise updates, global expansion, user-focused development, and advanced tech adoption are positioning the company for stronger growth and diversified revenue.

Catalysts

About Pearl Abyss- Engages in software development for games.

- Increasing regulatory scrutiny and evolving digital content laws globally threaten to restrict Pearl Abyss's ability to launch or monetize core franchises across key regions, which will likely hinder long-term revenue growth and compress margins due to heightened compliance costs.

- The ongoing shift in gamer attention from premium and PC/console experiences to mobile-first and shorter-session entertainment makes Pearl Abyss's core products less relevant, threatening further erosion in player engagement, declining lifetime customer value, and a shrinking addressable market, all pointing to top-line revenues remaining under sustained pressure over time.

- Heavy reliance on legacy IPs such as Black Desert and EVE-both of which showed sequential operating revenue declines-intensifies exposure to aging franchises with limited new audience expansion, creating a risk that recurring revenues will structurally decline and the overall earnings profile will deteriorate despite regular content updates.

- Persistent project delays and ballooning development expenses for new titles such as Crimson Desert-without any clear visibility on conversion of marketing buzz to sustained in-game monetization-are likely to drive up research and development costs, further weigh on net profit, and impair consistent earnings generation for several quarters.

- Escalating labor costs and intense talent competition in Korea's tech sector, as evidenced by developer headcount now representing 57% of staff and rising labor expenses quarter-over-quarter, are set to further erode operating margins and reduce Pearl Abyss's financial flexibility going forward.

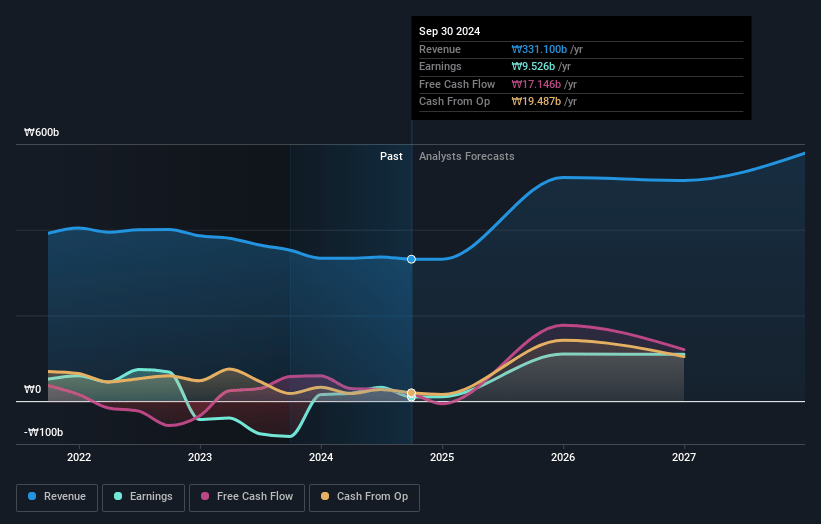

Pearl Abyss Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Pearl Abyss compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Pearl Abyss's revenue will grow by 14.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.1% today to 13.0% in 3 years time.

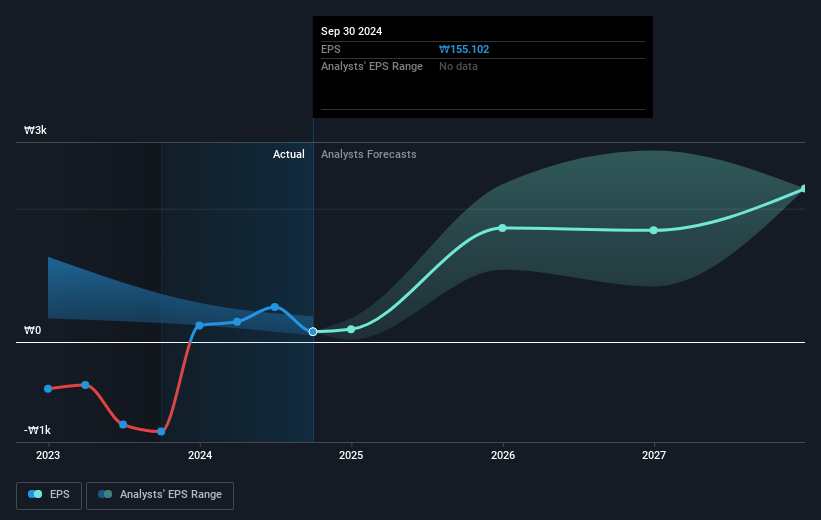

- The bearish analysts expect earnings to reach ₩66.2 billion (and earnings per share of ₩1026.8) by about July 2028, up from ₩48.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, down from 47.7x today. This future PE is greater than the current PE for the KR Entertainment industry at 19.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.29%, as per the Simply Wall St company report.

Pearl Abyss Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pearl Abyss is preparing for the global launch of Crimson Desert with highly positive feedback from demos and hands-on events across multiple regions, suggesting the potential for significant new revenue growth and expanding the company's addressable market.

- The company continues to invest in live service updates and expansion packs for core franchises like Black Desert and EVE, leveraging the industry trend of ongoing content development to support recurring revenues and strong user retention for long-term revenue stability.

- Pearl Abyss is executing an active global expansion strategy, emphasizing launches and substantial marketing in North America and Europe, which diversifies its geographic revenue base, reduces overreliance on any one region, and can help boost overall net margins through economies of scale.

- The company is demonstrating agility in incorporating user and influencer feedback into game development and optimization, particularly for major projects like Crimson Desert, indicating a commitment to quality that could enhance reputation, increase user engagement, and support higher earnings.

- Pearl Abyss is harnessing advanced technologies such as proprietary game engines and experimenting with blockchain-based game content, which can open new monetization channels and improve the company's competitive position, potentially resulting in improved long-term revenue growth and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Pearl Abyss is ₩23000.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Pearl Abyss's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩53000.0, and the most bearish reporting a price target of just ₩23000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩509.5 billion, earnings will come to ₩66.2 billion, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of ₩37300.0, the bearish analyst price target of ₩23000.0 is 62.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives