Key Takeaways

- Crimson Desert's launch and enthusiastic Western market reception could accelerate global growth and significantly boost international revenues, reducing geographic risk.

- Agile game design, live content updates, and unique monetization strategies are likely to drive sustained recurring revenues and higher long-term operating margins.

- Heavy dependence on aging core titles, rising costs, and shifting entertainment trends threaten growth, margin stability, and global expansion prospects.

Catalysts

About Pearl Abyss- Engages in software development for games.

- Analyst consensus expects a strong launch for Crimson Desert, but aggressive global marketing campaigns and unprecedented early media/influencer buzz indicate the potential for a blockbuster hit that could significantly exceed revenue projections and drive outsized earnings growth from late 2025 onward.

- While analysts broadly view expansion into new markets as a gradual revenue driver, the recent hands-on demos and overwhelmingly positive reception in high-value Western markets signal that Pearl Abyss could rapidly accelerate its user base and deliver a step-change in international revenues-materially improving the company's growth profile and geographic risk diversification.

- Pearl Abyss's deep integration of real-time user feedback into game design and frequent, high-value live content updates demonstrate a uniquely agile approach; this is likely to extend player engagement lifecycles and unlock higher, more sustained recurring revenues and better long-term operating margins.

- As gaming becomes further entrenched in daily entertainment due to higher mobile adoption and digital consumption, Pearl Abyss is positioned to capture outsized wallet share through expanding its flagship IPs and launching cross-platform experiences, directly supporting sustained top-line expansion.

- The company's proprietary engine technology and self-publishing strategy, combined with emerging opportunities in digital currencies and in-game monetization, could deliver structurally higher net margins and position Pearl Abyss for both organic and inorganic growth as global gaming platforms continue consolidating.

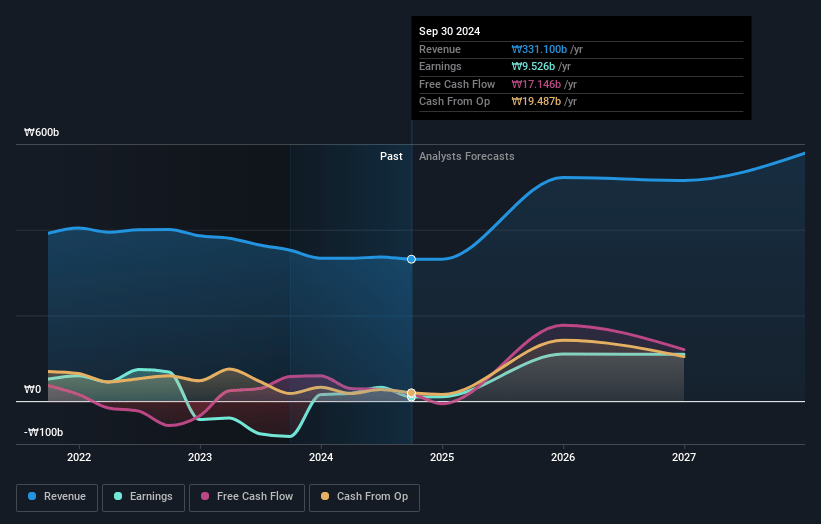

Pearl Abyss Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Pearl Abyss compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Pearl Abyss's revenue will grow by 26.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.1% today to 30.6% in 3 years time.

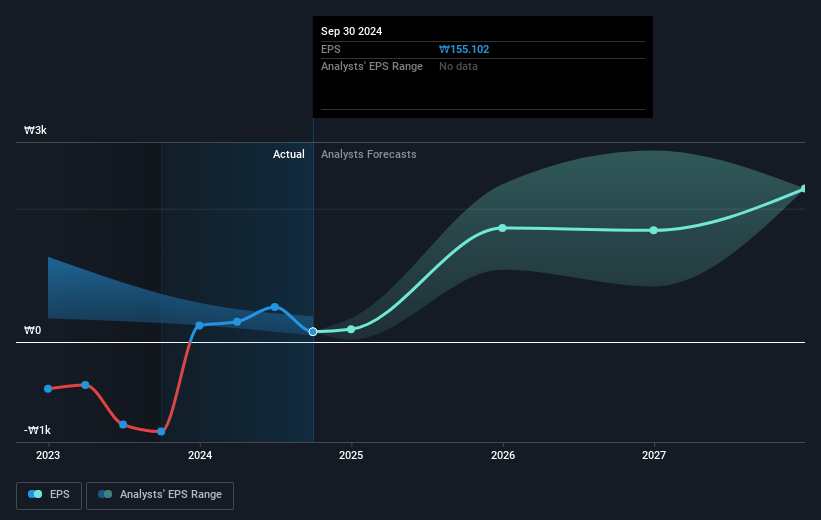

- The bullish analysts expect earnings to reach ₩210.0 billion (and earnings per share of ₩3259.3) by about July 2028, up from ₩48.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, down from 47.7x today. This future PE is greater than the current PE for the KR Entertainment industry at 19.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.29%, as per the Simply Wall St company report.

Pearl Abyss Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pearl Abyss remains heavily reliant on its aging Black Desert IP for revenue generation, as indicated by stable but stagnant contributions from existing titles and limited transparency on new revenue sources, which poses a risk of top-line stagnation or decline if engagement wanes and fewer new users are attracted.

- The ongoing development and imminent launch of Crimson Desert involve significant marketing and developmental spending, yet management was unable to provide any concrete performance metrics or conversion data, which signals a heightened risk of margin compression and negative impacts on earnings should the game underperform relative to its high investment.

- Operating revenue declined year-over-year and quarter-over-quarter, driven in part by the removal of China-related revenues and increased competition, while operating losses widened due to higher development costs, which may negatively impact both near-term earnings and long-term profitability if trends persist.

- Pearl Abyss's attempts to expand to new geographies are challenged by regulatory complexity and weakening performance in China, which could limit global reach, prevent effective revenue diversification, and reduce long-term growth prospects.

- The rise of alternative entertainment formats, such as short-form and user-generated content favored by younger gamers, competes with traditional MMORPGs like those produced by Pearl Abyss and may erode both user acquisition and average revenue per user over time, directly pressuring future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Pearl Abyss is ₩53000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Pearl Abyss's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩53000.0, and the most bearish reporting a price target of just ₩23000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩685.4 billion, earnings will come to ₩210.0 billion, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 9.3%.

- Given the current share price of ₩37300.0, the bullish analyst price target of ₩53000.0 is 29.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives