Key Takeaways

- Rapid international expansion, strategic deals, and IP-focused M&A poise Studio Dragon for outsized global growth and significant long-term earnings upside.

- Strong cost discipline, creator depth, and market premiumization position the company to sustainably outperform peers as global demand for Korean content rises.

- Dependence on a few hits, rising production costs, and global regulation risks threaten revenue stability and long-term earnings despite major partnerships.

Catalysts

About Studio Dragon- A drama studio, produces and provides drama contents worldwide.

- Analysts broadly agree that global OTT partnerships and diversification will expand Studio Dragon's content footprint, but this may be understated-Studio Dragon's rapid new market entries, Hollywood collaborations, and non-exclusive deals put them in a prime position to accelerate international revenue growth, outpacing current forecasts.

- Analyst consensus expects the implementation of pre-sale models and cost-plus arrangements to improve margins, yet with announced plans to reach near-100% actual cost settlement and a targeted 10% production cost reduction, Studio Dragon could see a step-change margin expansion and sustainable net income improvement beyond market expectations.

- Studio Dragon's aggressive M&A strategy, including the creation of a "Studio Dragon universe," the acquisition of production houses, and expanded IP rights, sets the stage for exponential IP-driven licensing opportunities and recurring high-margin syndication revenues, fueling long-term earnings power.

- The surge in global appetite for Korean content, underscored by successful distribution in new markets such as India, the Middle East, and Latin America, positions Studio Dragon to unlock premium pricing power for their IP, materially boosting both top-line revenue and average deal size over time.

- As rising budgets and higher production quality become industry norms, Studio Dragon's deep bench of high-grade creators, production scale, and early adoption of cost optimization make it one of the few players able to consistently deliver franchise-level content, driving structural gains in revenue share and operating leverage as global streaming competition intensifies.

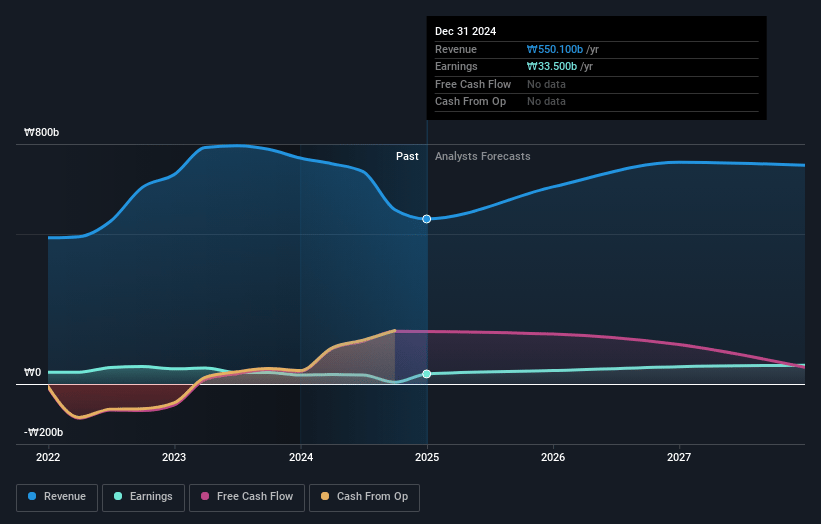

Studio Dragon Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Studio Dragon compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Studio Dragon's revenue will grow by 22.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.2% today to 12.5% in 3 years time.

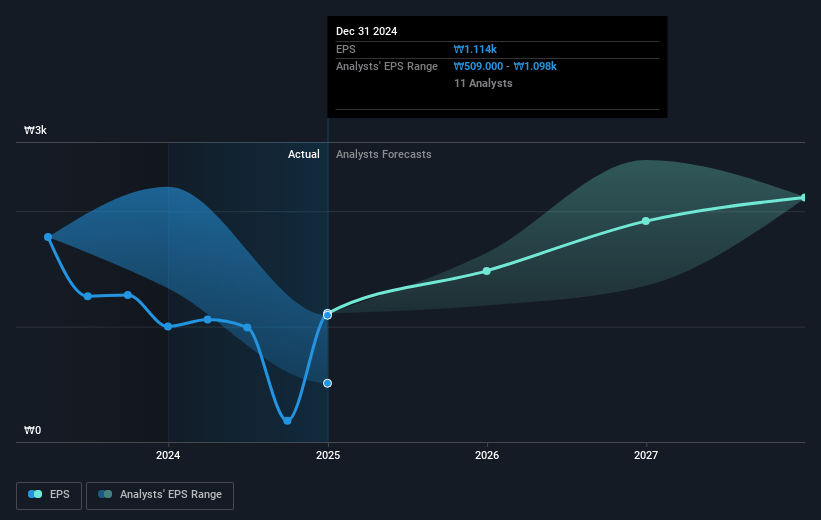

- The bullish analysts expect earnings to reach ₩113.6 billion (and earnings per share of ₩3960.02) by about July 2028, up from ₩15.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.4x on those 2028 earnings, down from 92.8x today. This future PE is greater than the current PE for the KR Entertainment industry at 19.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.17%, as per the Simply Wall St company report.

Studio Dragon Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Studio Dragon experienced a significant decline in global OTT-bound presales and saw reduced overseas sales due to underperforming new titles in Q1, which weakened profitability and highlights vulnerability to changing global content consumption trends; this directly threatens revenue growth and future earnings consistency.

- The company's heavy reliance on a few hit intellectual properties and the lack of major global releases in Q1 underscores its exposure to volatility in content performance, which can translate into unpredictable quarterly revenues and unstable earnings, making long-term financial forecasting more difficult.

- Management acknowledged rising production costs and discussed new practices to achieve only a modest 10% reduction, but inflation and intense competition for top talent are persistent industry tailwinds; if production expenses outpace content monetization, net margins will be compressed over the long term.

- As confirmed in executive comments, Studio Dragon's model still relies heavily on large distribution partners like Netflix and Amazon Prime, and any deterioration of licensing terms, exclusive agreements, or dissolution of partnerships could significantly impair topline revenue and profitability.

- Regulatory uncertainties-such as unresolved bans on Korean content in China and the potential for stricter local content quotas in target markets-pose risks to Studio Dragon's ability to expand globally and maintain its total addressable market, potentially stalling or shrinking revenue streams from key growth regions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Studio Dragon is ₩71000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Studio Dragon's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩71000.0, and the most bearish reporting a price target of just ₩30000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩909.9 billion, earnings will come to ₩113.6 billion, and it would be trading on a PE ratio of 24.4x, assuming you use a discount rate of 9.2%.

- Given the current share price of ₩48350.0, the bullish analyst price target of ₩71000.0 is 31.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.