Key Takeaways

- Demographic shifts, tightening regulations, and data privacy concerns threaten user growth, compliance costs, digital innovation, and overall profitability.

- Heightened competition and dependence on the core ecosystem risk eroding pricing power, platform advantages, and future business scalability.

- Diversified digital banking strategy, innovative products, and international expansion position KakaoBank for sustained revenue growth, increased profitability, and reduced reliance on its core domestic market.

Catalysts

About KakaoBank- An Internet bank, provides banking services through electronic financial transaction method in South Korea.

- The accelerating decline in South Korea's youth population and the overall aging demographic poses a structural threat to KakaoBank's core digital-native user base, which is likely to erode long-term user acquisition and deposit growth, thus dampening both future revenue and customer expansion prospects.

- Escalating regulatory demands-such as tighter credit controls, monitoring of household loan growth, and stricter capital requirements-will limit KakaoBank's ability to meaningfully expand loan assets, suppressing net interest margin recovery and heightening compliance costs, which will pressure both earnings and return on equity in the long run.

- The continued commoditization of digital banking services driven by entrants from big tech, fintech startups, and incumbents accelerating their digital transformation efforts threatens to erode KakaoBank's pricing power and customer retention, ultimately compressing margins and weakening the bank's ability to achieve sustainable revenue growth.

- Increasingly stringent data privacy regulations and heightened consumer sensitivity to the use of personal data will require KakaoBank to divert more resources to compliance and governance, constraining its capacity to fully leverage AI and data-driven fintech innovation, thereby capping margin expansion and stalling platform-related fee income growth.

- Persistent over-reliance on the Kakao ecosystem exposes the company to the risks of platform disruption, potential regulatory or antitrust scrutiny, and cascading reputational risks, any of which could abruptly curtail the inflow of new customers and cross-selling revenue, leading to lower-than-expected earnings and hampered business scalability.

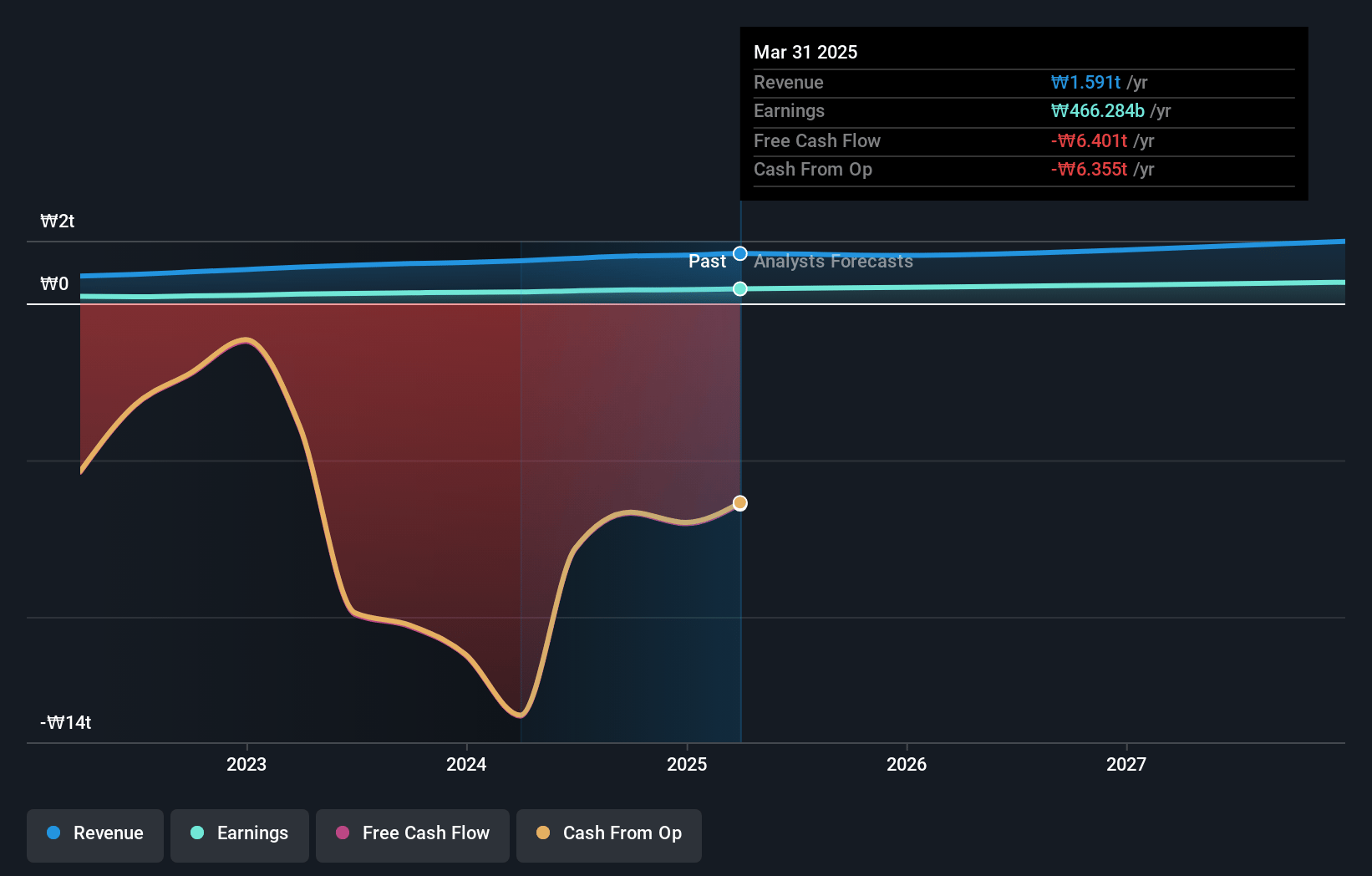

KakaoBank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on KakaoBank compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming KakaoBank's revenue will grow by 5.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 29.3% today to 34.0% in 3 years time.

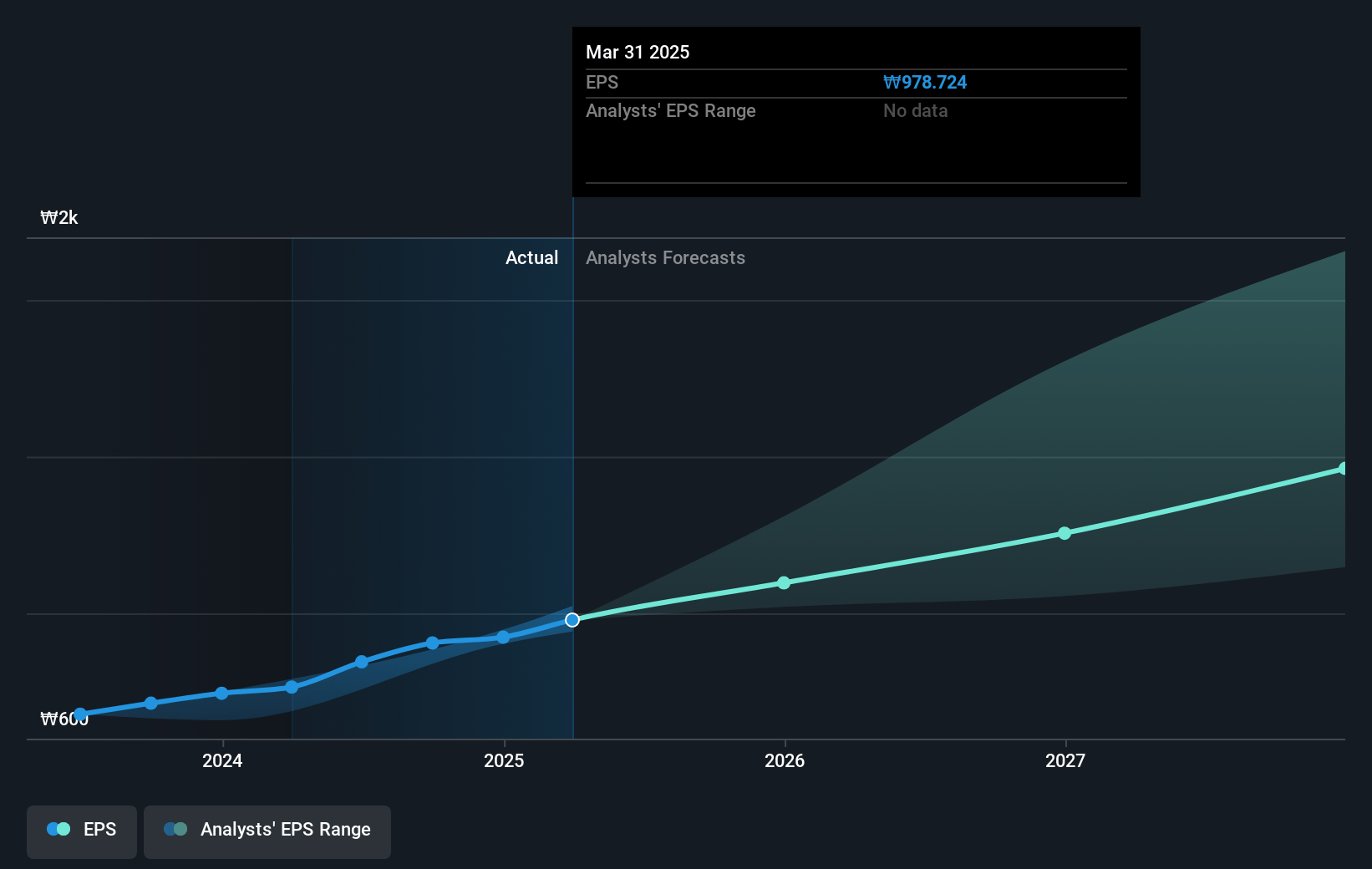

- The bearish analysts expect earnings to reach ₩634.3 billion (and earnings per share of ₩1228.47) by about July 2028, up from ₩466.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 30.4x today. This future PE is greater than the current PE for the KR Banks industry at 7.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

KakaoBank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued acceleration of digital adoption in banking, reflected by KakaoBank surpassing 25 million customers and ongoing robust deposit and platform engagement growth, suggests sustained increases in market share and a broadening addressable market that can support higher revenue and user growth over the long term.

- Expansion into wealth management, investment services, and innovative product lines-including recent launches in cryptocurrency tracking and new partnerships for investment services-demonstrates a diversification of offerings that will increase average revenue per user and potentially drive long-term earnings growth.

- Operational leverage from a digital-only infrastructure, as evidenced by consistently high shares of low-cost deposits and proactive management of funding costs, supports higher net margins and positions KakaoBank to benefit from further efficiency gains as it scales its deposit and lending platforms.

- The company's ongoing commitment to leveraging artificial intelligence across its banking services, including personalized search, financial calculators, and customer engagement tools, positions it to differentiate its offerings and deepen customer relationships, which may drive recurring platform revenue and improve profitability.

- KakaoBank's initial success with international expansion, highlighted by rapid growth in its Indonesian Superbank initiative and pending virtual bank applications in new markets, provides strategic opportunities to unlock new revenue streams and reduce reliance on the domestic market, thereby supporting sustained long-term earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for KakaoBank is ₩22000.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KakaoBank's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩34000.0, and the most bearish reporting a price target of just ₩22000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩1863.1 billion, earnings will come to ₩634.3 billion, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩29750.0, the bearish analyst price target of ₩22000.0 is 35.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.