Key Takeaways

- Digital platform expansion and bundled service strategies position Woori for accelerated customer growth, fee income, and sustained market share gains through cross-selling opportunities.

- Regulatory changes and evolving demographics support outsized long-term growth in wealth management, fintech partnerships, and broader monetization within integrated digital finance ecosystems.

- Overdependence on the domestic market, persistent asset quality concerns, lagging digital transformation, and unfavorable macroeconomic conditions threaten profitability and long-term growth prospects.

Catalysts

About Woori Financial Group- Operates as a commercial bank which provides various financial services to individual, business, and institutional customers in Korea.

- Analyst consensus highlights revenue stream diversification and non-interest income growth, but this narrative underestimates the rapid acceleration Woori is seeing from its digital super app and bundled platform strategies, which could catalyze a step-change in customer acquisition and fee income well beyond current projections, driving outsized future revenue and net margin expansion.

- While analysts broadly recognize aggressive capital allocation and capital adequacy improvements, they are likely underappreciating the near-term impact of the impending insurance acquisition, which is set to immediately add ₩300–400 billion to annual profits and boost ROE by around 1 percentage point, significantly accelerating group earnings and book value growth.

- Woori is uniquely positioned to capture Korea's surging demand for integrated digital finance, combining banking, securities, wealth, and even telecom services in a single mobile ecosystem, allowing for outsized market share gains and scalability in cross-sold financial products, translating to structurally higher long-run fee and interest income.

- Korea's demographic shift and growing middle class underpin a multiyear boom in demand for wealth management and retirement solutions, and Woori's accelerated digital and wealth management initiatives are set to capture disproportionate growth, driving sustainable increases in assets under management and fee-based revenue.

- Regulatory tailwinds promoting open banking and API-driven ecosystems allow Woori to swiftly capture emerging B2B and B2C monetization opportunities in data, payments, and fintech partnerships, fostering new revenue channels and further anchoring superior growth in operating earnings.

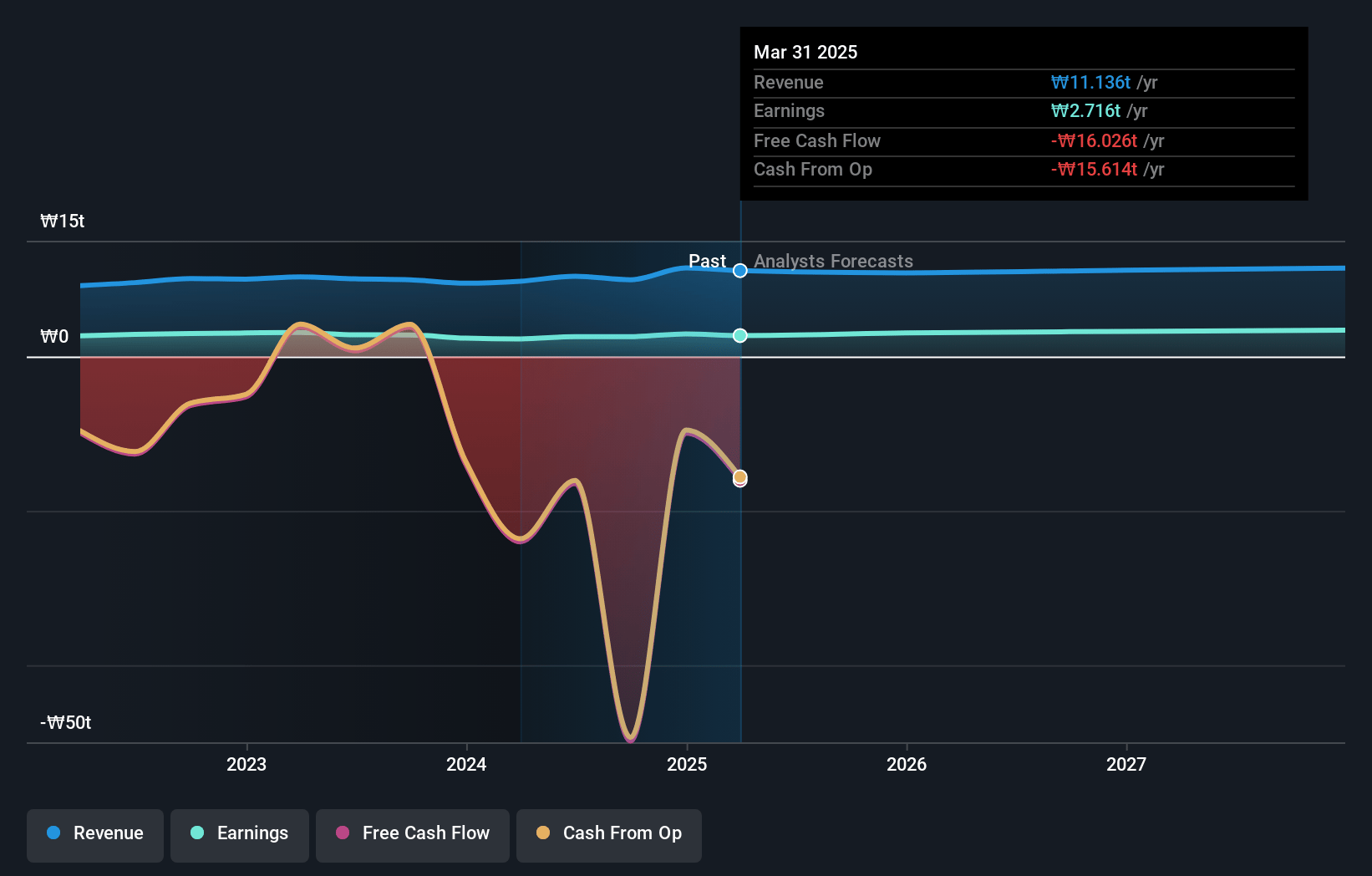

Woori Financial Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Woori Financial Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Woori Financial Group's revenue will grow by 3.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 24.4% today to 30.6% in 3 years time.

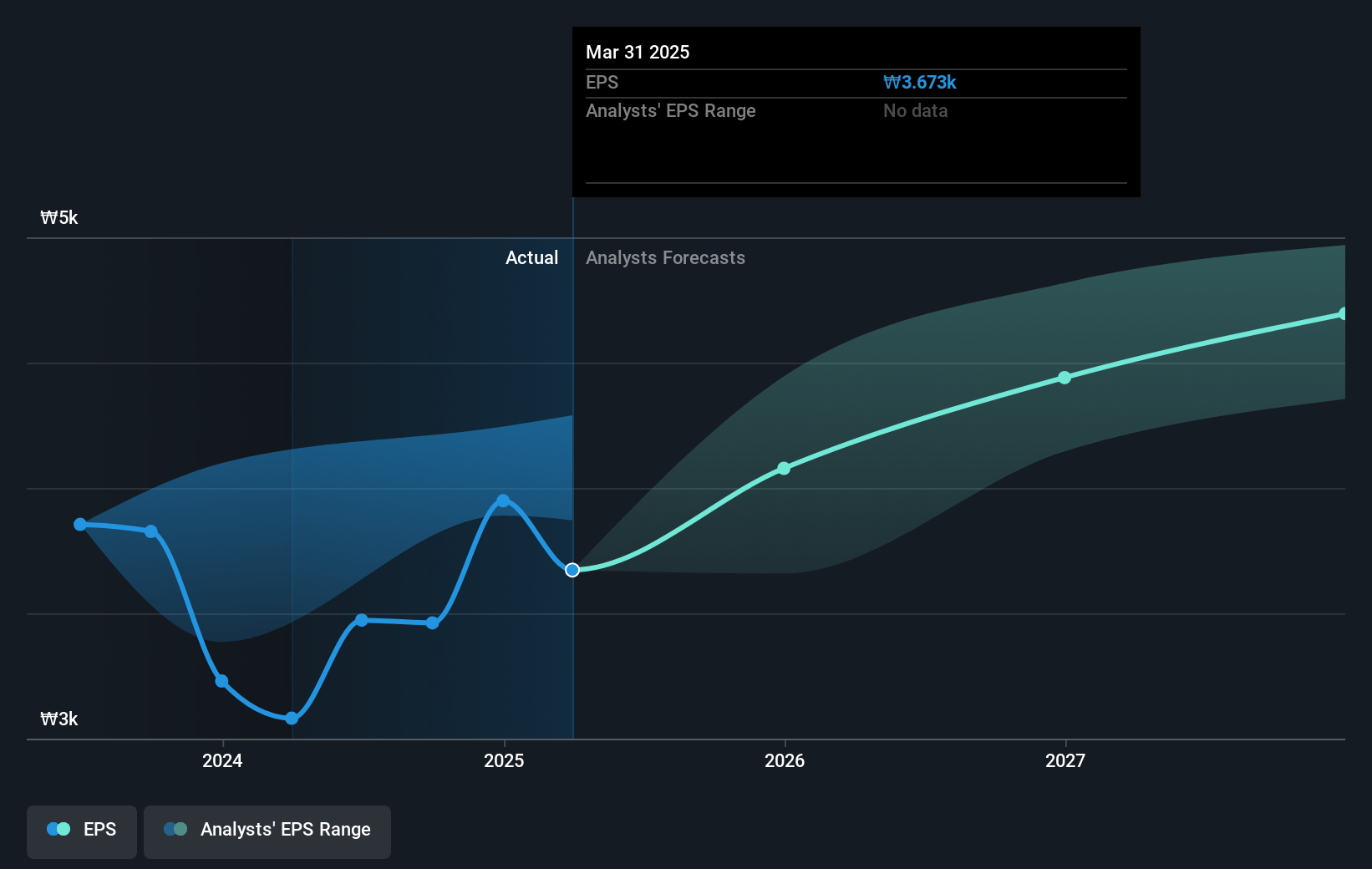

- The bullish analysts expect earnings to reach ₩3732.5 billion (and earnings per share of ₩5181.04) by about July 2028, up from ₩2715.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.6x on those 2028 earnings, up from 7.0x today. This future PE is about the same as the current PE for the US Banks industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 0.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Woori Financial Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Woori's heavy reliance on the South Korean market means it remains exposed to domestic economic fluctuations, heightened by regulatory constraints and market saturation, putting long-term pressure on both its revenue growth and earnings stability.

- Persistent asset quality issues are underscored by rising credit costs, a higher credit cost ratio than peers, and continued provisioning tied to high-risk SME and retail lending, signaling the risk of elevated nonperforming loans and future profit erosion if economic conditions deteriorate.

- Legacy IT infrastructure and the need for significant digital investments to compete with fintechs and digital-native challengers are straining operating expenses, while Woori's digital transformation lags behind peers, likely leading to compressed net margins over the long run.

- Compressing net interest margins are expected due to a low or volatile interest rate environment and elevated funding competition, limiting the profitability of core banking operations and posing a direct threat to net interest income.

- Economic stagnation in South Korea, driven by an aging population, shrinking workforce, and export dependencies, is likely to constrain loan demand and fee-based income, resulting in subdued revenue and limited earnings growth in the years ahead.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Woori Financial Group is ₩31157.54, which represents two standard deviations above the consensus price target of ₩23075.0. This valuation is based on what can be assumed as the expectations of Woori Financial Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩33500.0, and the most bearish reporting a price target of just ₩18000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩12190.2 billion, earnings will come to ₩3732.5 billion, and it would be trading on a PE ratio of 7.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩25850.0, the bullish analyst price target of ₩31157.54 is 17.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.