Key Takeaways

- Aggressive loan growth, digital expansion, and Southeast Asian market entry could significantly boost earnings and strengthen revenue diversification beyond consensus expectations.

- Superior asset quality and shareholder return strategy position the company for stronger profitability, resilience, and accelerated per-share performance versus peers.

- Lack of digital investment, domestic market concentration, demographic headwinds, and reliance on interest income threaten Hana Financial Group's long-term competitiveness and earnings stability.

Catalysts

About Hana Financial Group- Through its subsidiaries, provides financial services in South Korea.

- Analysts broadly agree that asset growth in line with nominal GDP and a focus on high-quality corporate loans will drive steady revenue, but this view underestimates Hana's ability to outpace industry loan growth as the Korean government urges more corporate lending and the group's capital ratios provide ample room for more aggressive expansion, implying greater upside for interest income and overall earnings than consensus expects.

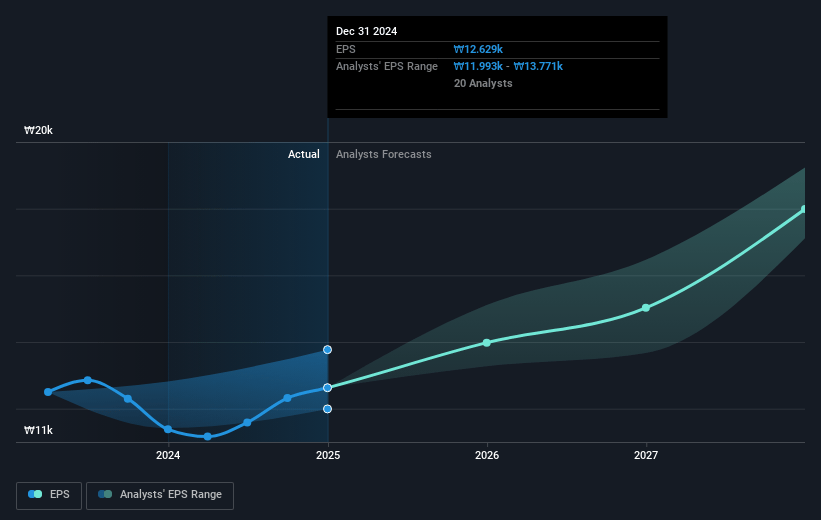

- While consensus expects improved shareholder returns from steadily executed buybacks and a fixed dividend, Hana's proactive and flexible share buyback-potentially above ₩400 billion per half-year and targeting a 50% shareholder return ratio by 2027-positions per-share metrics like EPS and BVPS for far stronger acceleration, especially as reduced share count amplifies the benefit of profit growth.

- Hana's strengthening digital banking platform is enabling lower cost-to-serve and expanding its fee-based digital services, which, together with its growing presence in digital payments and overseas card spending, are set to structurally improve net margins and drive more resilient, higher-margin fee income streams in the long run.

- The group's aggressive expansion and acquisitions in high-growth Southeast Asian markets, especially Vietnam and Indonesia, positions it to benefit disproportionately from rising middle-class affluence in the region, which will materially lift long-term revenue growth and earnings diversification above peers anchored in mature domestic markets.

- Hana's robust asset quality, underpinned by sector-leading levels of collateralization and rigorous credit screening-particularly for SME and SOHO loans-means the market is likely overestimating future credit costs and underappreciating the group's ability to defend profitability and capital ratios throughout economic cycles, reducing risk to net income and supporting sustainable payout growth.

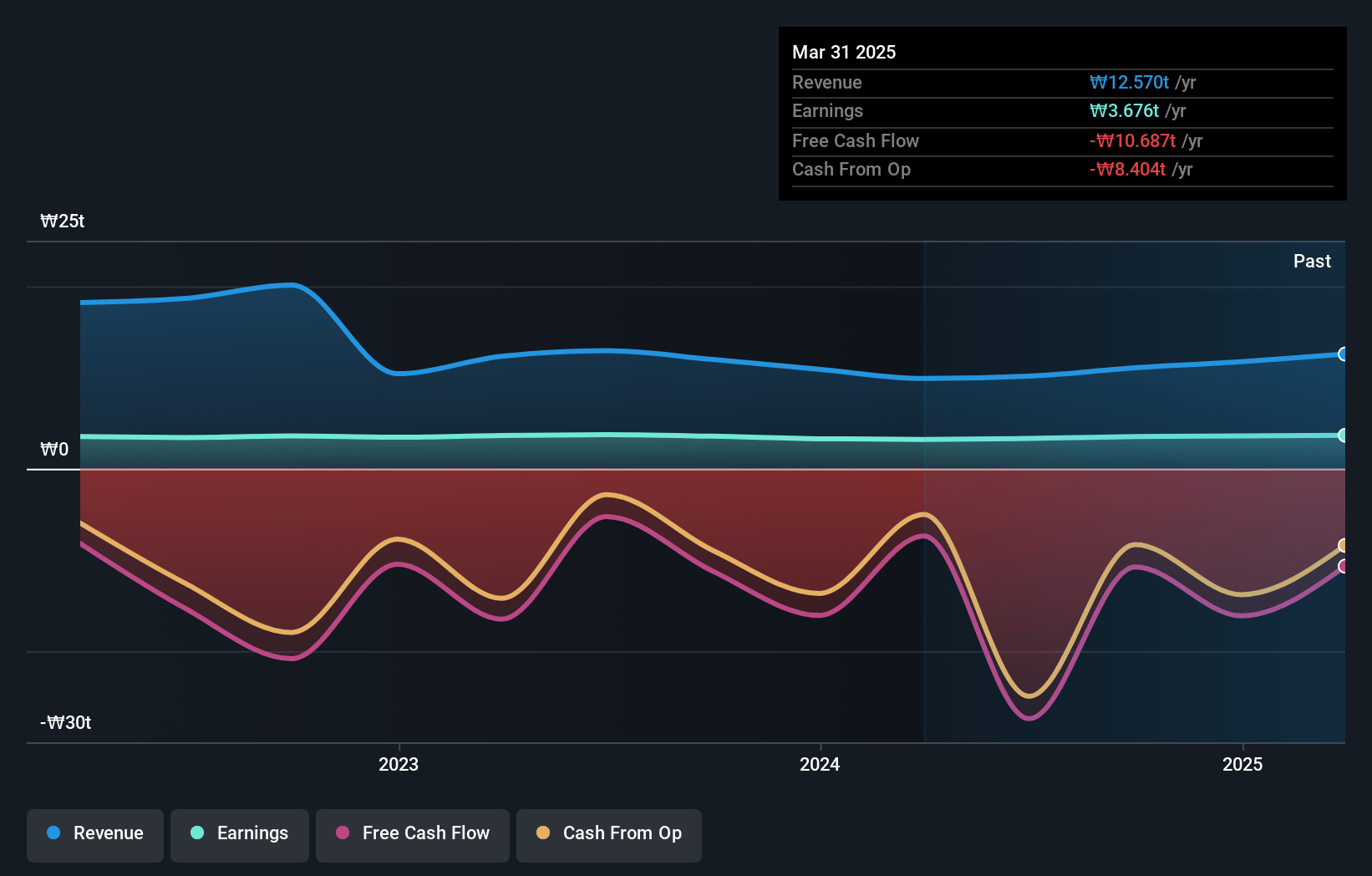

Hana Financial Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hana Financial Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hana Financial Group's revenue will decrease by 0.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 29.2% today to 38.5% in 3 years time.

- The bullish analysts expect earnings to reach ₩4865.6 billion (and earnings per share of ₩19176.1) by about July 2028, up from ₩3675.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, up from 6.9x today. This future PE is greater than the current PE for the KR Banks industry at 7.6x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Hana Financial Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hana Financial Group's persistent underinvestment in digital transformation compared to domestic and global peers risks declining long-term competitiveness, which could result in higher customer attrition and mounting costs to acquire and retain clients, ultimately exerting negative pressure on net margins.

- The accelerating digital disruption from fintech and big tech competitors is likely to erode traditional bank market share and compress margins, while the text indicates only moderate fee income growth and potential reliance on conventional banking business models, potentially restraining revenue growth and profitability.

- The group's heavy concentration in the South Korean market, paired with the country's aging population and declining birth rates, presents sustained risks of stagnating credit demand and reduced appetite for household loans and financial products, dampening long-term revenue and earnings growth potential.

- Despite short-term improvements, ongoing concerns about asset quality are reflected in rising delinquency and NPL ratios, as well as declining coverage ratios, which may force higher future credit costs and provisioning, thereby threatening long-term earnings stability and potentially impacting net income.

- High dependence on interest income in a low or declining interest rate environment, which the management themselves note could persist due to potential further policy rate cuts, exposes the group to net interest margin compression and limitations on net profit growth if rates remain subdued or decline further.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hana Financial Group is ₩123516.36, which represents two standard deviations above the consensus price target of ₩93022.73. This valuation is based on what can be assumed as the expectations of Hana Financial Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩130000.0, and the most bearish reporting a price target of just ₩65500.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩12638.6 billion, earnings will come to ₩4865.6 billion, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩93200.0, the bullish analyst price target of ₩123516.36 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.