Key Takeaways

- Internal and external growth strategies, including remodeling and property acquisitions, aim to boost future profitability and enhance long-term earnings.

- Sustainability initiatives and a stable financial base support cost reduction, net margin improvement, and earnings stability despite interest rate fluctuations.

- Remodeling projects and competitive pressures may impact short-term revenue stability and growth, while reliance on variable interest rates poses financial risks.

Catalysts

About Advance Residence Investment- Advance Residence Investment Corporation is the largest J-REIT specializing in residential properties and is managed by ITOCHU REIT Management Co., Ltd.

- The remodeling project is expected to continue, with planned implementation of approximately 300 units per fiscal period, leading to a significant increase in rent by 26.1%. This internal growth initiative should positively impact revenue and contribute to future profitability improvements.

- The acquisition of properties from the sponsor pipeline, with 20 properties estimated at over ¥40 billion, indicates a strategy for external growth that can enhance revenue and long-term earnings through strategic asset acquisitions.

- Expected improvements in the rental market, with continued population inflow to urban areas and increased rental demand, are likely to boost occupancy rates and rental income, enhancing overall revenues.

- Ongoing sustainability initiatives like LED installations and energy conservation certifications may lower operational costs and potentially improve net margins by making properties more attractive for eco-conscious tenants.

- A stable financial base with a diversified funding profile, including a decreasing loan-to-value (LTV) ratio and high fixed interest debt, positions the company well to mitigate the impact of rising interest rates and stabilize earnings.

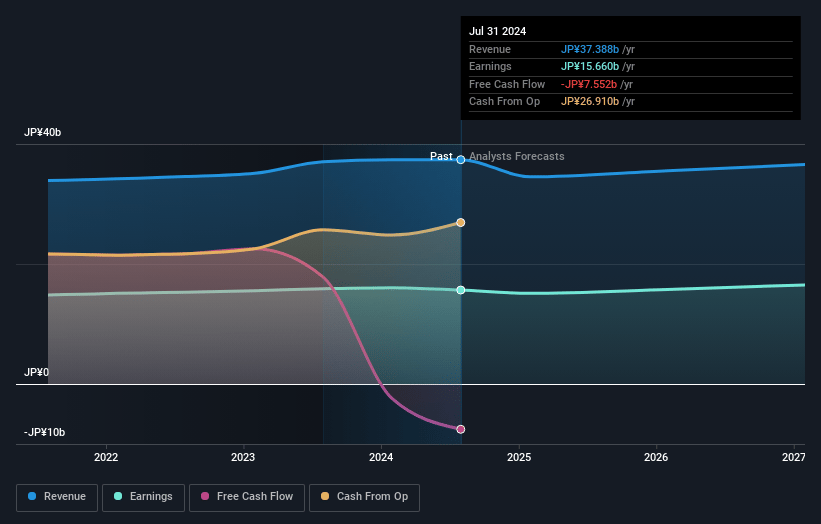

Advance Residence Investment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Advance Residence Investment's revenue will decrease by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 41.9% today to 45.9% in 3 years time.

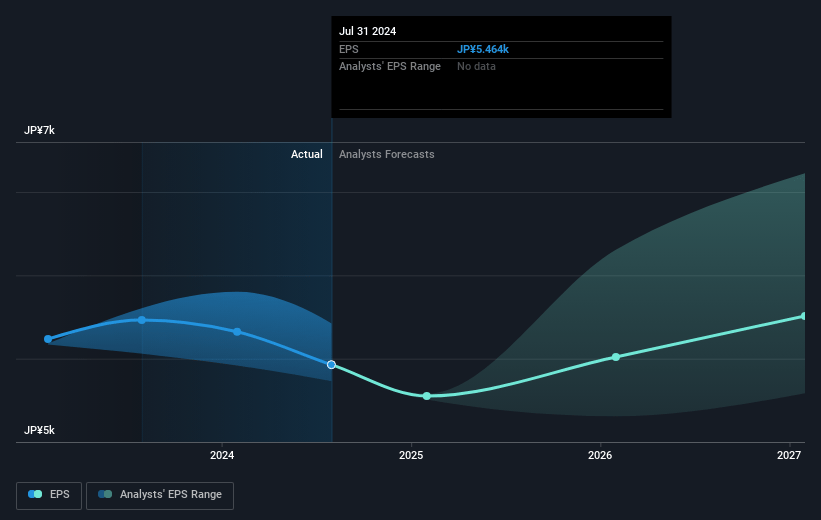

- Analysts expect earnings to reach ¥16.6 billion (and earnings per share of ¥5756.52) by about February 2028, up from ¥15.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ¥19.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 25.2x today. This future PE is lower than the current PE for the JP Residential REITs industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.45%, as per the Simply Wall St company report.

Advance Residence Investment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Remodeling projects, while aiming to increase rent and profitability, result in longer downtimes and could temporarily decrease occupancy rates, potentially affecting short-term revenue stability.

- The reliance on interest rates that are variable risks increased financial costs, which could adversely impact earnings if there are significant interest rate hikes in the future.

- The decrease in distribution from retained earnings per unit suggests cautious cash management, which might limit reinvestment in growth opportunities, potentially impacting net margins.

- External growth through acquisitions relies on sponsor pipelines and accessible financing; any shifts in the real estate transaction market or financial environment could affect future revenues and asset valuation.

- Competitive pressures, such as increased supply in certain markets like Nagoya, could lead to prioritization of occupancy rates over rental increases, potentially limiting revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥152972.222 for Advance Residence Investment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥185000.0, and the most bearish reporting a price target of just ¥69500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥36.0 billion, earnings will come to ¥16.6 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 5.5%.

- Given the current share price of ¥137900.0, the analyst price target of ¥152972.22 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives