Last Update 01 May 25

Key Takeaways

- Restructuring and closure of unprofitable malls and expansion challenges in China could pressure operating income and margins.

- Infrastructure and execution issues, along with external reliance, might create uncertainty in revenue growth and net margins.

- Strategic initiatives, domestic growth, international expansion, and operational synergies could enhance profitability, stabilize earnings, and diversify AEON Mall's revenue streams.

Catalysts

About AEON Mall- Develops, operates, and manages shopping malls in Japan, China, Vietnam, Cambodia, Indonesia, and internationally.

- The planned restructuring and closure of unprofitable malls in China and elsewhere might create short-term costs before yielding benefits, which could pressure net margins and operating income.

- AEON Mall's ongoing expansion into new malls, particularly in China, resulted in an operating income decrease of ¥1.8 billion. If these new malls fail to perform as expected, they could continue to negatively impact earnings and operating income.

- Delays in infrastructure development around key locations in Cambodia have already impacted performance negatively. Such infrastructure-related issues could result in ongoing revenue and net margin pressure if not resolved promptly.

- The integration into AEON as a wholly owned subsidiary and the associated organizational and operational changes might encounter execution challenges, which could lead to increased costs and compressed net margins during the transition period.

- While domestic mall renovations and inbound tourism strategies look promising, their reliance on external factors like consumer spending trends and tourism levels could make future revenue growth uncertain if these factors fluctuate adversely.

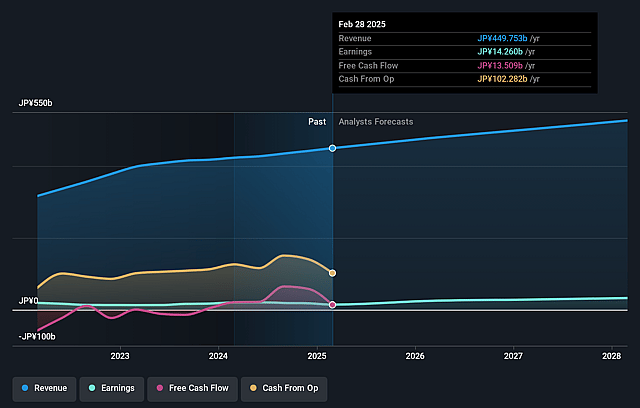

AEON Mall Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AEON Mall's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 6.3% in 3 years time.

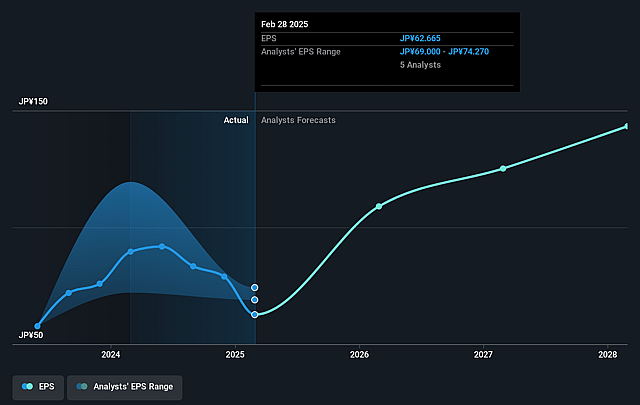

- Analysts expect earnings to reach ¥33.2 billion (and earnings per share of ¥145.98) by about May 2028, up from ¥14.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, down from 43.7x today. This future PE is greater than the current PE for the JP Real Estate industry at 10.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

AEON Mall Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued growth in domestic mall sales and customer visits could drive an increase in overall revenue, supported by strategic mall renovations and inbound tourism.

- Successful restructuring and turnaround of underperforming businesses, including the closing of low-potential malls, could enhance profitability and net margins.

- Synergies from becoming a wholly owned subsidiary of AEON, leveraging AEON Group assets, and integrating customer data could increase operational efficiency and expand earnings potential.

- Expansion and improvement in international markets like Vietnam and Indonesia demonstrate potential for revenue growth, suggesting diversified sources of income.

- Initiatives to improve profitability and reduce costs, particularly in challenging markets like China, could stabilize earnings and improve net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1946.667 for AEON Mall based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥524.2 billion, earnings will come to ¥33.2 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 7.0%.

- Given the current share price of ¥2740.0, the analyst price target of ¥1946.67 is 40.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.