Last Update 07 Dec 25

Fair value Increased 0.81%4502: Future Specialty Pipeline And Leadership Change Will Drive Upside Outlook

Analysts have nudged their fair value estimate for Takeda Pharmaceutical modestly higher to approximately ¥4,946 from about ¥4,906, reflecting slightly stronger long term revenue growth expectations and a marginally higher future earnings multiple, despite a small compression in projected profit margins.

What's in the News

- Revised guidance for fiscal year 2025 points to softer top line and a sharper drop in reported operating profit, driven by weaker ENTYVIO and VYVANSE sales, unfavorable product mix and higher expected impairments, partly offset by R and D cost savings (company guidance).

- The Ninth Circuit upheld certification of a landmark civil RICO class action over diabetes drug Actos, exposing Takeda and Eli Lilly to potentially more than JPY 1 billion in trebled damages and raising legal and regulatory risk around historic safety disclosures (lawsuit filing and court decision).

- Takeda is discontinuing its in house cell therapy efforts and taking a roughly JPY 58 billion impairment on its gamma delta T cell platform, while seeking partners to carry the technology forward and reallocating capital toward small molecules, biologics and ADCs (company statement).

- Key late stage pipeline readouts include positive Phase 3 data for narcolepsy candidate oveporexton and long term efficacy and safety signals for rusfertide in polycythemia vera and mezagitamab in IgA nephropathy, reinforcing a pivot toward targeted specialty therapies (medical congress presentations).

- Strategic initiatives span a major oncology collaboration with Innovent Biologics and a low carbon shipping partnership with VELA Transport, alongside an announced CEO transition to Julie Kim in June 2026. Together these developments are reshaping Takeda's global footprint and leadership profile (company announcements).

Valuation Changes

- Fair Value Estimate has risen slightly to approximately ¥4,946 from about ¥4,906, reflecting modestly stronger long term assumptions.

- The discount rate is unchanged at 4.8%, indicating no shift in the analyst view of Takeda's risk profile.

- Revenue growth edged up marginally to about 1.89% from roughly 1.89%, signaling a very small improvement in long term growth expectations.

- Net profit margin eased slightly to roughly 7.00% from around 7.03%, suggesting a minor anticipated compression in profitability.

- Future P/E increased modestly to about 27.2x from roughly 26.8x, implying a slightly higher valuation multiple applied to projected earnings.

Key Takeaways

- Removal of generic erosion headwinds and a strong late-stage pipeline position Takeda for earnings recovery and multi-year revenue expansion.

- Focused portfolio and emerging market access enable sustainable, higher-margin growth and enhanced long-term financial flexibility.

- Intensifying competition, regulatory pressures, rising costs, and debt constraints threaten Takeda's revenue growth, margins, and ability to invest for future sustainable performance.

Catalysts

About Takeda Pharmaceutical- Engages in the research, development, manufacture, marketing, and out-licensing of pharmaceutical products in Japan and internationally.

- The anticipated moderation and eventual stabilization of VYVANSE generic erosion after FY2025 will remove a major headwind for revenues, allowing Takeda's core growth and launch products to drive top-line and earnings recovery going forward.

- Rapid progress and positive late-stage data from Takeda's innovative pipeline, especially in high-need therapeutic areas like rare diseases (orexin agonists for narcolepsy, rusfertide for polycythemia vera), set the stage for multiple high-value product launches, which can catalyze multi-year revenue and margin expansion.

- The increasing prevalence of chronic and rare diseases in aging populations worldwide, coupled with Takeda's focused portfolio in gastroenterology, rare diseases, neuroscience, and oncology, positions the company to capture a growing patient base and secure sustainable, higher-margin revenue streams.

- Expanding healthcare access in emerging markets and new product penetrations (like QDENGA and plasma-derived therapies) enable Takeda to participate in broader market growth, supporting robust, long-term top-line growth potential.

- Ongoing operational efficiency efforts-including R&D savings reinvestment and successful debt refinancing-provide financial flexibility to support future pipeline investments and shareholder returns, bolstering both net margins and free cash flow over time.

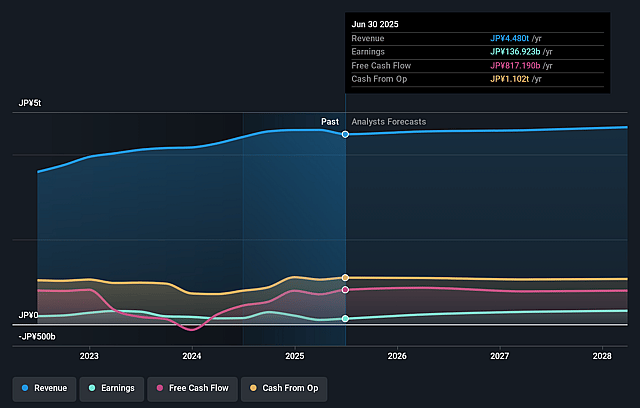

Takeda Pharmaceutical Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Takeda Pharmaceutical's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 7.2% in 3 years time.

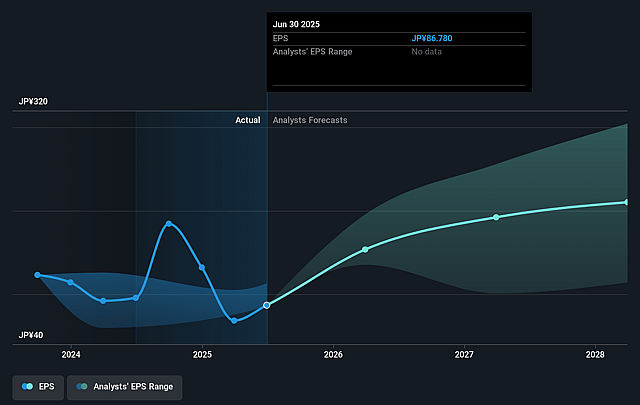

- Analysts expect earnings to reach ¥339.5 billion (and earnings per share of ¥216.77) by about September 2028, up from ¥136.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥485.9 billion in earnings, and the most bearish expecting ¥178.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 51.3x today. This future PE is greater than the current PE for the JP Pharmaceuticals industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 1.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Takeda Pharmaceutical Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating generic and biosimilar competition-especially for key revenue drivers such as VYVANSE and, prospectively, Entyvio-is causing significant revenue decline and compressed net margins, raising concerns about Takeda's ability to offset these headwinds with new product launches and pipeline performance.

- Rampant healthcare pricing reform (Medicare Part D redesign, IRA negotiation, and the looming threat of Most Favored Nation pricing in the U.S.) may structurally lower reimbursement rates for Takeda's key products and impede revenue growth and profitability in its largest market.

- Rising R&D and drug development costs, combined with the risk of pipeline underperformance (e.g., late-stage failures, delays, or limited differentiation in crowded indications), could mean that the anticipated inflection from late-stage pipeline assets fails to materialize, undermining long-term earnings growth.

- High post-acquisition debt burden from the Shire transaction increases vulnerability to interest rate changes and constrains free cash flow, potentially limiting reinvestment into future growth and putting pressure on shareholder returns if cash generation unexpectedly lags.

- Intensified competition from new entrants and innovative therapies (e.g., novel mechanisms in IBD, narcolepsy, HAE, and other targeted markets) risks eroding future market share for Takeda's specialty franchise, threatening both revenue growth and sustainable net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥5056.071 for Takeda Pharmaceutical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5900.0, and the most bearish reporting a price target of just ¥4500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥4696.5 billion, earnings will come to ¥339.5 billion, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥4499.0, the analyst price target of ¥5056.07 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Takeda Pharmaceutical?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.