Key Takeaways

- NEXON focuses on growing proven franchises with ongoing updates and localization, aiming for long-term revenue and profitability improvements.

- The company plans ambitious growth through new products, market expansion, and shareholder returns, reflecting confidence in significantly boosting revenue and operating income.

- Challenging market conditions, underperforming game titles, and rising costs threaten NEXON's revenue growth and financial performance.

Catalysts

About NEXON- Produces, develops, and services PC online and mobile games.

- NEXON is focusing on extending the success of its proven franchises, such as Dungeon&Fighter and MapleStory, through ongoing content updates and service improvements, which are expected to improve revenue and profitability over long periods. This strategy is expected to impact revenue and net margins positively.

- The launch of Dungeon&Fighter Mobile in China and plans for future updates are part of NEXON's strategy to sustain long-term revenue growth for the Dungeon&Fighter franchise, targeting a 25% revenue CAGR from 2023 to 2027. This focus on long-term growth is crucial for impacting revenue and earnings.

- NEXON is pursuing horizontal growth by developing new games and entering new markets, such as The First Descendant. These efforts aim to achieve approximately ¥100 billion in additional revenue between 2023 and 2027, thus impacting revenue significantly.

- The company is employing a hyper-localization strategy to adapt its content and promotions in diverse markets, leading to increased revenue for franchises like MapleStory outside Korea, with a 23% year-over-year increase in Q3. This strategy aims to improve revenue and earnings sustainability.

- NEXON’s planned share repurchase and new shareholder return policy reflect confidence in its future growth strategy, where significant investments in innovation and expanding their franchise portfolio are expected to drive revenue and operating income growth, with goals for a 50% revenue CAGR and a 70% operating income CAGR between 2023 and 2027. This has implications for enhancing earnings per share (EPS).

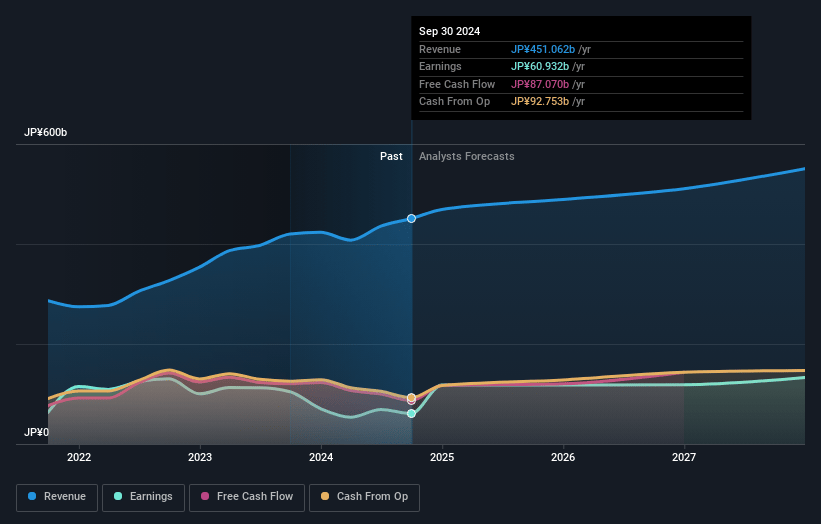

NEXON Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NEXON's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.5% today to 23.9% in 3 years time.

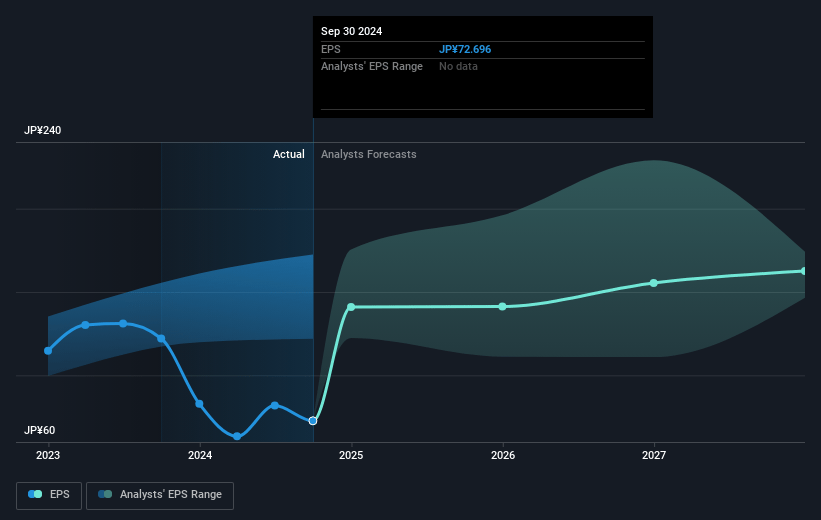

- Analysts expect earnings to reach ¥125.7 billion (and earnings per share of ¥155.83) by about January 2028, up from ¥60.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥157.0 billion in earnings, and the most bearish expecting ¥106.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, down from 27.8x today. This future PE is lower than the current PE for the JP Entertainment industry at 28.5x.

- Analysts expect the number of shares outstanding to decline by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.07%, as per the Simply Wall St company report.

NEXON Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The revenue from key games like Dungeon&Fighter and MapleStory in Korea is below expectations, with challenging market conditions leading to potential downturns, impacting future revenue and net margins.

- There is significant risk associated with the performance and market penetration of new titles such as The First Descendant in Western markets, especially given the faster-than-expected decline in user engagement post-launch, which could lead to lower future earnings.

- The reliance on existing franchises like Dungeon&Fighter, particularly within China, poses a risk if the games do not perform in line with growth expectations or if market saturation occurs, which could lead to reduced revenue growth.

- Potential currency exchange impacts, as highlighted in the report, continue to affect the company’s net income, posing a risk to the earnings outlook if adverse currency trends persist.

- Rising labor costs and increased marketing expenses, as expected in future quarters, could compress net margins if not offset by proportional revenue growth, affecting overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2844.79 for NEXON based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3500.0, and the most bearish reporting a price target of just ¥2230.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥526.1 billion, earnings will come to ¥125.7 billion, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of ¥2056.0, the analyst's price target of ¥2844.79 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives