Key Takeaways

- Heavy dependence on a declining domestic market and underperformance internationally will constrain revenue growth and place continued pressure on operating margins.

- Higher compliance and operational costs, alongside eroding brand equity and market share, will limit profitability and challenge Shiseido's premium positioning.

- Structural reforms, digital expansion, premium brand focus, and cost optimization position Shiseido for improved profitability, operational efficiency, and long-term growth in the global beauty market.

Catalysts

About Shiseido Company- Engages in the production and sale of cosmetics in Japan and internationally.

- Shiseido's heavy reliance on the stagnant Japanese domestic market and the shrinking customer base due to Japan's demographic decline will significantly restrict sustainable revenue growth and undermine long-term top-line expansion, particularly as inbound travel sales remain well below pre-pandemic levels.

- Persistently weak performance and declining consumer demand in China and Travel Retail, compounded by increasing geopolitical risks and rising nationalism, will continue to expose Shiseido to volatile revenues and restrict its ability to capitalize on core prestige brands, resulting in material pressure on overall operating margins.

- The company's complex global legacy infrastructure, high fixed R&D and marketing costs, and challenges in executing cost-reduction initiatives outside Japan are likely to prevent meaningful improvements in net margins, limiting any EPS growth and amplifying downside operating leverage during periods of sales contraction.

- Shiseido faces eroding pricing power and shrinking market share as agile indie and digital-native brands in the Americas and Europe outperform legacy firms in digital engagement and clean beauty innovation, leading to deteriorating brand equity and long-run profitability deterioration across key international markets.

- Rising pressure to overhaul product formulations for sustainability and clean beauty, coupled with tightening global regulatory requirements and ingredient scrutiny, will elevate compliance costs and cause ongoing margin contraction, while slow innovation cycles leave Shiseido less able to defend its premium positioning in increasingly fragmented markets.

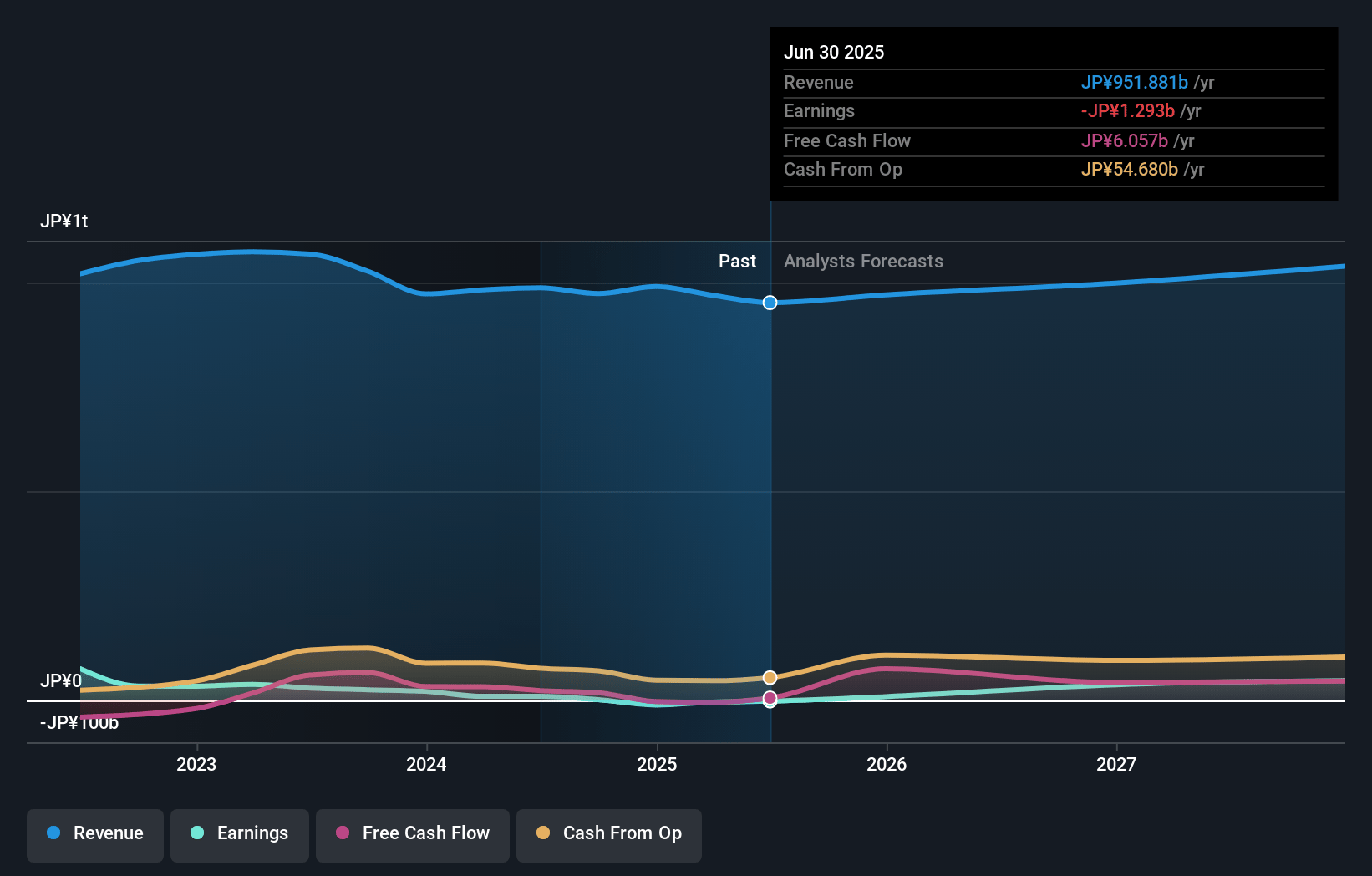

Shiseido Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Shiseido Company compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Shiseido Company's revenue will grow by 1.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.4% today to 3.8% in 3 years time.

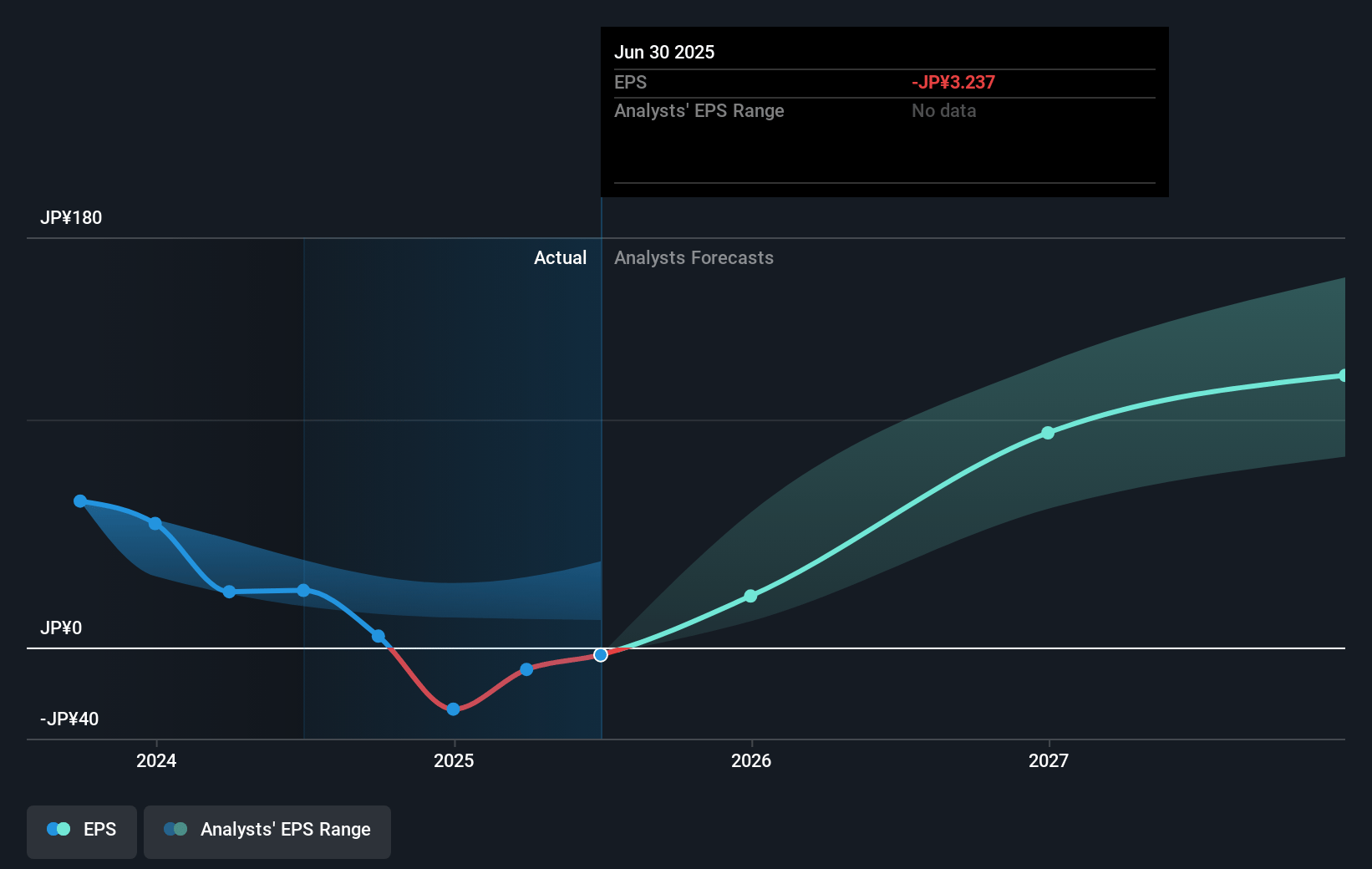

- The bearish analysts expect earnings to reach ¥38.5 billion (and earnings per share of ¥96.29) by about July 2028, up from ¥-3.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from -254.9x today. This future PE is lower than the current PE for the JP Personal Products industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

Shiseido Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Japan and Europe have demonstrated strong profitability improvements driven by structural reforms, with Japan achieving significant margin expansion and core operating profit growth, suggesting that improving cost management and focus on high-margin core brands could sustain or increase net margins and operating profits.

- Despite challenges in China and Travel Retail, Shiseido reported signs of recovery with positive sales growth in Q4 and market share gains, alongside e-commerce growth in the high teens percentage, indicating that revenue may stabilize or grow as consumer sentiment improves and digital channels expand.

- The company is accelerating marketing investment and innovation in its top global brands, including new product launches and technology-driven offerings, which could strengthen brand equity and allow for premium pricing, supporting topline growth and gross profit.

- Global cost-reduction programs and organizational streamlining are proceeding ahead of plan, expanding from Japan and China to Americas and headquarters, raising the likelihood of improved operational efficiency, lower SG&A costs, and higher core operating margins and earnings in future years.

- Expansion into new geographies and digital channels, along with targeted strategies for high-growth product categories such as luxury skincare, fragrances, and e-commerce, position Shiseido to benefit from secular trends in premium beauty and wellness sector, enhancing both long-term revenue prospects and sustainable earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Shiseido Company is ¥1742.28, which represents two standard deviations below the consensus price target of ¥2548.0. This valuation is based on what can be assumed as the expectations of Shiseido Company's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3240.0, and the most bearish reporting a price target of just ¥1700.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥1017.0 billion, earnings will come to ¥38.5 billion, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 6.5%.

- Given the current share price of ¥2451.0, the bearish analyst price target of ¥1742.28 is 40.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.