Key Takeaways

- Strategic U.S. acquisitions increase market share and revenue stability, supporting growth and profitability in high-margin segments.

- Expansion in RRP and geo-expansion boost revenue, as strong pricing power enhances net margins amid shifting product focus.

- Geographic sales mix and rising costs are pressuring Japan Tobacco's margins, while legal and currency issues threaten earnings and shareholder returns.

Catalysts

About Japan Tobacco- A tobacco company, manufactures and sells tobacco products, pharmaceuticals, and processed foods in Japan and internationally.

- The acquisition of Vector Group significantly increases Japan Tobacco's market share in the U.S., the world's largest and one of the most profitable markets, from 2.4% to 8.2%, likely boosting revenue and stable cash flow over the mid to long term.

- The continued geo-expansion of Ploom and increased market share in the HTS segment, especially in Japan and several competitive international markets, is expected to drive substantial revenue growth with RRP (Reduced-Risk Products) projected to more than double revenue by 2026.

- Strong pricing contributions in key markets such as Russia and the U.K., coupled with stable supply chain costs, are expected to enhance net margins and AOP despite volume pressures in some regions.

- Enhanced profitability and capital deployment from the Vector acquisition are likely to support increased investments in RRP, potentially accelerating earnings growth as JT shifts towards higher-margin products.

- The strategic positioning of JT's brands within the expanding deep discount segment in the U.S. offers potential for enhanced market share and pricing power, likely strengthening revenue and net margins.

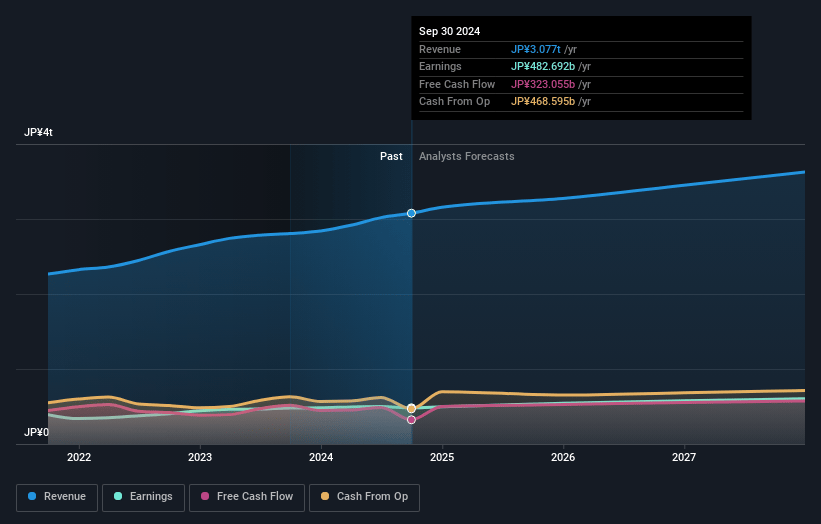

Japan Tobacco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Japan Tobacco's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.7% today to 16.6% in 3 years time.

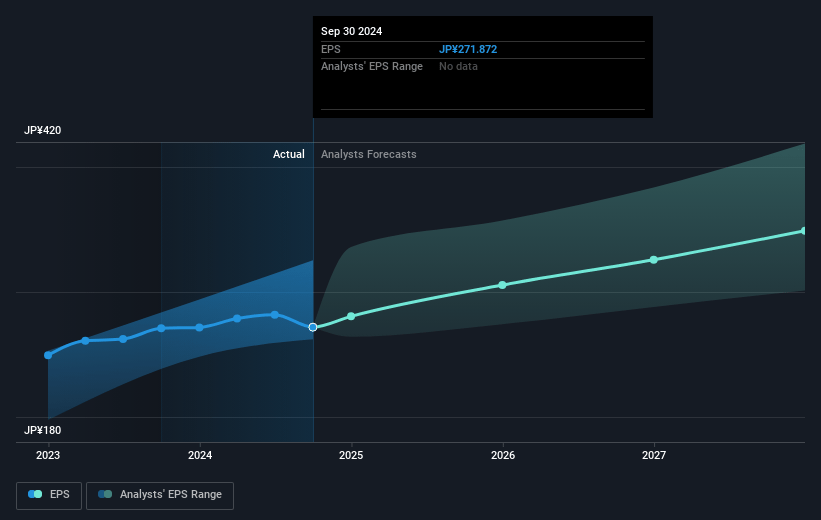

- Analysts expect earnings to reach ¥596.3 billion (and earnings per share of ¥342.84) by about January 2028, up from ¥482.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥665.0 billion in earnings, and the most bearish expecting ¥511.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 14.7x today. This future PE is greater than the current PE for the JP Tobacco industry at 14.7x.

- Analysts expect the number of shares outstanding to decline by 0.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Japan Tobacco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The geographic mix of sales, with higher volumes from lower-margin markets in the EMA cluster (such as Romania, Russia, and Turkey), could negatively impact overall margins, despite increased total volumes. This geographic mix can put pressure on net margins.

- Currency fluctuations, particularly the depreciation of emerging market currencies and the appreciation of cost-related currencies like the U.S. dollar and Swiss franc, have negatively impacted AOP, outweighing the benefits of a weaker yen and potentially affecting reported earnings.

- Increased supply chain and labor costs are putting pressure on margins, which, along with increased investment toward the geo-expansion of Ploom, could hinder profitability and net margins.

- Legal challenges, such as the Canadian litigation, pose significant financial risks, with a potential CAD 32.5 billion settlement that could affect dividend calculations and, consequently, shareholder returns, thereby impacting net income and cash flow projections.

- In the combustibles market, particularly in the U.S., the deep discount category poses competitive risks that could mitigate expected margin improvements post-Vector acquisition. This competitive pricing environment may limit revenue growth in that segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4590.91 for Japan Tobacco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5000.0, and the most bearish reporting a price target of just ¥4000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥3590.4 billion, earnings will come to ¥596.3 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥4005.0, the analyst's price target of ¥4590.91 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives