Key Takeaways

- ORIX's strategy to increase assets and diversify revenue in the U.S. aims to capitalize on future economic upturns despite geopolitical uncertainties.

- Expansion in renewable energy and asset management is set to align with global trends and boost long-term earnings and stability.

- Geopolitical and economic uncertainties in key markets pose significant risks to ORIX's revenue, earnings, and profit margins across various sectors.

Catalysts

About ORIX- Provides diversified financial services in Japan, the United States, Asia, Europe, Australasia, and the Middle East.

- ORIX's plan to expand the scale of its assets in ORIX USA from FY '26 March end and beyond, even amidst geopolitical uncertainties, suggests a strategy to enhance future revenue growth by capitalizing on potential economic recoveries and favorable market conditions. This approach focuses on increasing asset size and diversifying revenue streams.

- The expansion and redevelopment projects at Kansai Airport and other urban areas, including investments in infrastructure related to the Expo 2025 Osaka Kansai, are anticipated to drive significant operational growth. This expansion is likely to increase ORIX's revenue substantially, as it caters to a higher number of foreign passengers and boosts occupancy rates in hospitality ventures.

- Acceleration in renewable energy projects, such as ORIX's acquisition of hydropower resources in Spain and a power purchase agreement with Google, positions the company to capitalize on the growing demand for clean energy. This aligns with global decarbonization goals and should contribute to increasing long-term revenues and margins from sustainable energy solutions.

- The strategic focus on capital recycling in the Investment category, with plans to invest about ¥700 billion in new investments while realizing capital from existing assets, is set to sustain revenue growth and manage profitability. This approach could optimize asset allocation and enhance ORIX's earnings through profitable divestments and strategic acquisitions.

- ORIX's emphasis on expanding the asset management business, with plans to grow Robeco Group’s AUM to ¥100 trillion, aims to boost earnings through higher management fees and improve margins. The pursuit of more high-margin asset management roles and potential acquisitions of asset managers should strengthen ORIX's financials through enhanced earnings stability and growth potential.

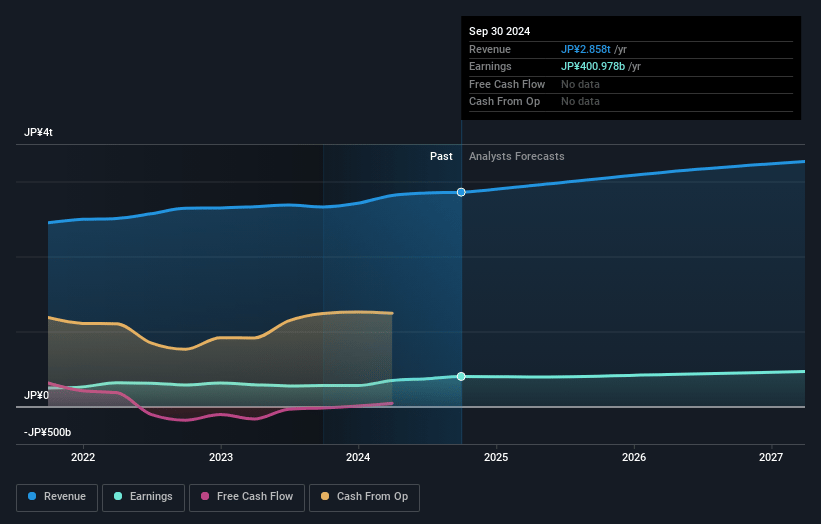

ORIX Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ORIX's revenue will grow by 5.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.0% today to 13.8% in 3 years time.

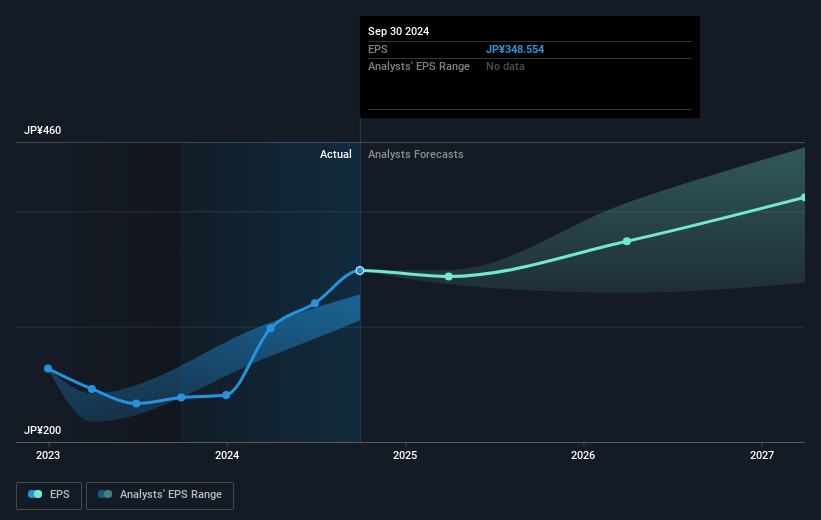

- Analysts expect earnings to reach ¥466.4 billion (and earnings per share of ¥419.95) by about January 2028, up from ¥401.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ¥390.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Diversified Financial industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 0.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

ORIX Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Political instability in Japan and geopolitical risks related to US elections could lead to economic uncertainty, affecting interest rates and foreign exchange conditions, which might undermine ORIX's financial performance, particularly revenue and earnings.

- ORIX is cautious about investments in Greater China due to sluggish consumer spending and real estate issues. Although they view their risk as limited, continued challenges in this region may restrict revenue growth opportunities.

- The US real estate market is facing increased nonperforming loans due to interest rate hikes, putting pressure on profitability. This situation, if prolonged, could continue to hinder ORIX USA's earnings.

- Rising aircraft and ship leasing costs, alongside potential geopolitical tensions, can impact the cost structure and margins of ORIX's transportation and aviation businesses.

- The environment and energy segment has shown losses due to government control on electricity prices in Spain. Future unpredictability in this and other international energy markets may negatively impact revenue and net profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥3997.78 for ORIX based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥4500.0, and the most bearish reporting a price target of just ¥3500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥3379.0 billion, earnings will come to ¥466.4 billion, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 8.9%.

- Given the current share price of ¥3305.0, the analyst's price target of ¥3997.78 is 17.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives