Narratives are currently in beta

Key Takeaways

- New attractions and improved park experiences are expected to boost revenues and maintain consistent attendance year-round.

- Efficient cost controls and management strategies are projected to improve margins and enhance shareholder value.

- Declining park attendance, rising costs, and weather dependencies threaten revenue consistency and profitability.

Catalysts

About Oriental Land- Operates and manages theme parks and hotels in Japan.

- The opening of Fantasy Springs, along with the new Tokyo DisneySea Fantasy Springs Hotel, is expected to boost future revenues through increased attraction offerings and accommodations. Financial impact: increased revenue.

- Plans to improve summer attendance by offering special experiences, appealing systems, and enhancing park comfort could mitigate the seasonal heat impact and lead to steadier year-round attendance. Financial impact: increased revenue.

- Efficient cost control measures, including group-wide efforts and potential reductions in expenses from the initial forecast, are projected to improve net margins despite anticipated cost increases. Financial impact: improved net margins.

- The strong demand for Tokyo Disney Resort vacation packages is expected to continue, potentially exceeding initial revenue forecasts and contributing to higher overall sales. Financial impact: increased revenue.

- New management plans, including shareholder returns through potential treasury stock acquisition, along with a focus on capital policy and cash allocation, are expected to drive future earnings growth and enhance shareholder value. Financial impact: increased earnings.

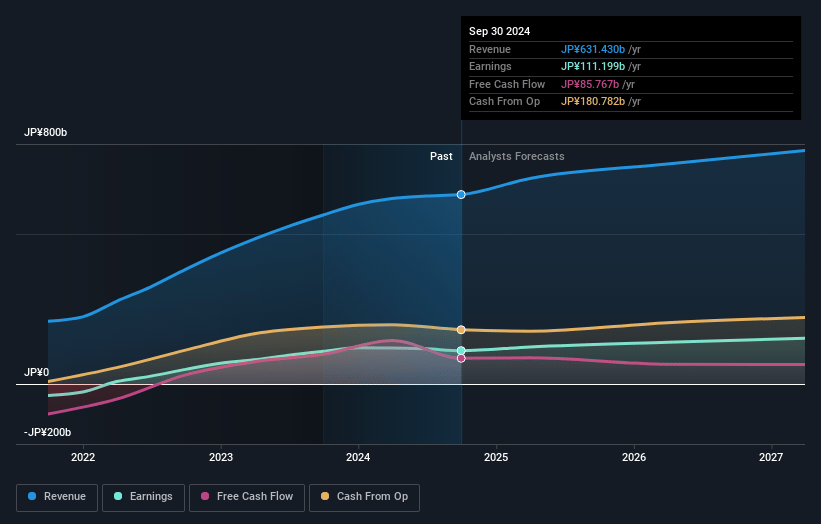

Oriental Land Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oriental Land's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.6% today to 19.2% in 3 years time.

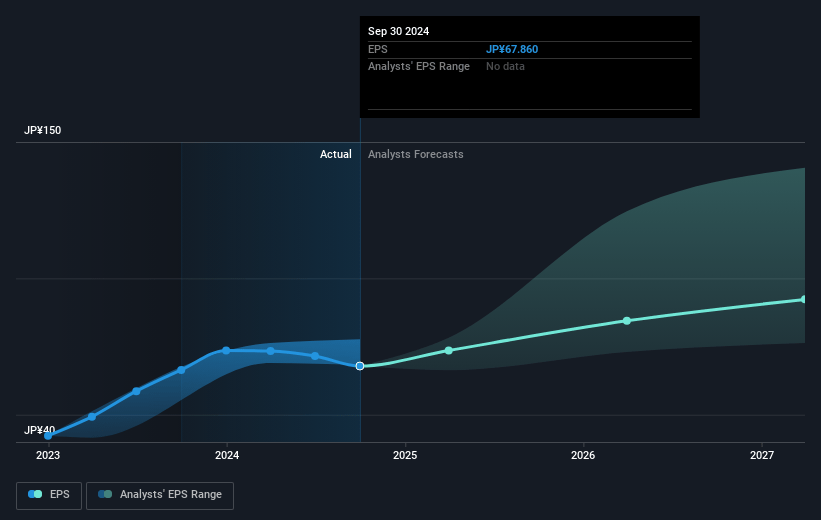

- Analysts expect earnings to reach ¥151.4 billion (and earnings per share of ¥91.92) by about January 2028, up from ¥111.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥176.0 billion in earnings, and the most bearish expecting ¥126.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.8x on those 2028 earnings, up from 54.2x today. This future PE is greater than the current PE for the JP Hospitality industry at 23.0x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.15%, as per the Simply Wall St company report.

Oriental Land Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Attendance at the theme parks has decreased due to a drop in travel demand and severe heat, which can negatively impact overall revenue and operating profit.

- Operating costs have increased, especially in the food and beverage segment, due to a surge in raw material prices and reliance on external suppliers, which could affect net margins.

- Personnel expenses have risen due to wage increases and additional staffing needs, particularly with the opening of new attractions, potentially impacting earnings.

- The merchandise revenue has fallen due to reduced sales prices and termination of certain product lines, which could negatively affect overall revenue.

- Future attendance might remain vulnerable to weather conditions, like severe heat, making it difficult to predict consistent revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥4446.81 for Oriental Land based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥5500.0, and the most bearish reporting a price target of just ¥3000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥787.9 billion, earnings will come to ¥151.4 billion, and it would be trading on a PE ratio of 57.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of ¥3676.0, the analyst's price target of ¥4446.81 is 17.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives