Key Takeaways

- Structural decline in mail revenues and legacy cost burdens threaten margins, while digital disruption and new competitors pressure growth in core business segments.

- Shifting consumer preferences, regulatory challenges, and state ownership risks may limit innovation, revenue growth, and capital returns in the long term.

- Multi-business diversification, digital innovation, and operational efficiency are driving sustainable earnings growth while reducing dependence on traditional mail and supporting long-term value creation.

Catalysts

About Poste Italiane- Provides postal, logistics, and financial and insurance products and services in Italy.

- Persistent decline in core mail volumes driven by ongoing digitalization and widespread adoption of electronic communications is projected to outpace incremental gains from repricing and value-added services, resulting in a structural decline in one of Poste Italiane's largest revenue streams.

- Accelerating competition from agile fintech, neobanks, insuretech, and e-commerce logistics leaders threatens Poste Italiane's ability to defend its market share in payments and parcel delivery, likely leading to revenue stagnation and margin compression across its fastest-growing divisions.

- The company remains heavily dependent on an expansive legacy network and high fixed costs, and even with ongoing cost optimization efforts, this legacy burden is expected to erode net margins as mail volumes contract and operational flexibility remains limited.

- Younger generations are increasingly shifting towards mobile-first and digitally native financial products, undermining the cross-selling potential of Poste Italiane's omni-channel platform and risking long-term revenue growth in banking, insurance, and payments.

- Regulatory risks tied to state ownership, including mandated service requirements and potential political interference, may lead to future price caps, elevated compliance costs, or forced capital redeployment, restricting both EPS growth and capital return to shareholders over the long run.

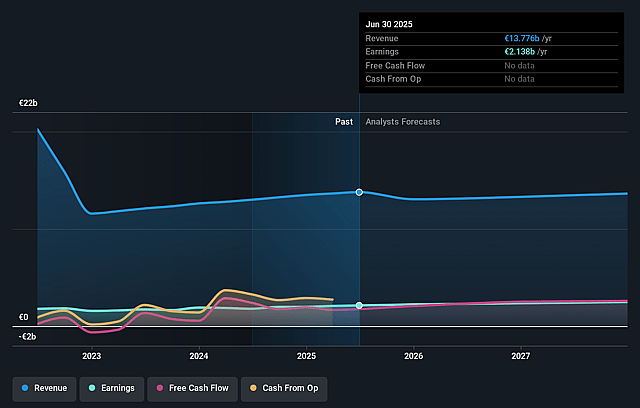

Poste Italiane Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Poste Italiane compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Poste Italiane's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.3% today to 17.1% in 3 years time.

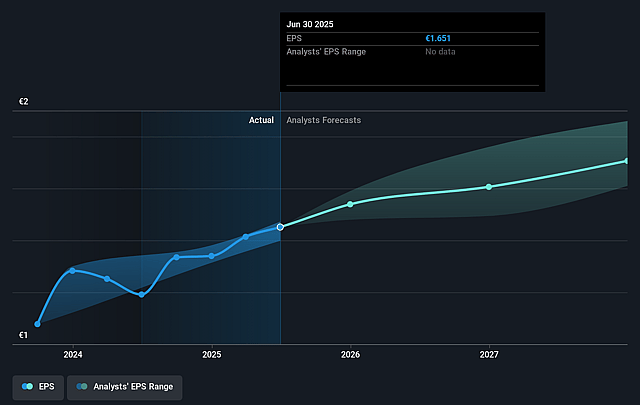

- The bearish analysts expect earnings to reach €2.3 billion (and earnings per share of €1.75) by about July 2028, up from €2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from 11.1x today. This future PE is greater than the current PE for the GB Insurance industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.24%, as per the Simply Wall St company report.

Poste Italiane Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained growth in parcel volumes driven by e-commerce adoption and last-mile delivery demand, coupled with efficient cost-saving delivery networks such as Punto Poste, provides strong support for revenue and margin growth in the logistics business over the long term.

- Life insurance and protection revenues are experiencing double-digit growth supported by an aging population and effective cross-selling, with high net inflows consistently outperforming the market, reinforcing visibility on earnings and supporting sustainable net income growth.

- The company's integrated omni-channel financial ecosystem-including banking, payments, insurance, and energy-combined with ongoing digital transformation and expanding product suites, continues to drive topline expansion and earnings diversity, reducing reliance on legacy mail services.

- Disciplined cost management, improved operational efficiency, and increasing profitability per employee are translating into higher EBIT growth and robust cash flows, indicating resilience and an ability to maintain or grow earnings even with expansion-related expense pressures.

- Strengthening partnerships and strategic investments, such as the acquisition of a significant stake in TIM and signing of a major MVNO contract, are positioned to generate value through synergies and new revenue channels, potentially driving long-term shareholder value and stable dividend growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Poste Italiane is €15.05, which represents two standard deviations below the consensus price target of €18.55. This valuation is based on what can be assumed as the expectations of Poste Italiane's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.5, and the most bearish reporting a price target of just €14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €13.4 billion, earnings will come to €2.3 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 17.2%.

- Given the current share price of €17.93, the bearish analyst price target of €15.05 is 19.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.