Key Takeaways

- Accelerating parcel, insurance, and digital payments growth, combined with omnichannel expansion, positions the company for sustained market share gains and stronger-than-expected recurring revenues.

- Unrecognized partnership synergies and strategic customer data utilization support durable margin expansion, with tailored ESG-linked offerings driving long-term profitability and market outperformance.

- Structural decline in mail, demographic challenges, high labor costs, and stiff competition in digital services threaten growth, profitability, and market share across Poste Italiane's core segments.

Catalysts

About Poste Italiane- Provides postal, logistics, and financial and insurance products and services in Italy.

- While analyst consensus expects parcel and e-commerce-driven revenue growth to remain robust, early Q2 data show parcel volume acceleration above initial guidance, suggesting Poste Italiane is poised for persistent double-digit revenue expansion and market share gains well in excess of forecasts, fueling material upside for top-line and operating leverage.

- Analyst consensus sees resilient financial product flows, but strong sequential net inflows, accelerating cross-selling enabled by omnichannel expansion, and rapid increases in high-margin insurance and protection revenues provide evidence that revenue and net margin growth in asset management, life insurance, and payments could far surpass expectations, particularly as an aging population drives long-term demand.

- The strategic stake in TIM and resulting multi-layered partnership are likely to unlock transformational cost and revenue synergies-including IT, distribution, and next-generation telco services-that remain unrecognized by the market, supporting further EBIT margin expansion and durable growth in bottom-line earnings over multiple years.

- Poste Italiane's leadership in digital payments, continued outperformance in cross-channel transactions, and the rapid upscaling of its energy client base due to accelerated European digitalization position it to capture incremental fee and transaction revenues across a fast-expanding ecosystem, meaning both recurring revenues and net margin uplift are likely underestimated.

- The unique combination of a vast, loyal customer base and proprietary data monetization allows Poste Italiane to deliver highly tailored financial and insurance products-particularly ESG-linked solutions-attracting environmentally conscious savers and investors, which will drive structural, above-market growth in recurring revenues and operating profitability well into the next decade.

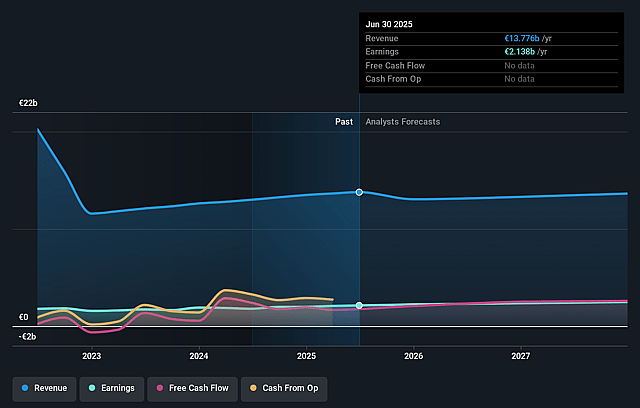

Poste Italiane Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Poste Italiane compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Poste Italiane's revenue will grow by 1.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.3% today to 18.3% in 3 years time.

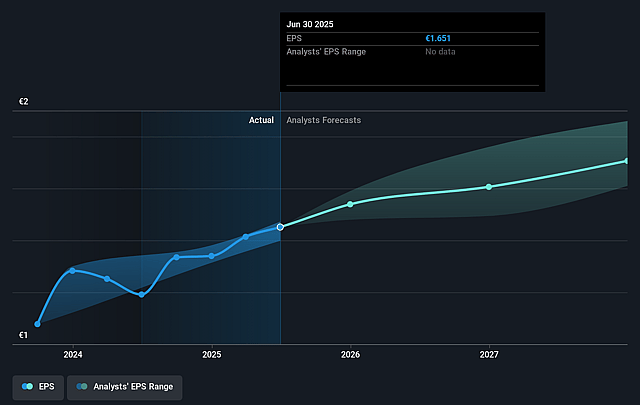

- The bullish analysts expect earnings to reach €2.6 billion (and earnings per share of €2.02) by about July 2028, up from €2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 11.1x today. This future PE is greater than the current PE for the GB Insurance industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.97%, as per the Simply Wall St company report.

Poste Italiane Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued structural decline in traditional mail volumes, only partially offset by periodic price increases and limited potential for value-added services, will likely erode legacy postal revenues and put persistent downward pressure on the company's overall revenue base.

- Demographic headwinds, such as Italy's shrinking and aging population, constrain the market for both postal and financial services, dampening long-term growth prospects and threatening the ability to sustain revenue and net income growth.

- Persistent high labor costs from an aging workforce, combined with rising operating expenses due to required investments in sustainability and modernization, restrict the company's ability to improve net margins and limit scalability in profitability.

- Poste Italiane faces intensifying competition in digital payments, banking, and insurance from more agile fintechs and global technology firms, which could reduce fee and commission income, diminish market share, and compress net margins in its financial services segment.

- Efforts to pivot from declining mail to parcel and logistics growth are challenged by fierce competition and structurally weaker profitability in the sector, so failure to achieve greater scale and cost leadership in logistics may result in stagnant or declining net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Poste Italiane is €21.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Poste Italiane's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €21.0, and the most bearish reporting a price target of just €14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €14.3 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 17.0%.

- Given the current share price of €17.98, the bullish analyst price target of €21.0 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.