Key Takeaways

- Expansion in e-commerce logistics and digital delivery is driving market share gains and supporting future revenue and margin growth amid declining mail volumes.

- Digital payments, insurance, and omnichannel strategies are boosting profitability, recurring fee income, and customer retention, enhancing long-term earnings resilience.

- Ongoing declines in core mail volumes, rising costs, regulatory and competitive pressures, and interest rate risks threaten profitability and sustainable revenue growth across Poste Italiane's businesses.

Catalysts

About Poste Italiane- Provides postal, logistics, and financial and insurance products and services in Italy.

- Growing parcel volumes, driven by e-commerce and secondhand market acceleration, are enabling Poste Italiane to gain market share in logistics while partially offsetting structural mail declines; continued expansion in last-mile and digital-enabled delivery is likely to support future revenue and margin growth.

- Increasing shift toward digital payments and integrated financial services is strengthening Postepay's performance, with double-digit transaction value growth, higher card usage, and successful cross-selling through the digital ecosystem, supporting higher net margins and recurring fee income.

- Robust growth in insurance, life, and pension products-supported by aging demographics and proactive portfolio rebalancing-indicates a sustainable increase in fee-based revenues and enhanced profitability due to higher-margin multi-class and protection products.

- Execution of Poste Italiane's omnichannel strategy, marked by integration of digital apps (with millions of active users) and physical branches, is driving customer engagement and higher product penetration per client, which is likely to underpin higher retention rates, customer lifetime value, and improved net margins over the long term.

- Strong underlying momentum in financial services-especially record net interest income, resilient retail deposits, and disciplined cost management-combined with an extremely robust solvency ratio and upgraded guidance, points to greater earnings resilience and the capacity for continued dividend growth.

Poste Italiane Future Earnings and Revenue Growth

Assumptions

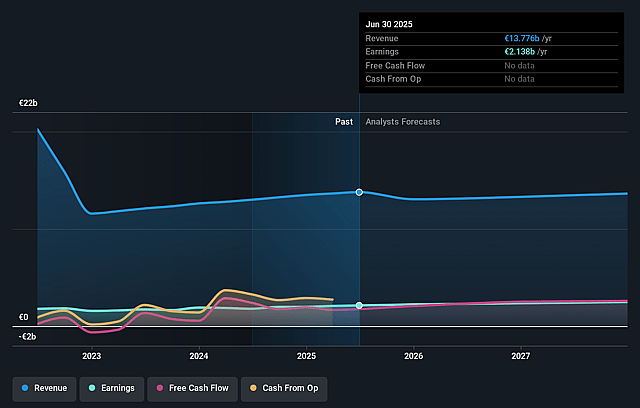

How have these above catalysts been quantified?- Analysts are assuming Poste Italiane's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.5% today to 18.5% in 3 years time.

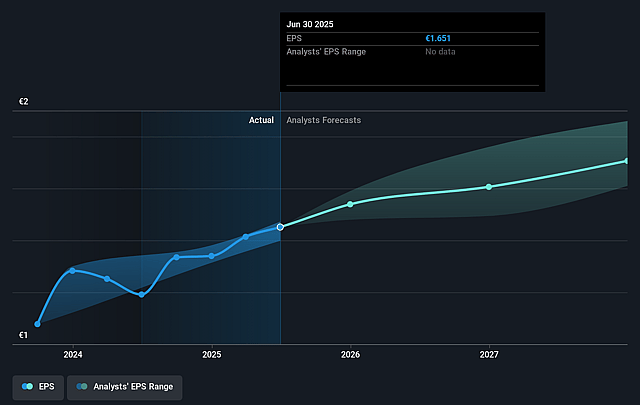

- Analysts expect earnings to reach €2.6 billion (and earnings per share of €1.97) by about July 2028, up from €2.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 11.5x today. This future PE is greater than the current PE for the GB Insurance industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.85%, as per the Simply Wall St company report.

Poste Italiane Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing secular decline in traditional mail volumes, only partially offset by repricing, remains a structural headwind; if parcel growth slows or repricing loses effectiveness, core revenues and margins from the Mail, Parcel & Distribution segment will face continued downward pressure, impacting overall group revenue and profitability.

- Poste Italiane's high fixed cost base, including rising HR costs tied to new labor agreements, union-negotiated annual increases, and increased headcount to support business growth, risks margin compression if topline growth stalls or operational leverage does not materialize as planned, weighing on net margins and earnings.

- The company faces potential long-term regulatory and industry risks-such as stricter data privacy, ESG, and financial compliance rules-which could drive up compliance and operational costs, squeezing margins and threatening earnings growth if not managed efficiently.

- Competition from expanding fintechs and global e-commerce/logistics firms, coupled with rapid digitalization in payments and financial services, could erode Poste Italiane's market share and limit its ability to sustain strong growth, directly impacting net margin and asset management fee-based revenue streams.

- Interest rate normalization or a return to a lower rate environment, as well as maturing postal savings products resulting in net outflows, could depress net interest income (NII) and limit investment portfolio returns, thus constraining future revenue growth potential and weakening overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €19.279 for Poste Italiane based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €21.0, and the most bearish reporting a price target of just €16.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €13.9 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 16.8%.

- Given the current share price of €18.97, the analyst price target of €19.28 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.