Key Takeaways

- International expansion, digitalization, and sustainability efforts are transforming Safilo into a multi-market growth leader with rising brand equity and earnings power.

- Strong prescription eyewear demand, stable long-term licenses, and increased negotiating leverage position the company for sustained revenue growth and margin expansion.

- Safilo faces margin pressure from price competition, license dependency, lagging digitalization, supply chain risks, and intensifying industry consolidation threatening sales and market share.

Catalysts

About Safilo Group- Engages in the design, manufacture, and distribution of optical frames, sunglasses, sports eyewear, goggles, and helmets in North America, Europe, the Asia Pacific, and internationally.

- While analysts broadly agree that the perpetual David Beckham eyewear license secures approximately half of total revenue, what is understated is the brand's rapid double-digit international growth and imminent expansion of retail footprints, making it a transformative multi-market growth engine that could drive both revenue acceleration and margin expansion beyond consensus expectations.

- Analyst consensus focuses on license portfolio stability, but with 80% of licensing agreements secured through 2030-2031 and early renewal momentum, Safilo is poised to command increased negotiating power and higher average selling prices during future renegotiations, substantially increasing gross margins for the medium-to-long term.

- Safilo is exceptionally well positioned to capitalize on surging, long-term global demand for prescription eyewear due to the aging global population and rising vision correction needs, demonstrated by resilient and growing prescription frame sales across all major markets, supporting sustained revenue and unit sales growth well above sector averages.

- The company's robust digitalization-including a strong direct-to-consumer channel, advanced B2B platforms adopted by over 28,000 clients, and proactive omnichannel strategies-signals significant long-run gains in operational efficiency, customer lifetime value, and net margin expansion as digital sales mix increases.

- Safilo's early and aggressive investment in sustainable materials and supply chain decarbonization (e.g., 95% renewable electricity and rapidly rising proportion of recycled/bio-based frames) is likely to accelerate customer and retailer preference for its brands globally, unlocking premium pricing potential and enhancing long-term brand equity and earnings power.

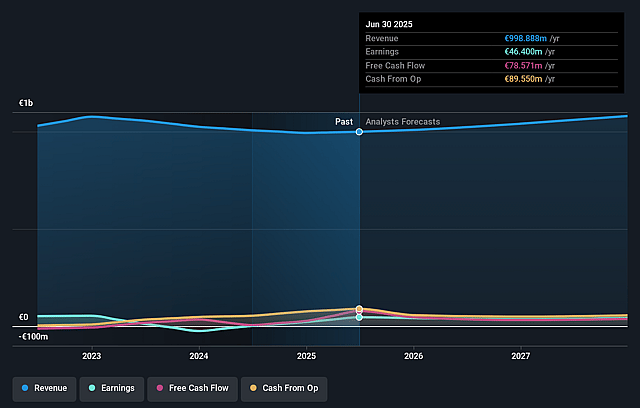

Safilo Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Safilo Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Safilo Group's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 4.2% in 3 years time.

- The bullish analysts expect earnings to reach €46.3 million (and earnings per share of €0.11) by about July 2028, up from €22.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, down from 20.9x today. This future PE is lower than the current PE for the GB Luxury industry at 22.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.18%, as per the Simply Wall St company report.

Safilo Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growing competition from direct-to-consumer brands and e-commerce disruptors is leading to intensified price competition in key segments such as Blenders and mass-market products, resulting in pressure on average selling prices and margin compression, which could negatively impact net margins and overall profitability.

- Safilo remains heavily reliant on licensed brands for a significant share of revenues, and while many licenses have been extended, the company is still exposed to revenue volatility and earnings risk if major partners terminate or choose not to renew agreements, as evidenced by the adverse sales impact from the Jimmy Choo license phase-out.

- The accelerated move toward digitalization in eyewear, such as AR virtual try-ons and personalized digital shopping, could erode Safilo's market position if it cannot continually invest at pace with industry leaders; while IT investment normalization is underway, lagging technology adoption could inhibit sales growth and result in lost market share.

- Safilo's supply chain is still exposed to geopolitical and tariff risks, with seventy percent of goods for the US market sourced from China, raising the threat of cost increases, operational disruptions, and gross margin pressure if tariff escalation or supply shocks occur.

- Intensifying industry consolidation, as with eyewear giants like EssilorLuxottica, may further restrict Safilo's distribution channels, reduce retailer shelf space, and heighten bargaining power of larger competitors, which could suppress sales growth and erode revenue over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Safilo Group is €1.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Safilo Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1.5, and the most bearish reporting a price target of just €1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.1 billion, earnings will come to €46.3 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 12.2%.

- Given the current share price of €1.13, the bullish analyst price target of €1.5 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.