Narratives are currently in beta

Key Takeaways

- BPER Banca's strategic initiatives focus on enhancing efficiency, modernizing operations, and leveraging economies of scale to boost revenue and improve margins.

- The bank's strong capital position and diversification into noninterest income streams support stable growth and enhance earnings potential.

- Adjusted net profit excluding non-recurring items may skew profitability perception, with pressures from interest rates and bond exposure heightening revenue and earnings risks.

Catalysts

About BPER Banca- Provides banking products and services for individuals, and businesses and professionals in Italy and internationally.

- BPER Banca's strategic plan includes 38 target initiatives aimed at unlocking full client value, leveraging economies of scale, and modernizing operations. These initiatives are expected to enhance efficiency and customer service, potentially leading to higher revenue and improved net margins.

- The bank has demonstrated robust revenue growth, with a 6% increase in net interest income over the first 9 months of 2024, despite lower interest rates. This bodes well for future earnings stability, even in fluctuating rate environments.

- The continued focus on capital-light, high-quality noninterest income, such as fees from non-life insurance and asset management, has supported commission income growth. This shift could bolster future net margins and diversify revenue streams.

- BPER's proactive management of risk-weighted assets, along with a strong CET1 ratio of 15.8%, underscores its solid capital position. This could support future growth initiatives and enable higher earnings through strategic investments or acquisitions.

- The bank's issuance of covered bonds and strategic positioning in the Italian government bond market reflect a strong liquidity profile. By aligning bond strategy with loan growth, BPER aims to maintain steady net interest income, supporting revenue and margin objectives.

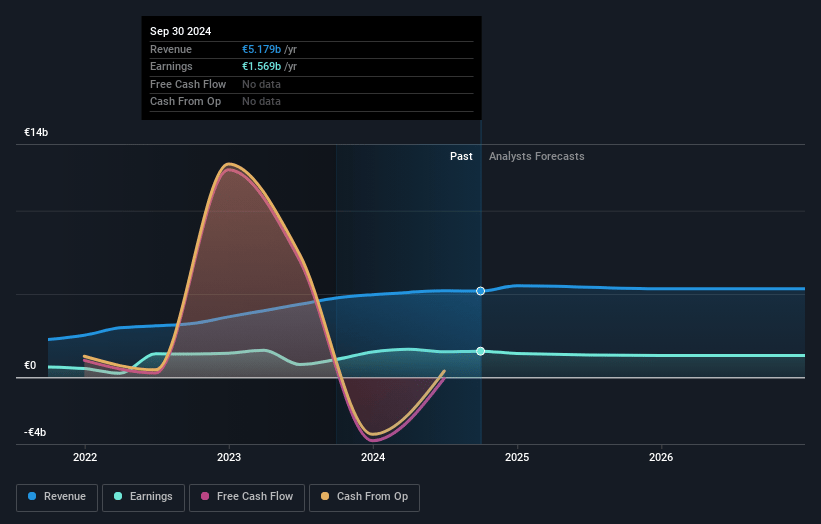

BPER Banca Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BPER Banca's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.3% today to 25.2% in 3 years time.

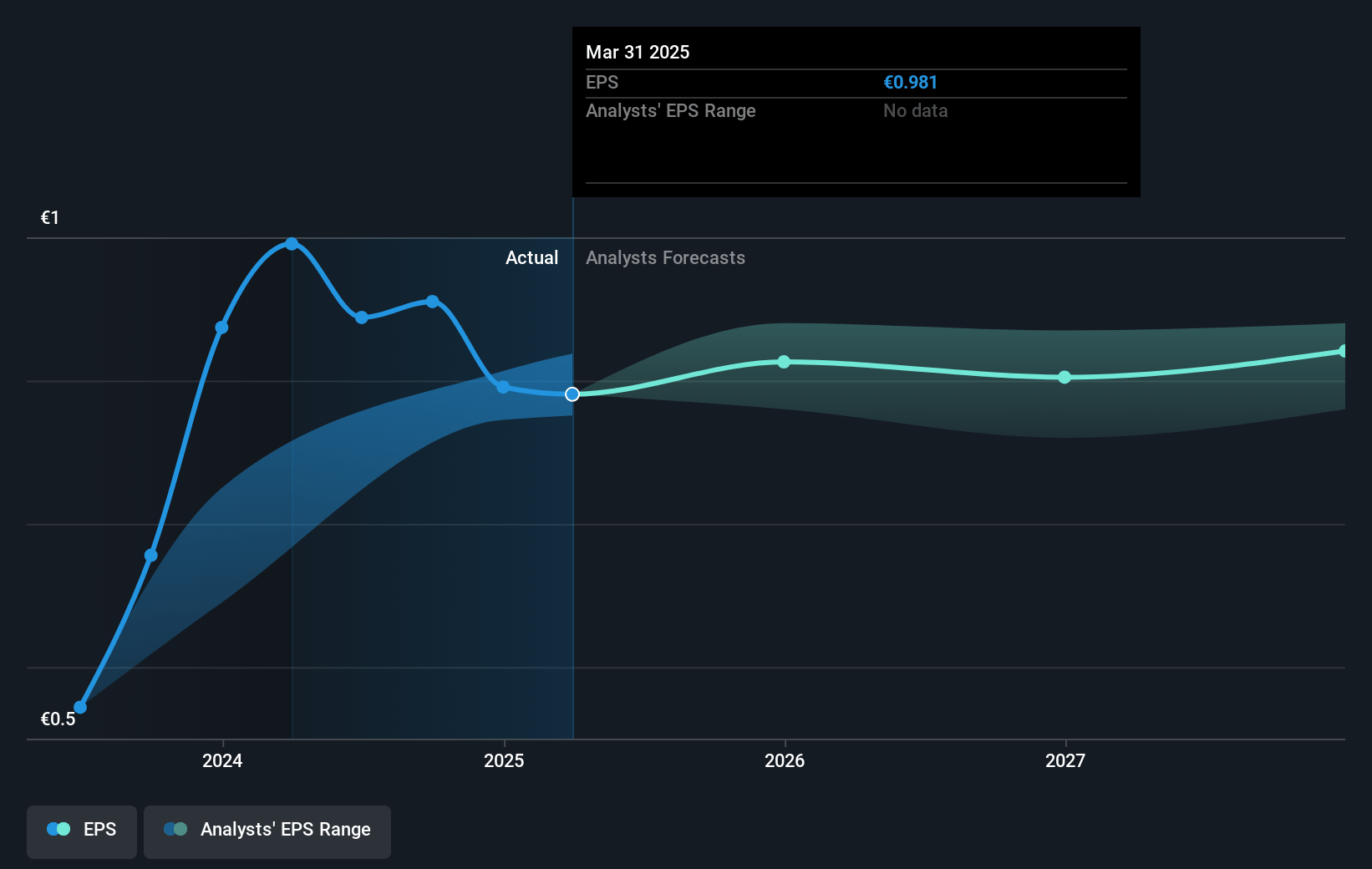

- Analysts expect earnings to reach €1.4 billion (and earnings per share of €0.95) by about January 2028, down from €1.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.5x on those 2028 earnings, up from 5.5x today. This future PE is lower than the current PE for the GB Banks industry at 12.4x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.97%, as per the Simply Wall St company report.

BPER Banca Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank's net profit has been adjusted to exclude one-time gains and HR-related actions, which may not reflect its true ongoing profitability, potentially impacting investor perceptions and future earnings predictability.

- Despite revenue growth, net interest income (NII) could face pressure from decreasing interest rates, which may challenge future earnings and necessitate compensatory growth in other areas, such as loans or commissions.

- Seasonality and cyclical trends, like lower commissions during summer, show potential volatility in revenue streams, posing risks to sustained revenue growth and profit margins.

- The bank anticipates a rise in the cost of risk due to macroeconomic uncertainties, which could weaken earnings by increasing provisions for bad loans and impacting overall portfolio quality.

- The exposure to Italian government bonds with a substantial share of short duration increases vulnerability to interest rate fluctuations, posing a potential risk to revenue from trading activities and impacting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €6.84 for BPER Banca based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €7.8, and the most bearish reporting a price target of just €4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €5.4 billion, earnings will come to €1.4 billion, and it would be trading on a PE ratio of 9.5x, assuming you use a discount rate of 10.0%.

- Given the current share price of €6.13, the analyst's price target of €6.84 is 10.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives