Key Takeaways

- Structural tailwinds from urbanization, policy support, and network expansion position the company for sustained volume and revenue growth ahead of peers.

- Strategic investments and infrastructure adaptability enable future growth from emerging fuels, diversifying revenue and enhancing long-term earnings stability.

- Accelerating EV adoption, regulatory risk, cost pressure, geographic concentration, and limited diversification threaten IGL's long-term volumes, margins, and future growth prospects.

Catalysts

About Indraprastha Gas- Engages in the distribution and sale of natural gas in India.

- While analyst consensus expects stable volume growth from term RLNG agreements, the company's current RLNG portfolio (with 65 percent Henry Hub linkage and minimal spot dependency) could not only shield margins from gas price shocks but also give IGL a cost advantage if global LNG supply remains abundant, leading to superior net margin expansion ahead of peers.

- Analysts broadly agree that a 10 percent sales volume growth in fiscal years 2025 and 2026 is likely; however, IGL's acceleration of CNG station commissioning, dramatic scaling in new GAs (with some GAs growing at 30 to 80 percent), and a surge in vehicle conversions suggest overall volume growth could materially exceed market expectations in the medium term, supporting stronger topline growth.

- Rapid urbanization and tightening policy against air pollution in the NCR are creating multi-year tailwinds, making CNG and PNG growth less cyclical and more structural; IGL's entrenched position in NCR and impending network build-outs in adjacent markets set the stage for sustained, compounded volume and revenue growth over the next decade.

- The company is uniquely positioned to transition its existing CGD infrastructure to supply emerging fuels like biogas and hydrogen blends as policies and technology evolve, providing a future-proof moat and new, higher-margin revenue streams that could drive significant long-term earnings re-rating.

- By combining heavy, multi-year core business capex (with plans to sustain over ₹1,300 crore a year for 3-4 years), aggressive rollout in underpenetrated areas, and full-scale diversification into solar and alternate fuels, IGL's blended EBITDA profile is set for both stability and incremental upside, paving the way for a multi-year improvement in return on capital employed and free cash flow.

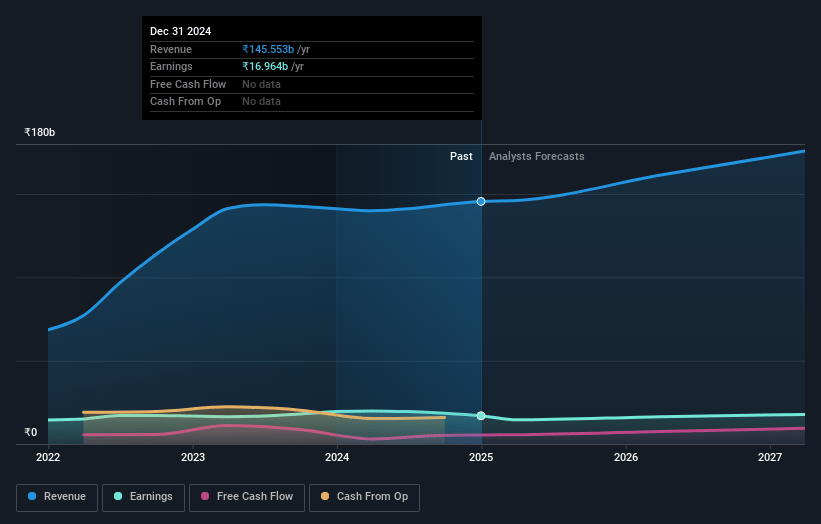

Indraprastha Gas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Indraprastha Gas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Indraprastha Gas's revenue will grow by 13.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 11.5% today to 10.0% in 3 years time.

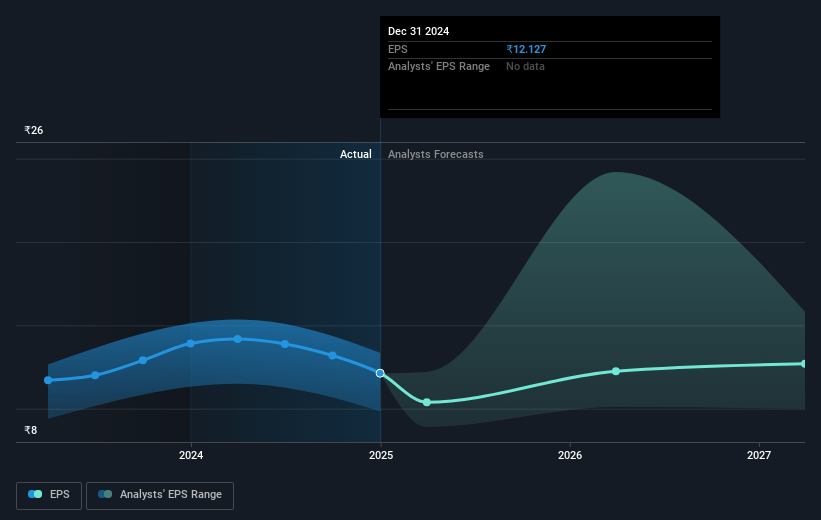

- The bullish analysts expect earnings to reach ₹21.6 billion (and earnings per share of ₹15.47) by about July 2028, up from ₹17.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.0x on those 2028 earnings, up from 17.1x today. This future PE is greater than the current PE for the IN Gas Utilities industry at 17.1x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Indraprastha Gas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid policy-driven push towards electric vehicle adoption in regions like Delhi (with DTC buses transitioning en masse to EVs and new tenders being exclusively for electric buses) highlights a secular threat of declining long-term CNG demand, posing a substantial risk to future revenue and sales volumes.

- Management commentary and investor concerns about potential Delhi policies banning new petrol, diesel, and CNG vehicles (particularly 2

- and 3-wheelers) create heightened regulatory and demand uncertainty, and if implemented, this would materially erode volume growth in IGL's core transport segments and dampen earnings growth.

- IGL's gas cost structure is under sustained pressure due to increased reliance on higher-priced RLNG and fluctuating government allocations of low-cost APM gas, which has already led to margin compression and will continue to threaten net margins if additional cost pass-through is constrained by price sensitivity or regulation.

- Geographic concentration risk remains high, with around 60% or more of volumes derived from the Delhi-NCR region, making the company's revenues and cash flows vulnerable to regional policy shifts, local competition, and specific economic shocks, amplifying the long-term volatility in earnings and topline growth.

- The relatively limited product diversification-IGL still relies heavily on CNG and PNG for vehicles and domestic use, and its renewable/alternative fuel initiatives (such as solar JV, CBG, and hydrogen) are in early stages-means that a transition away from natural gas could cause topline stagnation or decline if alternative fuels and EV uptake accelerate, impairing future revenue streams and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Indraprastha Gas is ₹423.64, which represents two standard deviations above the consensus price target of ₹236.63. This valuation is based on what can be assumed as the expectations of Indraprastha Gas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹648.0, and the most bearish reporting a price target of just ₹144.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹216.7 billion, earnings will come to ₹21.6 billion, and it would be trading on a PE ratio of 39.0x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹210.39, the bullish analyst price target of ₹423.64 is 50.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.