Key Takeaways

- Strong growth in high-margin express logistics, automation, and branch expansion positions the company for rapid revenue gains and improved operational efficiency versus consensus expectations.

- Early compliance investments and asset-light strategy minimize risk, enabling significant market share capture and sustained cash flow growth in a formalizing logistics sector.

- Slow tech integration, rising regulatory costs, weak uptake in growth areas, and mounting competition threaten TCI Express's profitability, revenue growth, and long-term market relevance.

Catalysts

About TCI Express- Provides express delivery solutions in India and internationally.

- While analyst consensus expects the Air Express and multimodal expansion to marginally improve margins and revenues, there is clear evidence of accelerating scale-rail and air verticals are already growing at over 25% and 50% year-over-year, respectively, suggesting that stronger execution, combined with aggressive branch rollout and personnel hiring, could lead to a rapid doubling in revenue share for high-margin segments and outperform consensus margin forecasts.

- Analysts broadly agree on the value of sorting center automation, but management's plan to complete a mesh network of 10 fully automated centers by 2030 will likely drive much higher operational leverage and throughput than expected-potentially unlocking a structurally lower cost base, raising EBITDA margins by more than the 150-200 basis points suggested for the next fiscal year.

- The shift of Indian logistics from unorganized to organized players is accelerating due to GST, formalization, and infrastructure upgrades; TCI Express's early, sustained investments in compliance and pan-India network position it to capture outsized market share gains as informal competitors exit, supporting both long-term volume growth and superior net earnings power.

- TCI Express's asset-light model and strategic timing of capacity addition, paired with a disciplined approach to branch expansion and cost rationalization, minimizes capex risk and enables sustained high returns on capital employed-driving consistent free cash flow growth even in industry downturns.

- The company's focus on value-added, high-yield express logistics (such as temperature-sensitive pharma, cold chain, and global Air Express) taps into rapidly expanding, underserved market niches, creating significant additional engines for top-line growth and gross margin expansion as secular trends in healthcare, electronics, and specialized manufacturing intensify.

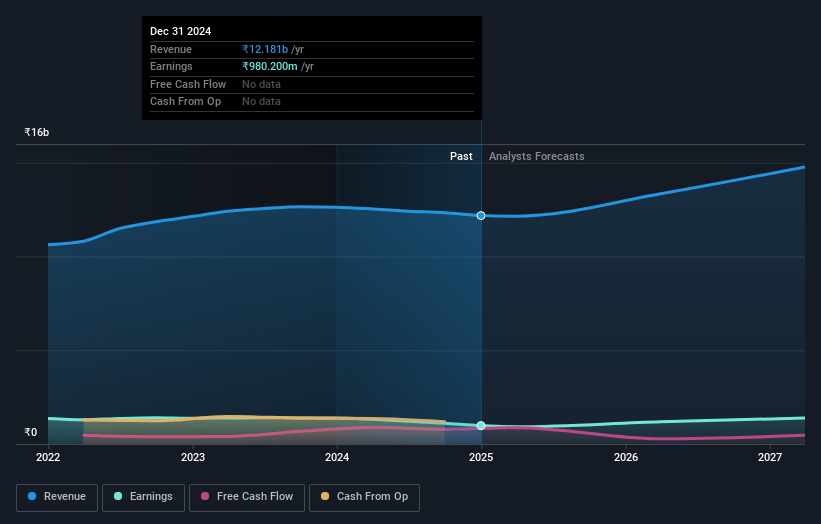

TCI Express Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TCI Express compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TCI Express's revenue will grow by 10.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.1% today to 9.6% in 3 years time.

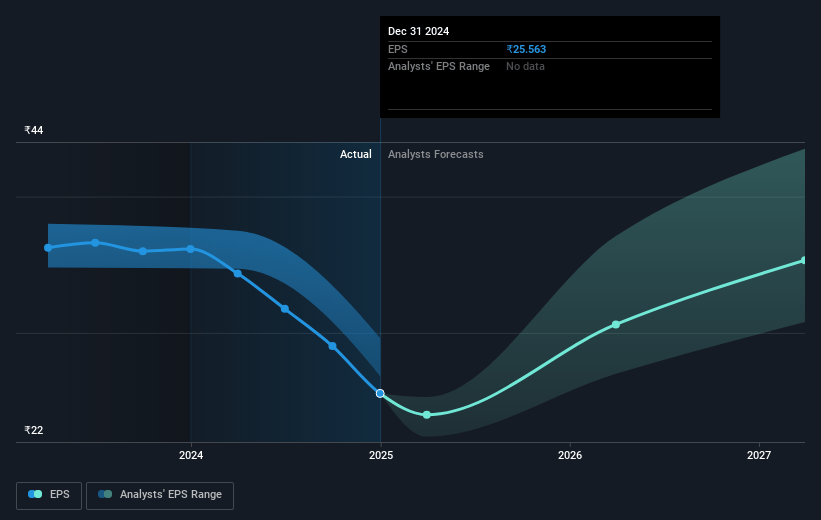

- The bullish analysts expect earnings to reach ₹1.6 billion (and earnings per share of ₹40.46) by about July 2028, up from ₹858.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.9x on those 2028 earnings, up from 32.4x today. This future PE is greater than the current PE for the IN Logistics industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.66%, as per the Simply Wall St company report.

TCI Express Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Proliferation of supply-chain automation and autonomous logistics technologies globally presents a risk, as TCI Express's digital integration and network automation rollout remains on a long timeline through 2030, potentially diminishing long-term competitiveness and resulting in higher per-unit costs that could adversely affect net margins.

- Rising environmental regulations and the global focus on carbon neutrality are likely to increase compliance costs and require expensive upgrades to TCI Express's fleet and network, constraining margin expansion and suppressing earnings growth.

- Secular growth of regional mini-warehousing and local fulfillment solutions fueled by quick commerce and near-shoring trends pose a threat, especially as TCI Express explicitly avoids quick commerce due to low profitability, which may lead to stagnating volumes and suppressed revenue in key growth areas.

- TCI Express continues to experience flat tonnage and limited network utilization in its core road express segment, a trend evident over the last 12 quarters, suggesting an ongoing risk of underutilized infrastructure, lower asset returns, and subdued revenue growth.

- Intensifying competition from disruptive, asset-light, technology-driven logistics start-ups and global peers is already manifesting in market share gains by firms such as Delhivery, and TCI Express's reluctance to aggressively pursue e-commerce or price-sensitive segments could precipitate further market erosion and compression of industry-wide profit margins, thus negatively impacting both revenue growth and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TCI Express is ₹1169.63, which represents two standard deviations above the consensus price target of ₹838.45. This valuation is based on what can be assumed as the expectations of TCI Express's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1250.0, and the most bearish reporting a price target of just ₹648.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹16.2 billion, earnings will come to ₹1.6 billion, and it would be trading on a PE ratio of 41.9x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹725.25, the bullish analyst price target of ₹1169.63 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.