Key Takeaways

- Failure to embrace automation and green technologies could erode competitiveness and squeeze margins under tightening industry standards.

- Exclusion from e-commerce growth and inability to offset rising costs may stall revenue while global competitors increase market share.

- Aggressive investment in automation and network expansion, strong rail and air express growth, and cost controls position the company for improved margins, earnings, and diversified revenue streams.

Catalysts

About TCI Express- Provides express delivery solutions in India and internationally.

- TCI Express faces the growing risk that automation and autonomous delivery technologies, such as drones and self-driving vehicles, will disrupt the traditional asset-light trucking model at the core of its operations. As global logistics rapidly adopts these technologies in the coming years, the relevance and competitiveness of TCI Express's existing network may decline, hampering future revenue growth and leading to market share loss if the company fails to adapt.

- Increasingly stringent ESG standards and carbon emission regulations are likely to lead to higher operating costs for logistics firms heavily reliant on diesel fleets. With TCI Express continuing to expand its branch and vehicle network without a clear transition plan to green transportation, net margins are likely to face sustained pressure over the long term.

- TCI Express's decision to avoid the fast-growing e-commerce and quick commerce segments, citing their lack of profitability, exposes the company to the risk of missing out on major secular growth in last-mile delivery. As dedicated e-commerce logistics players and global technology giants consolidate their dominance in this space, TCI Express's revenue base could stagnate or even decline.

- The company's capex-heavy investment in new sorting centers and network expansion is not translating into meaningful improvements in margins or returns, as direct cost savings are being offset by persistent inflationary pressures, especially in labor and toll costs. Without major volume growth or operational leverage, future profitability and return on invested capital may deteriorate further.

- Global giants such as DHL, FedEx, and Amazon Logistics continue to expand aggressively in India, leveraging deep pockets and superior digital capabilities. As these companies drive industry-wide adoption of technology-enabled, value-added services at scale, TCI Express risks erosion of its pricing power and relative competitiveness, creating long-term headwinds for both revenues and earnings.

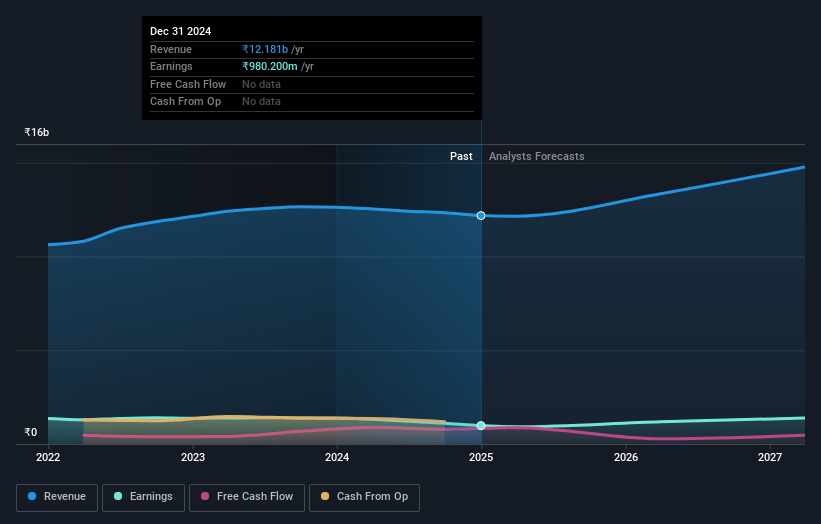

TCI Express Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TCI Express compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TCI Express's revenue will grow by 6.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.1% today to 8.1% in 3 years time.

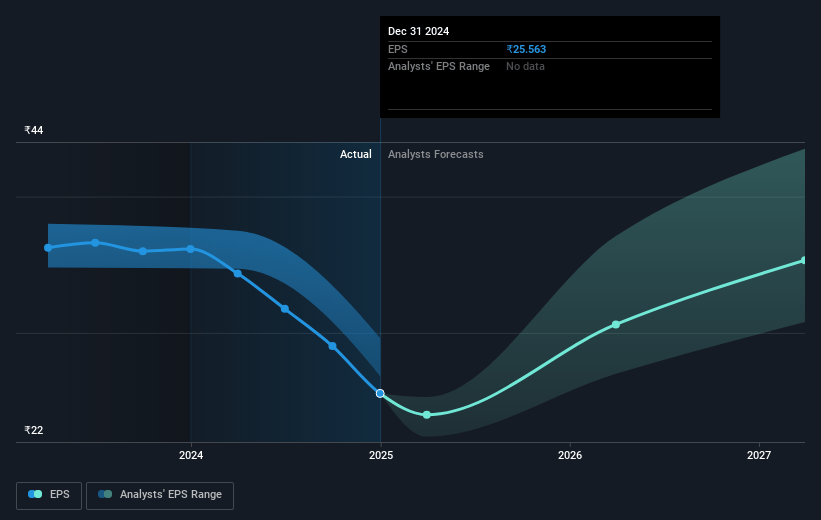

- The bearish analysts expect earnings to reach ₹1.2 billion (and earnings per share of ₹30.72) by about July 2028, up from ₹858.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, down from 32.6x today. This future PE is greater than the current PE for the IN Logistics industry at 21.5x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.64%, as per the Simply Wall St company report.

TCI Express Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TCI Express continues to invest aggressively in automation and branch network expansion, with targeted capital expenditure in sorting centers and technology upgrades, which should increase operational efficiency and could support higher EBITDA margins and net profit growth over the long term.

- The company demonstrated strong performance in its rail and air express segments, with rail express growing by around 25 percent and air international business registering 50 percent year-on-year growth, indicating successful diversification in high-yield and specialist logistics verticals that may support future revenue growth.

- Management has provided guidance for 7 to 8 percent tonnage growth and 10 to 12 percent revenue growth for the next year, driven by new branch openings, increased focus on underpenetrated regions like Eastern India, and further customer additions, all of which could support top-line and volume expansion.

- Despite short-term margin pressures from higher toll, labor, and air costs, the company has implemented cost rationalization and expects at least 150 to 200 basis points improvement in margins for the coming year by controlling costs, improving utilization, and passing some cost increases to customers, which could drive earnings growth.

- The company maintains a strong balance of business between SME and institutional clients and is well positioned to benefit from expected recovery in SME demand and industrial activity post-elections, supported by favorable government infrastructure initiatives, which could bolster revenues and stabilize margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TCI Express is ₹648.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TCI Express's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1250.0, and the most bearish reporting a price target of just ₹648.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹14.5 billion, earnings will come to ₹1.2 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 13.6%.

- Given the current share price of ₹728.85, the bearish analyst price target of ₹648.0 is 12.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.