Key Takeaways

- Rapid network expansion and targeted pricing strategies could accelerate subscriber gains and revenue growth beyond current expectations, strengthening earnings and market share.

- Diversification into digital services and industry consolidation, supported by regulatory relief, may drive sustained margin improvements and stabilise long-term financial health.

- High debt, persistent losses, intense competition, regulatory challenges, and equity dilution collectively constrain growth prospects and threaten long-term viability amidst industry disruption.

Catalysts

About Vodafone Idea- Provides mobile telecommunication services in India.

- While analyst consensus expects a steady improvement from Vodafone Idea's 4G and 5G rollout, the pace and scale of their recent CapEx and broadband site additions suggest a far more rapid reversal in subscriber loss and acceleration in 4G/5G user upgrades, potentially driving a sharper uplift in revenue and EBITDA than currently forecast.

- Analyst consensus anticipates tariff hikes will help ARPU and revenue, but rapid shifts in industry pricing models toward usage-linked tariffs and Vodafone Idea's targeted plans for high-data customers create the potential for ARPU to rise more structurally and aggressively over the next several years, with an outsized impact on earnings.

- India's mobile broadband penetration remains below 65 percent, and explosive growth in smartphone adoption and digital service integration will allow Vodafone Idea to capture significant incremental revenue from tens of millions of first-time data users, expanding overall revenue and market share well beyond current expectations.

- The company's transformation from a traditional telco to a full-scale digital service provider, leveraging partnerships in OTT, business solutions, IoT, and fintech, opens diversified and high-margin revenue streams which will increasingly contribute to net margins and overall profitability.

- The ongoing consolidation of the Indian telecom industry, with government support and regulatory relief uniquely benefiting the remaining major players, positions Vodafone Idea to benefit from stable industry pricing and reduced competitive intensity, driving structurally higher earnings and significantly improved financial health.

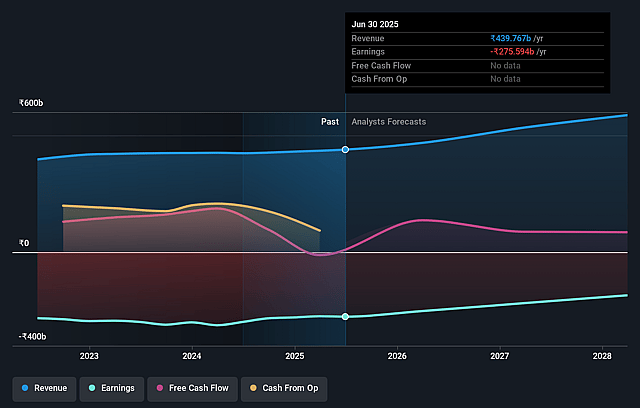

Vodafone Idea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vodafone Idea compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vodafone Idea's revenue will grow by 16.4% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Vodafone Idea will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Vodafone Idea's profit margin will increase from -63.0% to the average IN Wireless Telecom industry of 18.0% in 3 years.

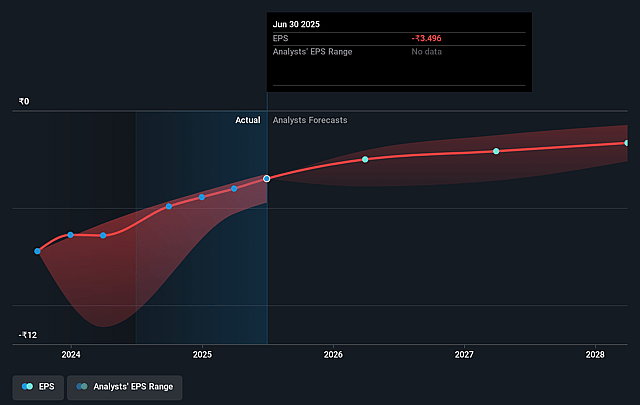

- If Vodafone Idea's profit margin were to converge on the industry average, you could expect earnings to reach ₹123.4 billion (and earnings per share of ₹0.93) by about August 2028, up from ₹-273.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, up from -2.4x today. This future PE is lower than the current PE for the IN Wireless Telecom industry at 47.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.1%, as per the Simply Wall St company report.

Vodafone Idea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's ability to fund network expansion and 5G rollout remains heavily dependent on successful debt funding or additional equity, yet persistent high debt and ongoing net losses place continual pressure on its balance sheet, restricting long-term investment and suppressing earnings growth.

- Industry-wide price wars, combined with India's extremely low ARPUs and lack of effective usage-linked pricing implementation, limit revenue-per-subscriber improvements and compress net margins in a fiercely competitive environment dominated by stronger rivals.

- The ongoing shift in consumer preference from traditional voice and data towards digital services and OTT platforms threatens to erode Vodafone Idea's legacy revenue streams, risking continued top-line stagnation or decline as customers gravitate to value-add competitors.

- Delays or uncertainties related to the resolution of large government dues (AGR liabilities) and continued dependence on regulatory relief create persistent overhangs, distracting management, deterring lenders, and posing a risk to future cash flows and the company's ability to invest or return to profitability.

- Repeated dilution of equity to raise capital, including substantial government ownership, increases the dilution risk for shareholders, placing downward pressure on earnings per share and limiting potential stock price appreciation despite operational improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vodafone Idea is ₹12.47, which represents two standard deviations above the consensus price target of ₹7.35. This valuation is based on what can be assumed as the expectations of Vodafone Idea's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹15.3, and the most bearish reporting a price target of just ₹2.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹686.2 billion, earnings will come to ₹123.4 billion, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 17.1%.

- Given the current share price of ₹6.15, the bullish analyst price target of ₹12.47 is 50.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.