Last Update 14 Dec 25

Fair value Increased 0.28%TCS: Future AI Data Centers And Cloud Deal Will Shape Measured Upside Potential

Analysts have nudged their price target on Tata Consultancy Services slightly higher to ₹3,476 from ₹3,467, citing marginally stronger long term revenue growth, stable profit margins, and a modest uplift in expected future valuation multiples.

What's in the News

- Board to meet on December 10, 2025, to approve a Securities Purchase Agreement and Plan of Merger for the acquisition of Coastal Cloud Holdings, LLC and its subsidiaries, marking a sizable inorganic growth move in cloud consulting (Board Meeting)

- New wholly owned subsidiary HyperVault AI Data Center Limited incorporated to build multiple AI and sovereign data centers in India, fully funded by TCS with INR 75 million in initial capital and 100 percent ownership (Business Expansions)

- Earlier board approval on October 9, 2025, for setting up a wholly owned Indian subsidiary focused on AI and sovereign data centers, underscoring a strategic pivot toward infrastructure-led AI services (Board Meeting)

- Strategic partnership with Box, Inc. to combine TCS industry expertise and the Box AI-first content platform, offering integrated AI and content solutions for sectors including financial services, healthcare, manufacturing, retail, and government (Client Announcements)

- Resulticks expands its alliance with TCS into full-scale execution, with TCS leading onboarding of 250 agencies and more than 2,500 brands onto the RESUL platform and driving AI-powered, omnichannel marketing deployments (Client Announcements)

Valuation Changes

- Fair Value: Risen slightly to ₹3,476 from ₹3,467, reflecting a marginally higher intrinsic value estimate.

- Discount Rate: Increased marginally to 15.99 percent from 15.98 percent, implying a slightly higher required return on equity.

- Revenue Growth: Edged up modestly to 5.95 percent from 5.93 percent, indicating a small improvement in long term growth expectations.

- Net Profit Margin: Ticked up slightly to 19.79 percent from 19.79 percent, signaling essentially stable profitability assumptions.

- Future P/E: Risen marginally to 32.35x from 32.28x, pointing to a small uplift in expected valuation multiples.

Key Takeaways

- TCS is leveraging AI integration and talent development to enhance revenue growth and meet tech-driven project demands, boosting net margins.

- Strategic investment in AI, legacy modernization, and BFSI technology stack modernization poises TCS for market share growth and improved revenue.

- Revenue declines in key markets, coupled with delayed projects and shrinking operating margins, pose challenges to future growth and profitability.

Catalysts

About Tata Consultancy Services- Provides information technology (IT) and IT enabled services in the Americas, Europe, India, and internationally.

- TCS has seen significant traction and momentum in AI, particularly AI for business, which involves deploying AI across various value chains to improve customer experience and operational speed. This is expected to drive net new revenue opportunities and enhance revenue growth.

- The strong TCV (Total Contract Value) of $12.2 billion in Q4, with a good mix of large, medium, and small deals, is an indicator of future revenue visibility. This suggests a potential increase in revenue as these deals convert to actual projects and executions.

- Investments in talent development and an increase in the percentage of digital-specific hires, with a shift towards higher-end skills such as AI and GenAI, suggest that TCS is preparing to meet future demand for tech-driven projects. This strategic hiring is likely to support higher realization rates and improve net margins over time.

- The emphasis on modernizing technology stacks for BFSI clients, including legacy modernization and cloud adoption, should provide TCS opportunities for significant revenue gain as clients undertake comprehensive digital transformation initiatives.

- TCS's strategic focus on AI infrastructure investments, legacy modernization, and expanding its product portfolio and platforms indicate a strong potential for capturing a larger market share, which could lead to improvements in both revenue and operating margins as these businesses scale.

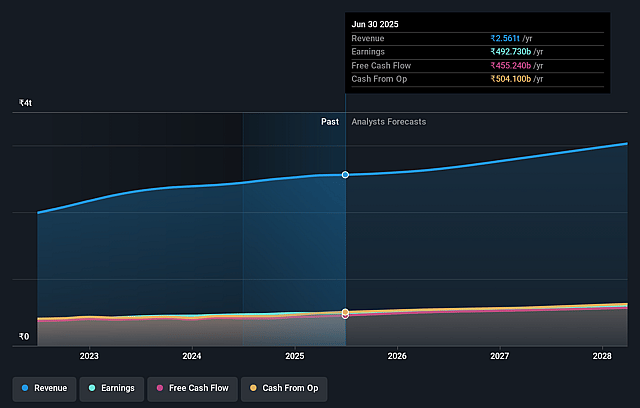

Tata Consultancy Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tata Consultancy Services's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.2% today to 19.8% in 3 years time.

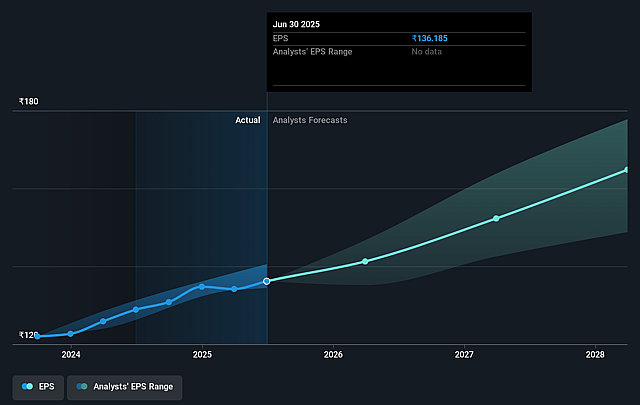

- Analysts expect earnings to reach ₹604.1 billion (and earnings per share of ₹166.89) by about September 2028, up from ₹492.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹538.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.7x on those 2028 earnings, up from 22.7x today. This future PE is greater than the current PE for the IN IT industry at 26.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.87%, as per the Simply Wall St company report.

Tata Consultancy Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A decline in revenue from North America, the largest market, where revenue decreased by 1.9% year-on-year, poses a risk to future revenue growth.

- The Consumer Business Group declined by 0.2% and faces caution and delays in discretionary projects due to reduced consumer sentiment, impacting revenue growth.

- A potential slowdown in the manufacturing sector, particularly in the auto subsegment, due to uncertainties in the EV market and supply chain disruptions, could negatively affect future revenues.

- Instances of delayed decision-making and discretionary spending scrutinies in sectors like insurance and healthcare, driven by global economic uncertainties, could adversely affect revenue and earnings.

- Declining operating margins, affected by tactical interventions such as promotions and marketing expenses, suggest challenges in maintaining profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3723.182 for Tata Consultancy Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹4610.0, and the most bearish reporting a price target of just ₹2620.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹3048.7 billion, earnings will come to ₹604.1 billion, and it would be trading on a PE ratio of 34.7x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹3097.5, the analyst price target of ₹3723.18 is 16.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Tata Consultancy Services?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.