Catalysts

About Tata Consultancy Services

Tata Consultancy Services is a global IT services and consulting company that delivers technology, AI and digital transformation solutions to enterprises, governments and other institutions.

What are the underlying business or industry changes driving this perspective?

- The multiyear pivot to AI-led services risks eroding TCS' traditional labor-arbitrage advantage, as clients demand higher productivity and automation. This could potentially compress pricing power and net margins, even if reported revenue grows.

- Large-scale, capital-intensive investments in sovereign AI data centers and related infrastructure could lock the company into a lower return, asset-heavy model at a time when industry economics favor asset-light cloud and software platforms. This may weigh on long-term earnings quality and return on equity.

- Rapid AI-driven modernization of legacy estates, especially in BFSI, may shorten engagement durations and reduce steady application maintenance revenue before new AI and agentic workloads are large enough to fully offset the lost run rate. This could create medium-term pressure on top line growth.

- Building and retaining a future-ready AI talent base at scale through wage hikes, reskilling and localized hiring may structurally raise the cost base, while clients simultaneously seek cost takeout from AI. This may tighten the spread between revenue growth and operating margins.

- If hyperscalers, deep tech providers and large enterprises increasingly internalize AI capabilities and standardize platforms, TCS could be pushed toward more commoditized implementation and co-location work in India. This may limit pricing differentiation and dilute earnings growth leverage from its current high-margin services mix.

Assumptions

This narrative explores a more pessimistic perspective on Tata Consultancy Services compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

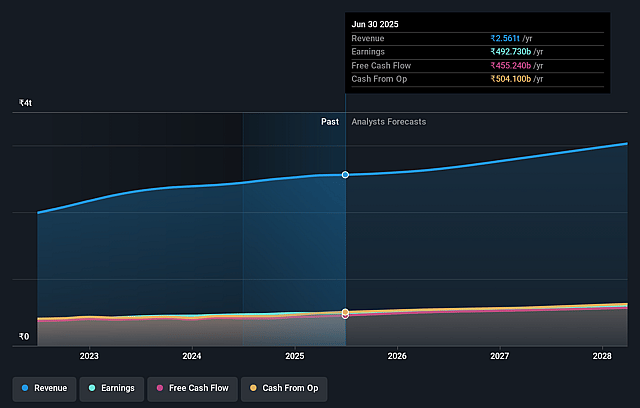

- The bearish analysts are assuming Tata Consultancy Services's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 19.2% today to 19.1% in 3 years time.

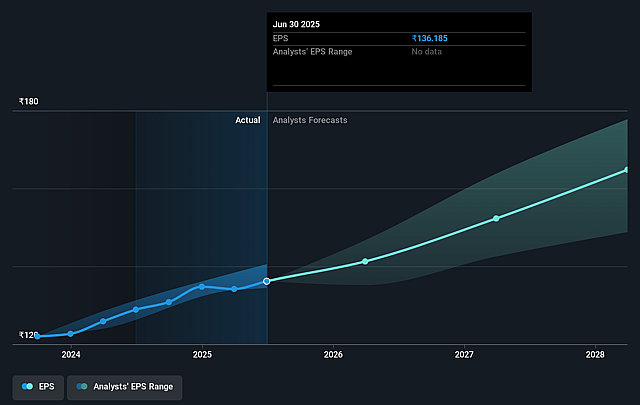

- The bearish analysts expect earnings to reach ₹561.2 billion (and earnings per share of ₹155.25) by about December 2028, up from ₹494.4 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹683.5 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, up from 23.6x today. This future PE is greater than the current PE for the IN IT industry at 25.3x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.99%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is positioning itself to become the world's largest AI-led technology services provider, supported by a rapidly scaling internal AI transformation program, growing AI-first solutions and agentic AI offerings for clients. This positioning could sustain or accelerate long-term revenue growth and protect earnings.

- Strong deal momentum, including a robust total contract value of $10 billion with 16 percent year-on-year growth and large, complex AI-enabled mega deals, suggests a healthy pipeline that may translate into durable top line expansion and support for net margins over time.

- Industry-leading operating margins of 25.2 percent, disciplined execution, and very strong free cash flow generation with a net income margin of 19.6 percent and net cash from operations at 110.1 percent of net income indicate significant financial resilience. This resilience can absorb AI investments and still underpin long-term earnings.

- Large-scale investments in AI infrastructure, including a sovereign AI data center business with expected annuity-type revenues and deeper partnerships with hyperscalers and deep tech players, may open new, higher visibility revenue streams and support long-term profitability and return on equity.

- A future-ready talent model with aggressive upskilling in higher-order AI skills for around 150,000 associates, localized hiring across key markets and ongoing wage investments positions the company to capture AI-driven demand. This positioning could bolster service quality, sustain pricing and support both revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Tata Consultancy Services is ₹2602.79, which represents up to two standard deviations below the consensus price target of ₹3476.31. This valuation is based on what can be assumed as the expectations of Tata Consultancy Services's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹4810.0, and the most bearish reporting a price target of just ₹1950.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹2931.1 billion, earnings will come to ₹561.2 billion, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹3220.5, the analyst price target of ₹2602.79 is 23.7% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Tata Consultancy Services?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.