Key Takeaways

- Accelerating partnerships and technological investments are driving higher-value contracts, enhanced client relationships, and sustained profit and margin expansion.

- Strategic upskilling and expertise in emerging digital solutions position the company for outsized market share and premium service pricing.

- Heightened global uncertainty, overdependence on automotive clients, digital disruption, fierce competition, and talent challenges threaten profitability, margin stability, and future growth prospects.

Catalysts

About Tata Technologies- Provides product engineering and digital services in India, the United Kingdom, North America, rest of Europe, and internationally.

- Analysts broadly agree that the BMW joint venture is scaling rapidly and will boost earnings, but given that headcount is already outpacing initial ramp-up projections, the JV could exceed profitability forecasts, with spill-over effects likely to open doors to additional high-margin, long-term contracts with other premium German OEMs, driving sustained multi-year profit growth and earnings outperformance.

- While consensus expects large deal wins and client relationships to provide a robust pipeline for revenue, the current pipeline of delayed but not cancelled large deals, coupled with a rapid rebound in contracting once trade clarity returns, provides the prospect for a faster-than-expected acceleration in deal closures and revenue recognition, setting up for a step-change in top-line growth across FY 2026 and FY 2027.

- Structural global shifts toward digital transformation, accelerated by OEMs looking to regionalize supply chains and outsource complex engineering for new product cycles, position Tata Technologies to benefit disproportionately from higher-value, recurring service contracts, which will directly support both sustained revenue growth and long-term margin expansion.

- As global adoption of electric vehicles and software-defined vehicles accelerates, Tata Technologies' deep IP investment in AI, embedded software, and smart manufacturing platforms provides first-mover advantage in supporting OEM digitalization, resulting in expanding addressable markets and higher-value engagements that are likely to lift both average contract values and net margins.

- The company's rapidly scaling upskilling initiatives, with over 60% of engineers AI-ready and internal training driving next-gen competencies, enable Tata Technologies to capture market share amid talent shortages and rising costs in developed markets, which in turn will support premium pricing, long-term client stickiness, and consistent margin enhancement.

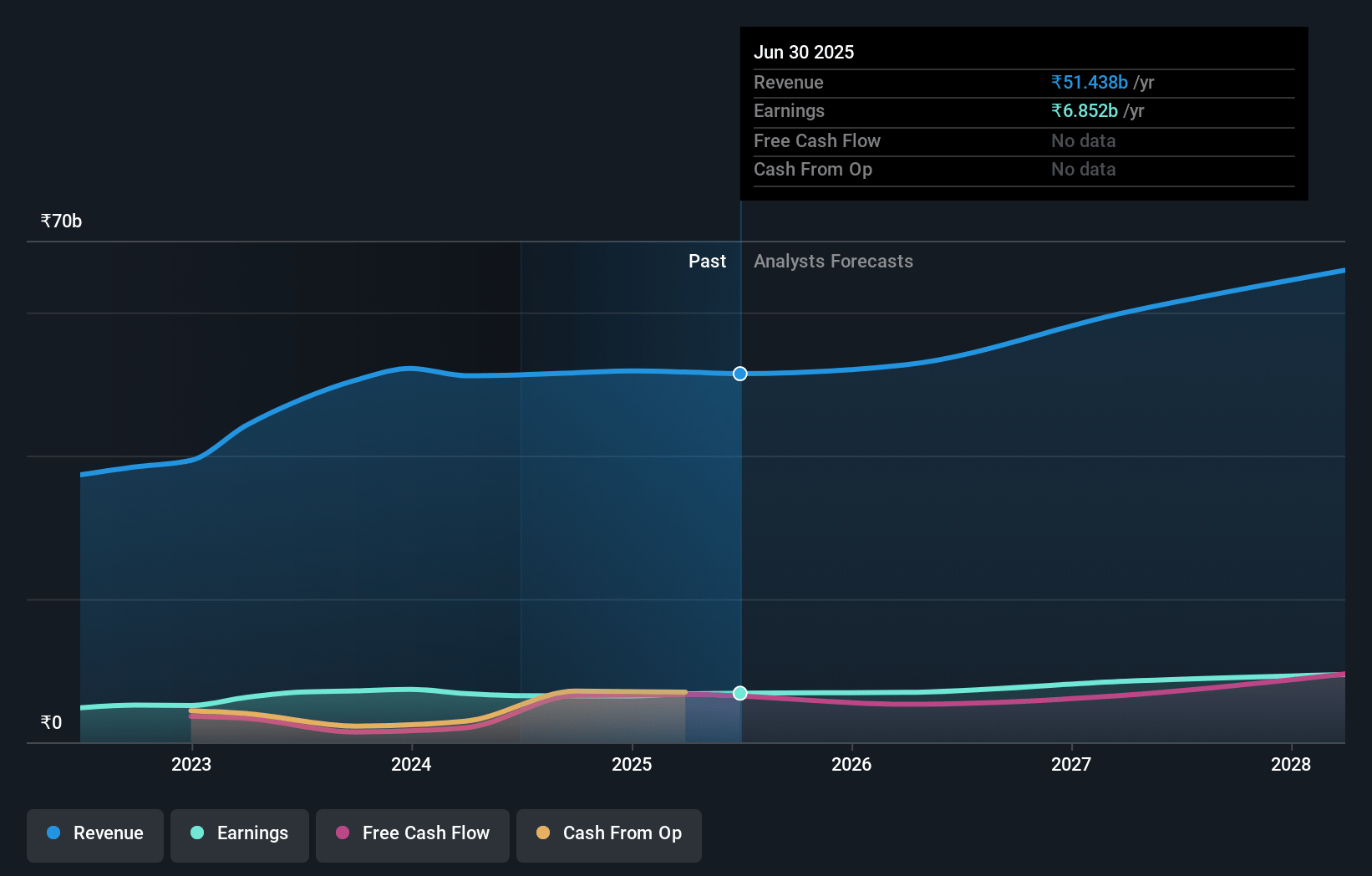

Tata Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tata Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tata Technologies's revenue will grow by 11.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.1% today to 14.1% in 3 years time.

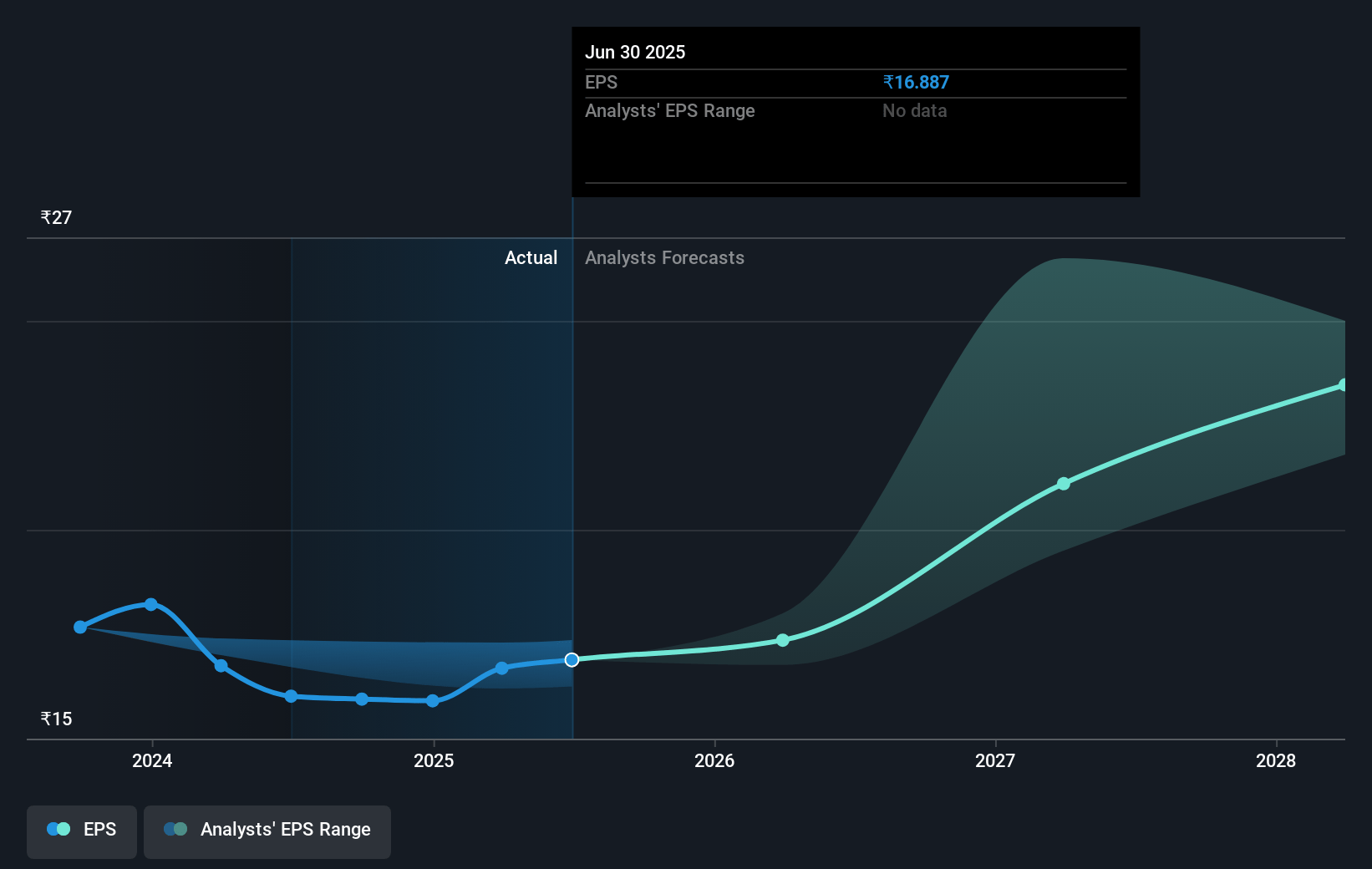

- The bullish analysts expect earnings to reach ₹10.0 billion (and earnings per share of ₹25.81) by about July 2028, up from ₹6.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 68.3x on those 2028 earnings, up from 42.5x today. This future PE is greater than the current PE for the IN IT industry at 30.4x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.27%, as per the Simply Wall St company report.

Tata Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising geopolitical tensions and ongoing trade and tariff disruptions, especially among major economies, have led to delays in customer decision-making and deal closures; this persistent uncertainty has already resulted in a sequential decline in revenues in certain quarters and could continue to dampen overall revenue growth if unresolved.

- Rapid advances in artificial intelligence and automation may lessen demand for traditional engineering and IT services, increasing competitive pressure both on pricing and on the mix of Tata Technologies' service portfolio, which could negatively affect net margins and the company's long-term earnings growth if digital transformation outpaces the company's adaptation.

- Despite efforts at diversification, the business remains highly concentrated in the automotive sector and dependent on key anchor clients like Tata Motors and JLR; any sector-specific downturns, regulatory changes, or increased tendency of automotive OEMs to bring engineering functions in-house could severely impact the company's revenue visibility and stability.

- Intensifying competition from global engineering and digital services firms, including larger Indian IT players expanding into ER&D, may force Tata Technologies to lower pricing or invest more heavily in talent and innovation, putting downward pressure on operating margins and ultimately affecting profitability.

- Talent shortages, wage inflation, and higher attrition rates in India's IT and engineering talent pool, combined with increasing compliance pressures from global cybersecurity and data privacy regulations, are expected to drive up operating costs and complicate project delivery, negatively impacting both profitability and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tata Technologies is ₹1107.78, which represents two standard deviations above the consensus price target of ₹685.8. This valuation is based on what can be assumed as the expectations of Tata Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1340.0, and the most bearish reporting a price target of just ₹480.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹71.1 billion, earnings will come to ₹10.0 billion, and it would be trading on a PE ratio of 68.3x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹708.8, the bullish analyst price target of ₹1107.78 is 36.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.