Key Takeaways

- Rising AI adoption, regulatory changes, and talent challenges threaten Persistent's margins and revenue stability, while rapid tech shifts require costly, continual skill upgrades.

- Heavy reliance on a few major clients exposes the company to significant risks if customer concentration issues or large-scale insourcing occurs.

- Persistent's strong growth, AI-driven innovation, deep client relationships, and major tech alliances are driving higher-margin, recurring revenues and positioning it for sustained global expansion.

Catalysts

About Persistent Systems- Provides software products, services, and technology solutions in India, North America, and internationally.

- The accelerating adoption of AI-driven automation may rapidly commoditize Persistent Systems' core IT and digital engineering service offerings, making it increasingly difficult to command premium pricing and leading to a sustained contraction in net margins.

- Increasing global regulatory pressures around data sovereignty, privacy, and digital taxes threaten to disrupt Persistent's cross-border delivery model, creating expense drag from compliance costs and capping international revenue growth over the long term.

- Persistent's high client concentration, with the top 10 clients making up over 42 percent of revenues and some verticals reliant on a single large customer, leaves the company acutely vulnerable to the loss of a major client or large-scale insourcing, with disproportionately negative effects on topline revenue and earnings stability.

- The relentless pace of technological change, including the shift toward cloud-native, generative AI, and low-code/no-code solutions, risks Persistent's platforms and skillsets becoming obsolete, necessitating continuous, expensive re-skilling and reinvestment that could erode future profitability and dilute return on capital employed.

- Mounting wage inflation and persistent talent retention challenges in India further strain Persistent's cost base; as competition from global IT service majors and SaaS-focused rivals eats into Persistent's core market, this will likely trigger margin compression that prevents the company from sustaining its historical earnings growth trajectory.

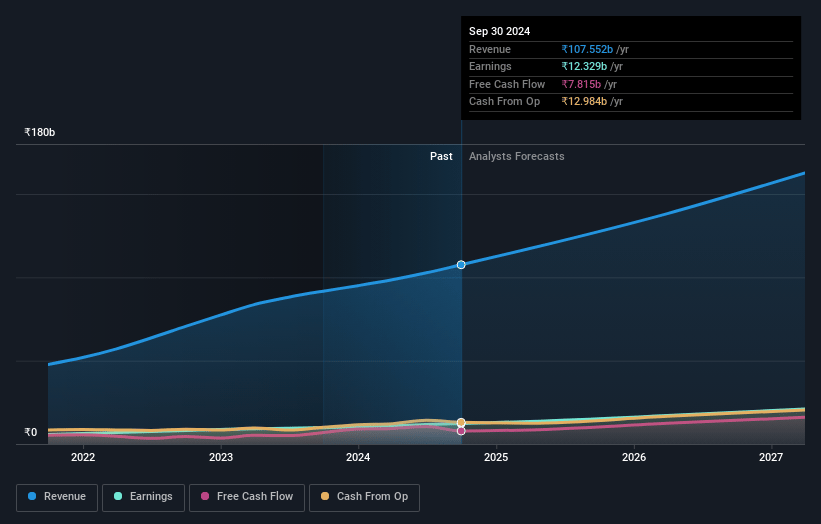

Persistent Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Persistent Systems compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Persistent Systems's revenue will grow by 12.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.7% today to 12.9% in 3 years time.

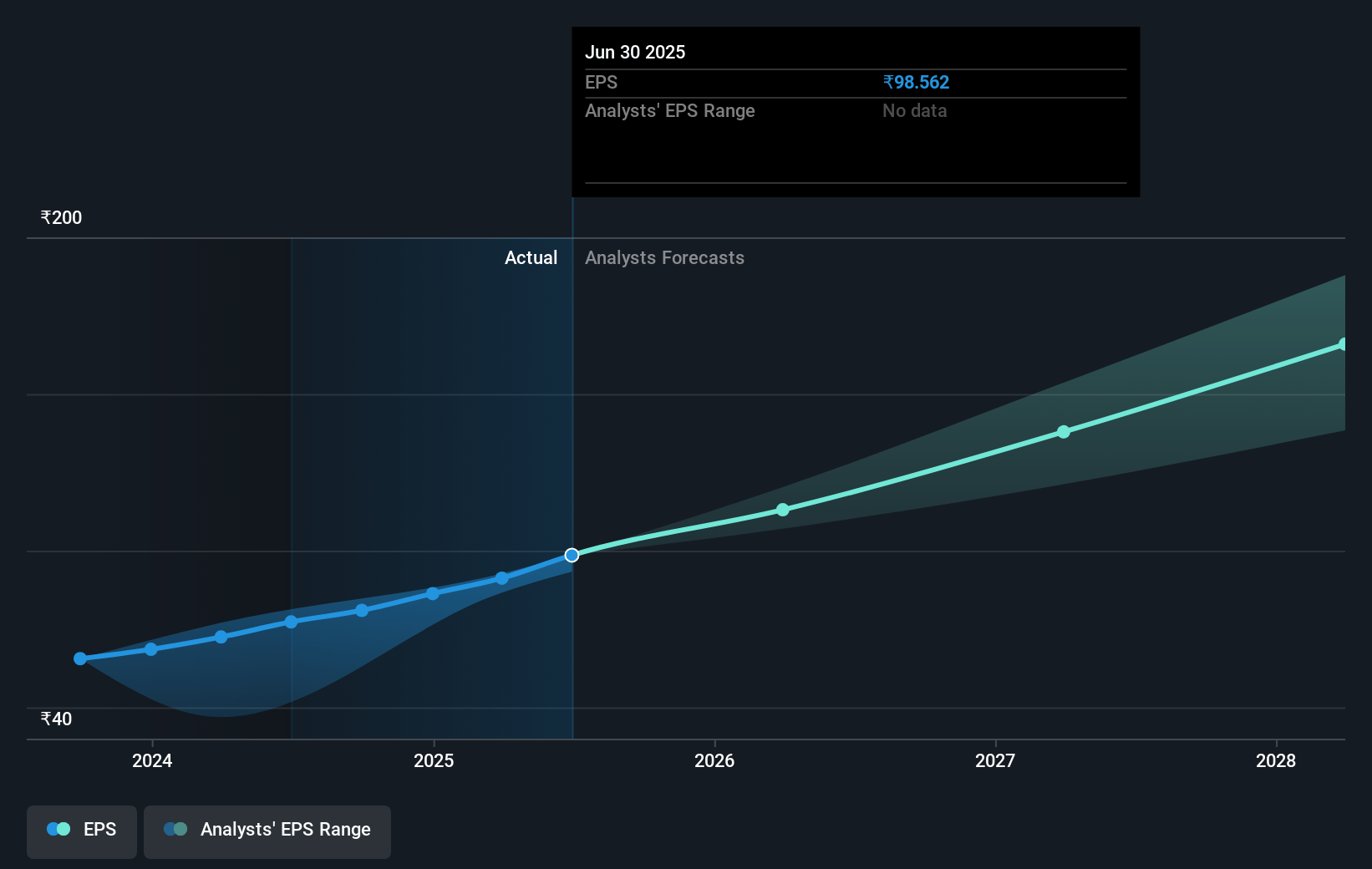

- The bearish analysts expect earnings to reach ₹22.1 billion (and earnings per share of ₹141.3) by about July 2028, up from ₹14.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 41.8x on those 2028 earnings, down from 59.6x today. This future PE is greater than the current PE for the IN IT industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 1.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.3%, as per the Simply Wall St company report.

Persistent Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and consistent revenue growth over 20 consecutive quarters, expansion across industry verticals such as healthcare (up 54% year-on-year), banking and financial services (up 17.8%), and technology, as well as growth in Europe and North America, signals robust top line momentum and growing market share, supporting sustained long-term revenue expansion.

- The company's ongoing investment in AI platforms and proprietary IP, such as SASVA, GenAI Hub, and iAURA, along with 35 patents filed, is driving competitive differentiation and moving more of Persistent's business toward higher-margin, IP-led, and outcome-based models, which could increase both margins and recurring earnings in the long run.

- Deep client relationships and demonstrated success in significantly expanding revenue from top clients-number of customers with annual revenues over $75 million and $50 million has doubled year-over-year-help improve client stickiness, reduce churn risk, and support predictable revenue growth.

- Strategic alliances with major technology partners such as Salesforce, Microsoft, AWS, NVIDIA, IBM, Google, and Databricks, alongside industry-wide recognitions and multiple partner awards, position Persistent to continue scaling high-value digital and AI services globally, leading to higher deal wins and potential for both revenue and margin improvement.

- A clear commitment to margin improvement, with EBIT margins rising year-on-year and management explicitly targeting an additional 200 to 300 basis point expansion as revenue approaches $2 billion by FY27, points toward further improvement in profitability and earnings growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Persistent Systems is ₹3904.39, which represents two standard deviations below the consensus price target of ₹5848.0. This valuation is based on what can be assumed as the expectations of Persistent Systems's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹7637.0, and the most bearish reporting a price target of just ₹3675.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹171.1 billion, earnings will come to ₹22.1 billion, and it would be trading on a PE ratio of 41.8x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹5592.5, the bearish analyst price target of ₹3904.39 is 43.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.