Narratives are currently in beta

Key Takeaways

- Integration of Cigniti accelerates revenue growth and improves EBITDA margins, signaling potential for enhanced earnings and margins.

- Strategic investments in AI and partnerships with major tech platforms promise future revenue expansion and improved margins.

- Relying on key sectors and AI initiatives could risk revenue stability, while expansion and integration challenges may pressure profit margins and operating expenses.

Catalysts

About Coforge- Provides information technology (IT) and IT enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

- Coforge's rapid revenue growth, particularly the integration and strong performance of the Cigniti business, suggests an acceleration toward its next revenue milestone of $2 billion. This implies significant future revenue growth.

- The company's order book has increased by over 40% YoY, with large deal signings and a healthy pipeline across multiple verticals and geographies. This bolsters expectations of sustained revenue increases and a robust demand environment.

- The consolidation and integration of Cigniti have not only accelerated revenue growth but have also significantly improved EBITDA margins, showcasing the potential for further margin enhancement and earnings growth.

- Investments in AI and strategic partnerships with major tech platforms like Microsoft and ServiceNow position Coforge well for capturing emerging opportunities in tech-driven transformation projects, promising future revenue expansion and potentially improved net margins.

- The structured and disciplined management of operational costs, such as the gradual reduction of ESOP costs, is expected to positively impact net margins and overall earnings in the coming quarters.

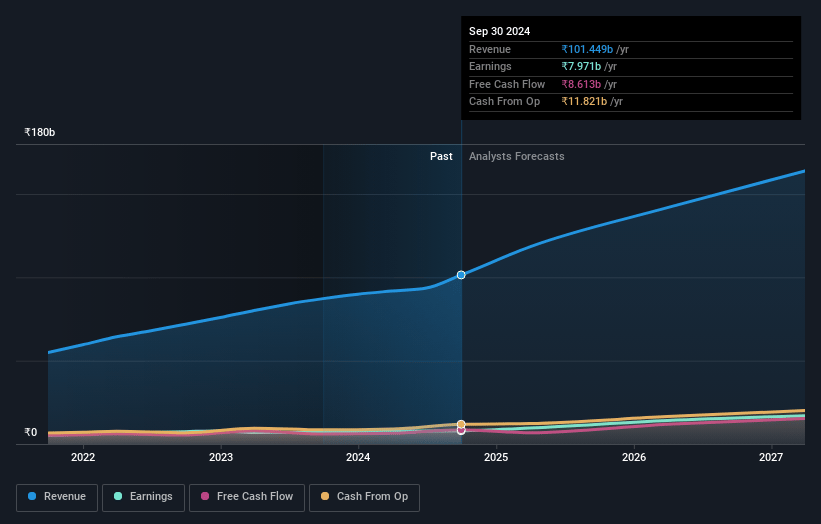

Coforge Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coforge's revenue will grow by 18.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 10.6% in 3 years time.

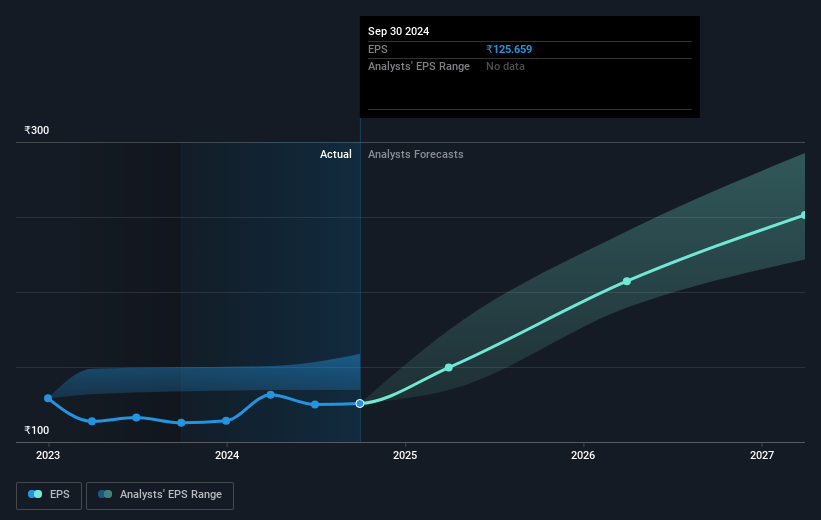

- Analysts expect earnings to reach ₹19.5 billion (and earnings per share of ₹270.9) by about January 2028, up from ₹7.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹14.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 51.8x on those 2028 earnings, down from 75.5x today. This future PE is greater than the current PE for the IN IT industry at 32.8x.

- Analysts expect the number of shares outstanding to grow by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.59%, as per the Simply Wall St company report.

Coforge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Coforge's ambitious expansion initiatives, such as the operational integration of Cigniti, may lead to challenges in maintaining efficiency and profit margins, potentially impacting net margins.

- Heavy reliance on specific verticals like BFS and insurance, which showed strong Y-o-Y growth, could backfire if these sectors face slowdowns, affecting revenue diversity and sustainability.

- The firm's strategy of focusing on AI and cutting-edge solutions may backfire if adoption rates slow or the anticipated AI-driven efficiencies lead to lower billing rates, impacting revenues.

- Increased ESOP costs and integration expenses, despite plans for reduction, could continue to pressure operating expenses in the short term, affecting net profit margins.

- Potential regulatory hurdles and delays in the merger and amalgamation processes with Cigniti could lead to additional unforeseen financial costs, affecting net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹9431.55 for Coforge based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹12000.0, and the most bearish reporting a price target of just ₹5220.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹183.0 billion, earnings will come to ₹19.5 billion, and it would be trading on a PE ratio of 51.8x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹8746.55, the analyst's price target of ₹9431.55 is 7.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives