Key Takeaways

- Expanding stores in smaller cities and leveraging improving consumer sentiment aims to drive strong revenue growth and capitalize on the shift to organized value retail.

- Technology upgrades and omnichannel integration are expected to enhance operational efficiency, customer acquisition, and profitability while strengthening competitive positioning.

- Mounting competition, rising costs, digital lag, shifting consumer preferences, and supply chain risks threaten V-Mart's growth, profitability, and market positioning.

Catalysts

About V-Mart Retail- Operates a chain of retail departmental stores in India.

- V-Mart's aggressive net new store expansion (targeting 12–15% increase in selling area and ~65 store additions this year) in Tier 2/3/4 and semi-urban cities positions it to benefit from the long-term structural shift toward organized value retail and the rising urbanization and disposable income in these regions, which is expected to support robust revenue growth.

- Improved consumer sentiment, driven by factors such as controlled inflation, strong monsoon, higher rural/farmer incomes, and macro tailwinds (industrialization), is likely to boost discretionary spending and organized value retail adoption, directly benefitting V-Mart's top-line and supporting higher sales densities.

- Ongoing technology investments (automated supply chain, inventory management, and AI-driven analytics) are leading to more efficient working capital utilization, reduced aged inventory, and higher full price sell-throughs, which should help improve net margins and EBITDA.

- Focus on deeper omnichannel integration (cost controls, online-to-store synergies, and digital team involvement in analytics) is expected to facilitate customer acquisition, enhance shopping frequency, and gradually increase digital contribution-driving incremental revenue and margin improvement.

- V-Mart's sharper pricing and evolving product strategy (greater value-led assortment and festival-driven innovation) alongside disciplined cost controls and improving vendor management is set to strengthen its competitive position, limit margin downside from higher rentals and promotions, and grow operating profits and earnings over time.

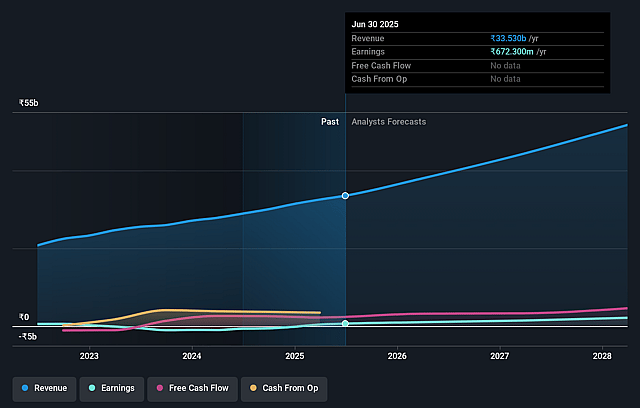

V-Mart Retail Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming V-Mart Retail's revenue will grow by 16.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 4.4% in 3 years time.

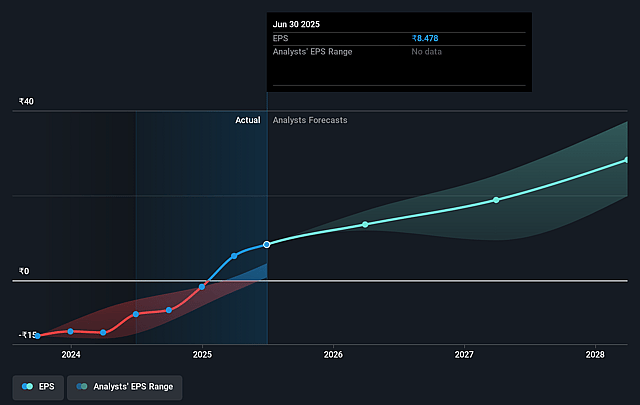

- Analysts expect earnings to reach ₹2.3 billion (and earnings per share of ₹30.06) by about August 2028, up from ₹672.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹3.0 billion in earnings, and the most bearish expecting ₹1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.3x on those 2028 earnings, down from 87.7x today. This future PE is lower than the current PE for the IN Multiline Retail industry at 87.7x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.62%, as per the Simply Wall St company report.

V-Mart Retail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both national and regional organized value retailers, as well as niche players, is causing aggressive store openings and differentiated strategies (including higher variety and targeted experiences), which could dilute V-Mart's market share and pressure same-store sales growth, thus impacting revenue and earnings growth.

- Persistent rental inflation, particularly for new and renewing retail spaces, is increasing rental costs by 5–7% annually; this erodes V-Mart's traditional cost advantage in discount retail, potentially compressing operating margins and reducing net profitability over time.

- Limited focus and slow progress on scaling the omni-channel and digital business-while competitors and consumer preferences increasingly shift online-means V-Mart risks underperforming digital-first rivals, and may see revenue growth constrained as more commerce moves to e-commerce platforms.

- V-Mart's strategy to expand store count aggressively in Tier 2/3/4 cities could face challenges from changing consumer aspirations towards branded and premium products as incomes rise in smaller towns, risking a misalignment of V-Mart's value-mass positioning with future demand and potentially impacting both topline growth and store-level profitability.

- External risks, including supply chain dependence on a diversified vendor base with exposure to tariff-related disruptions, and rising labor and logistics costs, could increase execution complexity and cost volatility, leading to inconsistent inventory availability and downward pressure on gross and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1019.067 for V-Mart Retail based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1494.0, and the most bearish reporting a price target of just ₹602.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹53.1 billion, earnings will come to ₹2.3 billion, and it would be trading on a PE ratio of 54.3x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹742.6, the analyst price target of ₹1019.07 is 27.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.