Last Update 06 Sep 25

Fair value Increased 7.69%Boutique Expansion And Digitalization Will Boost Luxury Lifestyle

The consensus analyst price target for Ethos has been raised from ₹3,250 to ₹3,500 as both the future P/E and discount rate remain effectively unchanged, indicating a higher fair value assessment without a shift in key valuation assumptions.

What's in the News

- Ethos incorporated "Micron Watch Services Private Limited" as a subsidiary to set up watch service centers in select Indian cities, holding a 50.1% stake; Mr. Yashovardhan Saboo acts as nominee shareholder.

- Scheduled a board meeting to approve unaudited financial results for the quarter ended June 30, 2025, and appoint Mr. Vishal Arora as Secretarial Auditor.

- Considered and completed allotment of 2,277,250 fully paid-up equity shares on a rights basis at INR 1,800 per share.

- Completed a follow-on equity rights offering, raising INR 4.09905 billion through the issuance of 2,277,250 common shares at INR 1,800 each.

Valuation Changes

Summary of Valuation Changes for Ethos

- The Consensus Analyst Price Target has risen from ₹3250 to ₹3500.

- The Future P/E for Ethos remained effectively unchanged, moving only marginally from 52.43x to 52.09x.

- The Discount Rate for Ethos remained effectively unchanged, moving only marginally from 15.03% to 15.01%.

Key Takeaways

- Retail network expansion and exclusive partnerships in high-margin categories position Ethos to capture luxury demand and structurally improve profitability over time.

- Digital investments and pre-owned segment growth enhance customer engagement and revenue resilience, while regulatory changes support margin and supply chain flexibility.

- Aggressive physical expansion, inventory build-up, and diversification expose Ethos to operational, working capital, and demand risks amid shifting consumer behavior and external regulatory challenges.

Catalysts

About Ethos- Operates a chain of luxury watch boutiques in India.

- Significant expansion of Ethos’ retail network—including openings in premium urban centers, flagship projects like City of Time and targeted growth in Tier 2 cities—positions the company to capture the rising demand for branded and luxury goods driven by growing middle-class disposable income, directly supporting long-term revenue growth.

- Increasing focus on exclusive brand partnerships and expansion into high-margin categories such as luxury jewelry (Messika) and premium luggage (Rimowa), alongside product offerings tailored to Indian consumers, is expected to drive structural improvement in gross margins and overall earnings.

- Ongoing investment in digitalization—including CRM upgrades, rebranding, omni-channel integration, and preparation for e-commerce launches (e.g., Rimowa)—leverages consumer reliance on digital retail, increasing customer acquisition efficiency, boosting retention, and improving revenue per customer.

- Diversification into new luxury lifestyle categories and a growing pre-owned business provide Ethos with multiple sources of growth, leveraging the broader trend of aspirational lifestyle upgrades, supporting both topline and profitability resilience.

- Anticipated regulatory and market changes, such as the India-Switzerland EFTA agreement reducing duties over the next several years, are expected to structurally benefit Ethos by enhancing net margins and enabling more flexible supply-chain models (SOR), further supporting earnings growth.

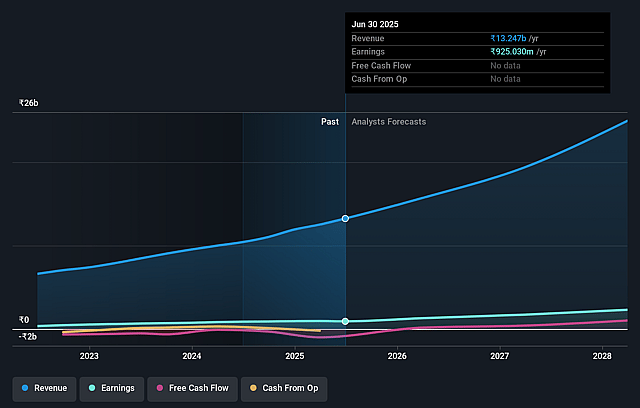

Ethos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ethos's revenue will grow by 24.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 9.7% in 3 years time.

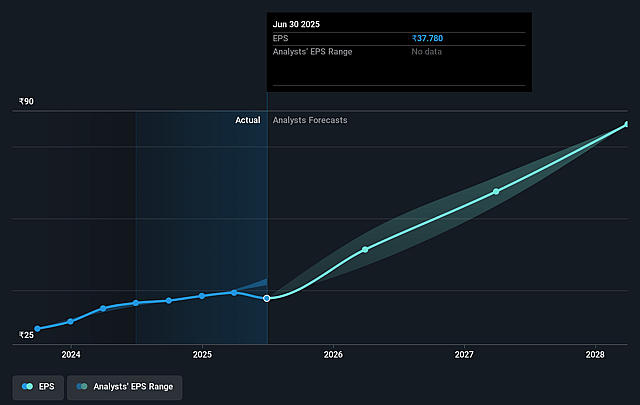

- Analysts expect earnings to reach ₹2.5 billion (and earnings per share of ₹81.5) by about September 2028, up from ₹925.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.4x on those 2028 earnings, down from 68.3x today. This future PE is greater than the current PE for the IN Specialty Retail industry at 28.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.03%, as per the Simply Wall St company report.

Ethos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating expansion of company-owned boutiques with high upfront CapEx and inventory investment exposes Ethos to elevated operational leverage and working capital risk—if new stores ramp up sales slower than expected or underperform, this could compress margins and earnings.

- High physical store count and continued emphasis on brick-and-mortar formats may limit flexibility amid secular shifts toward e-commerce and digital-native brands, increasing the risk of declining foot traffic and sales productivity, which could impact revenue growth and profitability over time.

- Sustained inventory build-up (from ₹440 crores to ₹593 crores) ahead of revenue ramp, coupled with proactive advance payments and reduced trade payables, increases working capital requirements and may pressure net margins and returns if not managed prudently, particularly if demand softens.

- Ethos’ strategy to diversify into new luxury categories (jewelry, luggage, new geographies) requires careful brand fit and execution—missteps, slower consumer adoption, or lower-than-expected profitability in these segments could dilute focus and impede earnings growth.

- Margin improvements via exclusive and high-margin partnerships are at risk from currency volatility (CHF/INR swings), regulatory changes (tariffs, GST), and the uncertain pace/timeline of EFTA benefits; these external factors could create earnings volatility and limit the sustainability of recent gross/EBITDA margin gains.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3250.0 for Ethos based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹25.4 billion, earnings will come to ₹2.5 billion, and it would be trading on a PE ratio of 52.4x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹2359.7, the analyst price target of ₹3250.0 is 27.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.