Last Update 09 Dec 25

540205: Stable Margins And Earnings Visibility Will Drive Future Upside Potential

Analysts have nudged their price target on Aditya Vision slightly higher to approximately ₹633 per share from about ₹633 previously, reflecting a marginally higher assumed discount rate and steady expectations for revenue growth, profit margins and valuation multiples.

What's in the News

- Board meeting scheduled for November 7, 2025, to consider and approve standalone unaudited financial results for the quarter and half year ended September 30, 2025 (company filing)

- Special and extraordinary shareholders meeting to be conducted via postal ballot in India on December 13, 2025 (company filing)

Valuation Changes

- Fair Value: unchanged at approximately ₹633 per share, indicating no material shift in intrinsic value estimates.

- Discount Rate: risen slightly from about 14.9 percent to around 15.1 percent, reflecting a modest increase in perceived risk or cost of capital.

- Revenue Growth: effectively unchanged at roughly 23.9 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin: broadly steady at about 5.2 percent, implying no significant revision to profitability assumptions.

- Future P/E: risen slightly from about 51.9x to roughly 52.2x, pointing to a marginally higher valuation multiple on forward earnings.

Key Takeaways

- Store expansion in smaller cities and rising consumer incomes are set to drive significant revenue growth and market share gains against unorganized competitors.

- Strong cost control, efficient inventory management, and supportive vendor relationships should sustain healthy margins and enhance earnings stability.

- Geographic concentration, sluggish digital adaptation, product seasonality, and intensifying competition threaten revenue growth, margin stability, and long-term market relevance.

Catalysts

About Aditya Vision- Engages in the retail business of consumer durables and electronics in India.

- Store expansion into underpenetrated Tier 2 and Tier 3 cities of Uttar Pradesh, alongside a robust pace of new openings (25–30 stores planned for FY '26), positions the company to capture a larger, fast-growing addressable market amid rising middle-class incomes and urbanization-likely driving strong double-digit revenue growth.

- Increased disposable income in core markets, supported by government measures such as Bihar's free electricity scheme and Union Budget tax relief, is expected to fuel discretionary spending on electronics and appliances, which should directly boost top-line sales.

- Continued effective cost controls and operating expense rationalization, even during challenging quarters, can support stable or improved net margins as operating leverage benefits accrue from maturing new stores and a normalized environment.

- Proactive inventory management and strong vendor partnerships (with OEMs providing inventory support rather than Aditya Vision resorting to price discounting) has strengthened the company's working capital position and should help minimize margin compression, positively impacting earnings.

- Sustained consumer preference for organized, branded retail experiences, especially in underpenetrated regions, positions Aditya Vision to gain share from unorganized players as the sector formalizes further, supporting multi-year margin and earnings growth through scale and supply chain efficiencies.

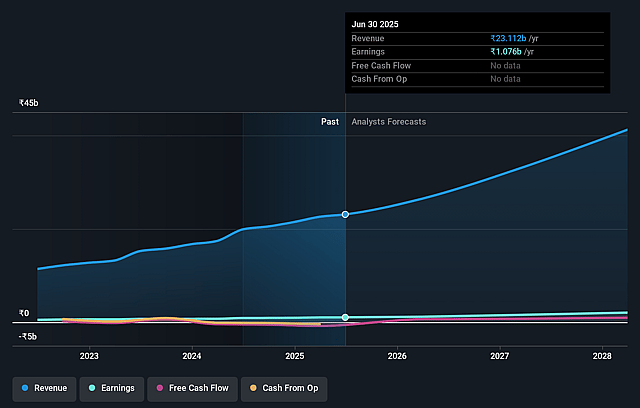

Aditya Vision Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aditya Vision's revenue will grow by 22.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 5.1% in 3 years time.

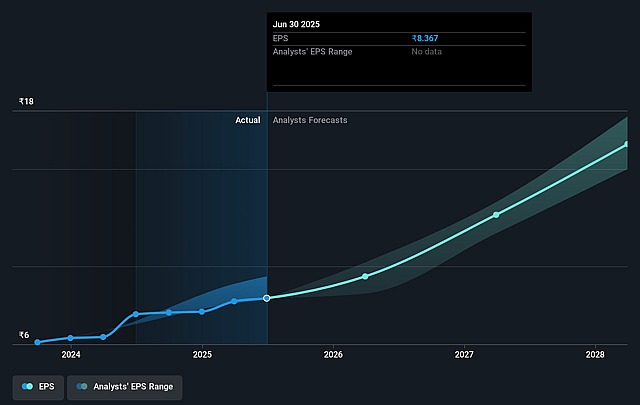

- Analysts expect earnings to reach ₹2.2 billion (and earnings per share of ₹15.37) by about September 2028, up from ₹1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.6x on those 2028 earnings, down from 59.2x today. This future PE is greater than the current PE for the IN Specialty Retail industry at 29.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.13%, as per the Simply Wall St company report.

Aditya Vision Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains heavily dependent on Bihar (76% of revenue), with only gradual expansion into Uttar Pradesh and Jharkhand; this geographic concentration leaves Aditya Vision highly exposed to regional economic, political, and weather-related risks, which may limit long-term revenue growth and earnings consistency.

- Same-store sales growth (SSSG) for Q1 FY '26 was negative (-4%), following a historically strong base, and management did not provide concrete growth guidance for the full year; persistent negative or weak SSSG may signal peaking market penetration and could dampen future topline and net margin growth.

- Despite ongoing expansion (25–30 new stores each year), there is no clear discussion of progress or strategy on digital transformation, e-commerce, or omni-channel integration, raising the risk that rapidly growing online retail channels and tech-savvy competitors could erode market share and operating margins over time.

- The company's portfolio is highly reliant on consumer electronics-particularly air conditioners, which made up 42% of Q1 sales and 65% of AC volumes occur in Q1-leaving earnings and working capital exposed to seasonality, inventory risk, and sudden shifts in consumer product preferences or regulatory norms (such as upcoming BEE changes).

- Intensifying competition from large pan-India and online players (e.g., Reliance Digital, Croma, Amazon, Flipkart) is likely to increase price pressures and reduce gross/net margins, as Aditya Vision has not indicated any significant differentiation through brand exclusivity, technology, or after-sales service, potentially constraining both revenue expansion and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹541.333 for Aditya Vision based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹628.0, and the most bearish reporting a price target of just ₹450.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹42.8 billion, earnings will come to ₹2.2 billion, and it would be trading on a PE ratio of 48.6x, assuming you use a discount rate of 15.1%.

- Given the current share price of ₹495.2, the analyst price target of ₹541.33 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Aditya Vision?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.