Key Takeaways

- Robust demand and shifting preferences for premium, tech-enabled spaces drive strong growth, higher occupancy, and recurring rental income across residential and commercial portfolios.

- Prudent development strategy, solid cash flows, and favourable policy trends minimize risk while enabling scalable, self-funded expansion and stronger project valuations.

- High geographic and segment concentration, execution risks, over-leveraging, and secular office space headwinds threaten revenue stability, profit margins, and long-term financial health.

Catalysts

About Max Estates- Max Estates Limited construction and develops residential and commercial properties.

- Strong demand for premium residential and commercial real estate in Delhi NCR-driven by continued urbanization, rising affluence, infrastructure improvements, and the influx of global enterprises-is expected to support sustained double-digit top-line growth and reduce inventory risk, boosting revenue visibility.

- Shifting tenant preferences toward Grade A, tech-enabled, and sustainable office spaces is benefiting Max Estates as demonstrated by 100% occupancy and premium leasing rates in their commercial portfolio, which should enhance recurring annuity rental income and expand EBITDA margins.

- The company's focus on high-quality, end-user-driven developments with differentiated brands (Max Estates, Antara) and prudent launch sizes across multiple micro-markets helps mitigate macro and sector-specific risks, supporting stable cash flows and making revenue more resilient.

- Healthy presales pipeline, robust collection efficiency (96%+), and self-funded residential projects with minimal reliance on external debt position the balance sheet well for near-term and long-term expansion, further supporting stable net margins.

- Policy reforms that encourage formalization and transparency, along with growing institutional investment and REIT participation, create additional liquidity and exit options for Max Estates' high-quality projects, potentially leading to higher valuations and lower cost of capital.

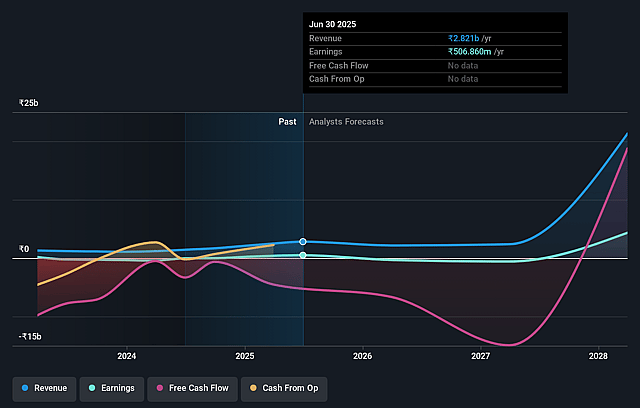

Max Estates Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Max Estates's revenue will grow by 66.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.0% today to 9.3% in 3 years time.

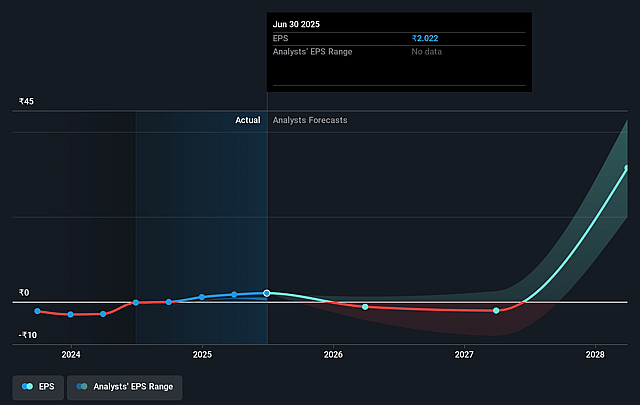

- Analysts expect earnings to reach ₹1.2 billion (and earnings per share of ₹23.06) by about September 2028, up from ₹506.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 130.4x on those 2028 earnings, down from 140.5x today. This future PE is greater than the current PE for the IN Real Estate industry at 35.4x.

- Analysts expect the number of shares outstanding to decline by 4.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.1%, as per the Simply Wall St company report.

Max Estates Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy concentration in Delhi NCR, specifically Noida and Gurugram, exposes it to city

- or region-specific economic, regulatory, or demand shocks, which could lead to revenue volatility and risk to asset values over the long term, especially if the NCR market underperforms versus other metros.

- The long-term trend toward single-digit price appreciation after a sharp catch-up period, combined with developers increasingly launching premium/luxury units, may lead to market oversupply in the high-end segment and compression of margins if demand softens, directly impacting sales velocity, revenue growth, and EBITDA margins.

- Execution risk remains significant due to the reliance on securing regulatory approvals (such as RERA and building plans), and a slowdown or unpredictability in approval processes across multiple concurrent projects could delay launches, extend working capital cycles, and negatively impact cash flow and net profit realization.

- Aggressive expansion through multiple projects, with plans to launch ₹9,500 crores of GDV in the near term, and additional acquisitions funded through significant cash outlays or rising debt, raises the risk of over-leverage, higher interest expenses, and potential stress on balance sheet strength and net margins if sales slow or cost overruns occur.

- The office leasing strategy's long-term resilience is subject to secular risks from growing adoption of remote/hybrid work and evolving occupier preferences toward more flexible or tech-enabled spaces; any lasting decline in traditional office space demand may reduce occupancy rates and recurring rental income, pressuring future earnings and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹715.0 for Max Estates based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹810.0, and the most bearish reporting a price target of just ₹625.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹13.0 billion, earnings will come to ₹1.2 billion, and it would be trading on a PE ratio of 130.4x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹442.35, the analyst price target of ₹715.0 is 38.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.