Last Update 12 Sep 25

Fair value Increased 7.22%The consensus analyst price target for Tilaknagar Industries has increased to ₹609.00, primarily reflecting sharply higher revenue growth forecasts despite a decline in net profit margin.

What's in the News

- Board approved INR 9.86 billion private placement combining equity and convertible warrants, with significant participation from institutional and HNI investors; warrants priced at INR 95.5 with exercise price of INR 286.5.

- Shareholder meetings convened to approve increases in authorized share capital, preferential allotment of equity shares, and issuance of convertible warrants.

- Subsidiary "Grain & Grape Works Private Limited" incorporated to support business expansion.

- Board approved fund-raising via equity and/or securities instruments using multiple modes, and appointed CRISIL as monitoring agency; also considering expansion of Prag Distillery.

- Bombay High Court Division Bench allowed Tilaknagar’s appeals, maintaining the status quo prohibiting introduction of competing products under "MANSION HOUSE" and "SAVOY CLUB" trademarks in India pending a final decision.

Valuation Changes

Summary of Valuation Changes for Tilaknagar Industries

- The Consensus Analyst Price Target has risen from ₹568.00 to ₹609.00.

- The Consensus Revenue Growth forecasts for Tilaknagar Industries has significantly risen from 14.9% per annum to 34.8% per annum.

- The Net Profit Margin for Tilaknagar Industries has significantly fallen from 10.79% to 8.01%.

Key Takeaways

- Premiumization of the product portfolio and expansion into luxury segments are driving higher margins and positioning Tilaknagar for long-term growth.

- Strategic acquisitions, capacity upgrades, and geographic expansion are set to boost revenue streams, operational efficiency, and overall financial stability.

- Increased leverage from acquisitions, limited diversification, regulatory risks, reliance on subsidies, and intensifying competition may threaten margins and sustainable growth prospects.

Catalysts

About Tilaknagar Industries- Engages in the manufacture and sale of Indian made foreign liquor and its related products in India.

- The ongoing shift of Indian consumers toward premium branded alcoholic beverages, combined with Tilaknagar's clear strategy to premiumize its portfolio (e.g., launch of Monarch Legacy in luxury, higher investment in super-premium brands like Samsara), sets the stage for sustained increases in average selling price (ASP) and net margins over time.

- Rapid urbanization and rising incomes in India, supported by robust volume growth (26.5% YoY in Q1), are expanding the consumer base for organized players like Tilaknagar, implying room for continued topline/revenue growth as new markets open up.

- The transformative acquisition of Imperial Blue provides immediate scale and diversification into the high-volume whisky segment, allowing Tilaknagar to leverage operational synergies and expand its reach across 27 states, which is likely to drive both revenue and EBITDA margin improvement post-integration.

- Expansion plans such as the bottling capacity upgrade at Prag Distillery and targeted distribution growth in East and Northeast India unlock new volume and geographic revenue streams while also creating supply chain efficiencies that could benefit operating margins.

- Ongoing improvement in the balance sheet, with the company moving to net cash, combined with strategic cost optimizations and reduction in legacy legal costs, lays the groundwork for lower finance costs and sustainable long-term earnings growth.

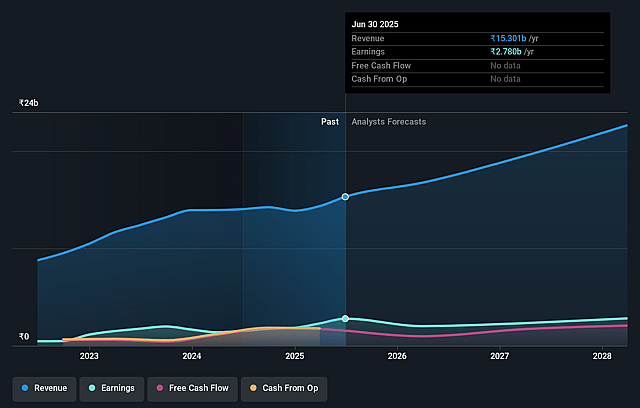

Tilaknagar Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tilaknagar Industries's revenue will grow by 14.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.2% today to 10.8% in 3 years time.

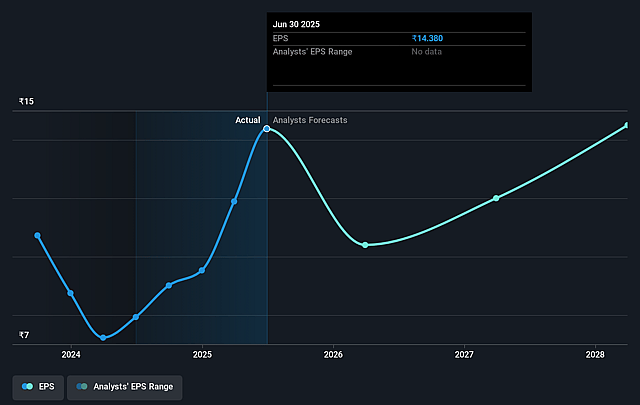

- Analysts expect earnings to reach ₹2.5 billion (and earnings per share of ₹13.87) by about September 2028, down from ₹2.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 63.6x on those 2028 earnings, up from 33.3x today. This future PE is greater than the current PE for the IN Beverage industry at 37.4x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Tilaknagar Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned acquisition of Imperial Blue is being funded nearly equally through debt and equity, which will significantly raise the company's debt levels in the near term; integration risks and high leverage could strain net margins and earnings if anticipated synergies or growth do not materialize as planned.

- With over 90% of revenue still concentrated historically in the brandy segment, Tilaknagar's limited diversification exposes it to market share loss and margin erosion if consumer preferences shift or new competitors aggressively enter its core categories.

- Recent and potential future excise duty hikes in key markets like Maharashtra – and a generally high and unpredictable regulatory/tax environment – pose a persistent risk to both volume growth and net revenues, especially given the company's small and threatened presence in these geographies.

- While recent margin improvements have been buoyed by government subsidy income-mainly from industrial promotion schemes-this stream is neither predictable nor quantifiable going forward; dependence on such subsidies creates earnings volatility and obscures the sustainability of current profitability levels.

- The competitive landscape is intensifying, with multinational and domestic players expanding rapidly in premium and craft alcohol segments; Tilaknagar's ambitious product launches may require substantial and sustained A&SP investment, potentially compressing EBITDA margins if not matched by strong premiumization-led growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹568.0 for Tilaknagar Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹23.2 billion, earnings will come to ₹2.5 billion, and it would be trading on a PE ratio of 63.6x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹477.75, the analyst price target of ₹568.0 is 15.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.