Key Takeaways

- Rising preference for passive and alternative assets, along with slow digital adoption, threatens UTI AMC's revenue growth and scalability.

- Regulatory pressures and disrupted distribution channels are expected to compress margins and diminish long-term profitability.

- Strong distribution efficiency, investment performance, and product diversification are driving sustainable revenue growth, market share gains, and earnings stability amid evolving investor preferences and expanding operations.

Catalysts

About UTI Asset Management- UTI Asset Management Company (P) Ltd. is a privately owned investment manager.

- The rapid growth of passive products like ETFs and index funds, which now comprise a significant share of UTI AMC's AUM, is set to further accelerate. As passive products continue to attract larger inflows due to investor preference for low-cost strategies, yields are expected to dilute by several basis points. This will significantly compress management fee revenues and erode overall profitability.

- The intensifying shift toward digital distribution and emergence of new fintech platforms threatens to bypass traditional asset management channels. UTI AMC's incremental branch expansion and distribution network investment may become obsolete, resulting in high fixed costs with diminishing client acquisition efficiency, ultimately undermining both revenue growth and operating margins.

- Demographic changes and evolving investor preferences favoring alternative assets such as private equity, real estate, or high-yield instruments over conventional mutual funds are likely to slow down net inflows into equity and hybrid funds. This will constrain AUM growth and hit long-term scalability for UTI AMC, dampening future top-line expansion.

- Persistently slower digital transformation compared to agile competitors means UTI AMC risks losing out on the next generation of retail clients, as tech-savvy investors increasingly migrate to more advanced fintech-driven platforms. This will lead to stagnant or declining net inflows, impacting both top-line revenue growth and sustainable earnings power.

- Regulatory pressure, particularly with further tightening of fee caps and SEBI's ongoing push for lower distributor commissions, will compress fee incomes and reduce margin flexibility. As future inflows shift to lower-yielding products and regulatory headwinds intensify, net margins and core profitability are likely to remain under substantial pressure.

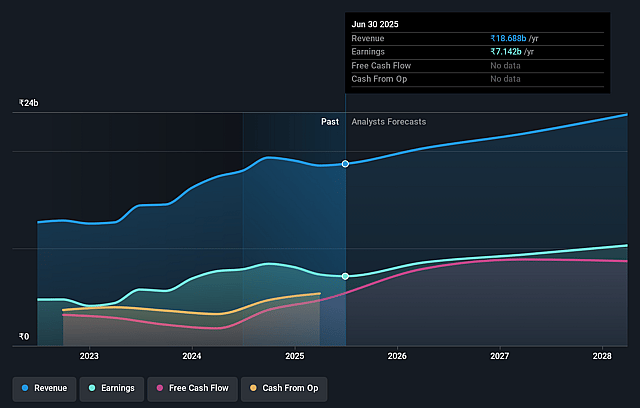

UTI Asset Management Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on UTI Asset Management compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming UTI Asset Management's revenue will grow by 8.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 38.2% today to 39.5% in 3 years time.

- The bearish analysts expect earnings to reach ₹9.4 billion (and earnings per share of ₹73.39) by about September 2028, up from ₹7.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 24.2x today. This future PE is lower than the current PE for the IN Capital Markets industry at 23.2x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.68%, as per the Simply Wall St company report.

UTI Asset Management Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained long-term growth in India's mutual fund industry is supported by robust macroeconomic fundamentals, expanding retail participation, and growing SIP inflows, which will likely drive broad-based increases in UTI AMC's revenue and maintain optimism for earnings growth in the coming years.

- UTI AMC's successful physical and digital expansion into B30 (beyond top 30) and Tier 2-3 cities, without a significant increase in operating costs, points to scalable distribution efficiency, which supports margin resilience and potential market share gain, positively impacting net margins and topline revenue.

- Improved investment performance, with 59% of equity AUM in the top quartile for one year and continuing strength over shorter time periods, increases the likelihood of further market share gains as longer track records translate into increased flows and better fee income, improving the company's revenue outlook.

- Product diversification with launches in passives (ETFs and index funds), smart beta, and alternatives enables UTI AMC to capture shifting investor preferences and defend against fee compression, providing stability and growth in revenue streams and protecting profitability.

- The company's strong position in retirement and pension management, as well as expanded global operations attracting international inflows, presents recurring and growing sources of institutional AUM, contributing to steady fee income and underpinning long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for UTI Asset Management is ₹1028.78, which represents two standard deviations below the consensus price target of ₹1402.31. This valuation is based on what can be assumed as the expectations of UTI Asset Management's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1650.0, and the most bearish reporting a price target of just ₹965.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹23.8 billion, earnings will come to ₹9.4 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1349.4, the bearish analyst price target of ₹1028.78 is 31.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.