Key Takeaways

- Cost-neutral expansion, localized education, and digital initiatives position UTI to capture underserved markets, fueling resilient AUM growth and sustained margin improvement.

- Diversification into new product lines and international markets, along with automation-driven efficiency gains, provide strong prospects for enhanced profits and fee resilience.

- Rising reliance on passive products, limited diversification, and higher costs expose UTI AMC to margin pressure, revenue volatility, and vulnerability to industry and regulatory changes.

Catalysts

About UTI Asset Management- UTI Asset Management Company (P) Ltd. is a privately owned investment manager.

- Analyst consensus expects robust AUM and revenue growth from the Tier 2 and Tier 3 branch expansion, but this likely understates the impact, as UTI's strategy of cost-neutral expansion and highly localized financial literacy campaigns positions it to dominate untapped markets, potentially driving a structural uplift in both AUM growth rates and client retention, translating to sustainably higher core revenues and long-term earnings growth.

- While analysts broadly agree that technology and digital initiatives will improve operating efficiency and margins, the transformative deployment of tools like Salesforce marketing automation and a now nearly 50% digital sales mix could rapidly compress acquisition costs and unlock significant scale benefits, resulting in operating leverage and margin expansion well ahead of industry peers.

- UTI's rigorous investor education programs and deep on-ground engagement-especially with youth and women-are accelerating the rise in financial literacy, suggesting UTI will be a prime beneficiary as tens of millions of new investors shift from physical to financial assets, driving persistent increases in retail flows, folios, and recurring management fee income.

- The company's diversified expansion into ETFs, alternatives, and global markets, combined with a first-mover advantage in international distribution and fund launches, sets the stage for exponential product-driven AUM gains and fee diversification, particularly as Indian capital markets attract greater institutional and sovereign investment allocations.

- UTI's aggressive rationalization of distributor commissions and process automation is only beginning to be reflected in yield and cost savings, indicating there is significant embedded future upside to net profit margins as these cost reductions are fully realized in subsequent quarters and years.

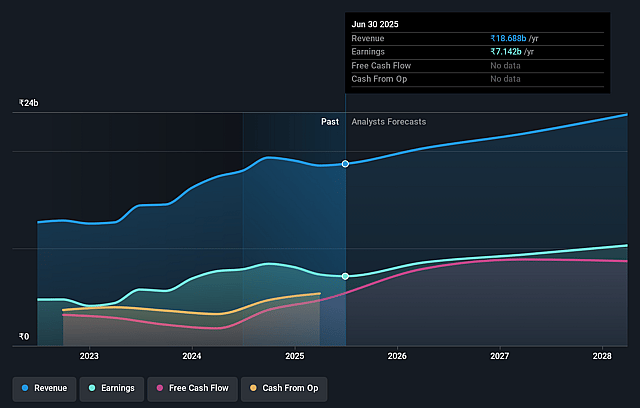

UTI Asset Management Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UTI Asset Management compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UTI Asset Management's revenue will grow by 11.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 38.2% today to 46.8% in 3 years time.

- The bullish analysts expect earnings to reach ₹12.1 billion (and earnings per share of ₹95.42) by about September 2028, up from ₹7.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.2x on those 2028 earnings, down from 24.1x today. This future PE is lower than the current PE for the IN Capital Markets industry at 23.5x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.77%, as per the Simply Wall St company report.

UTI Asset Management Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued strong growth in passively managed products, such as ETFs and index funds, is leading to lower average management fee yields, as highlighted by management's expectation of a dilution in yields due to higher ETF inflows; this secular shift threatens to compress revenues and overall profitability over the long term.

- UTI AMC remains dependent on relatively short-term improvements in fund performance, with management emphasizing that returns have improved only in the recent 1-year and even shorter periods, which creates the risk that inconsistent performance in the future could lead to persistent redemption pressure and stagnation or decline in assets under management, negatively impacting revenue and earnings.

- UTI AMC's relatively limited diversification into alternative assets and international markets (with international AUM comprising a minor portion and showing recent AUM declines due to market and currency impacts) makes the company more vulnerable to stagnation or downturns in the Indian retail mutual fund space, thereby limiting top-line growth and increasing revenue volatility.

- The company's cost base is rising, with ongoing significant branch expansion, investment in technology, and higher employee costs forecasted for both the core and subsidiary businesses; this trend, combined with industry-wide pressure on management fees, could lead to declining net margins and operational leverage.

- The mutual fund industry as a whole is experiencing moderation in fund inflows during market corrections, and regulatory changes like the removal of indexation benefits for debt mutual funds or stricter fee structures could increase compliance costs and further constrain profitability at UTI AMC.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UTI Asset Management is ₹1650.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UTI Asset Management's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1650.0, and the most bearish reporting a price target of just ₹965.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹25.9 billion, earnings will come to ₹12.1 billion, and it would be trading on a PE ratio of 21.2x, assuming you use a discount rate of 14.8%.

- Given the current share price of ₹1342.0, the bullish analyst price target of ₹1650.0 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.