Last Update 05 Sep 25

With both the future P/E and discount rate for UTI Asset Management remaining nearly unchanged, analysts have left their consensus price target effectively steady at ₹1402.

What's in the News

- Upcoming board meeting to discuss the relinquishment of the current Managing Director & CEO position and consider the appointment of Mr. Vetri Subramaniam as Additional Director (Executive Category) and Managing Director & CEO, effective February 1, 2026.

- Announced annual dividend of INR 26.00 per share, payable in August, with ex-date and record date in July.

- Scheduled board meeting to consider and approve unaudited standalone and consolidated financial results for the quarter ending June 30, 2025.

Valuation Changes

Summary of Valuation Changes for UTI Asset Management

- The Consensus Analyst Price Target remained effectively unchanged, at ₹1402.

- The Future P/E for UTI Asset Management remained effectively unchanged, moving only marginally from 19.78x to 19.58x.

- The Discount Rate for UTI Asset Management remained effectively unchanged, moving only marginally from 14.68% to 14.67%.

Key Takeaways

- Strategic branch expansion and tech adoption could boost investor acquisition, enhance efficiency, and improve profit margins in Tier 2/3 cities.

- Global expansion and ESG focus may increase AUM and revenue through heightened investor interest and international opportunities.

- Rising costs, market challenges, and regulatory changes pose risks to revenue growth, profitability, and earnings stability for UTI Asset Management.

Catalysts

About UTI Asset Management- UTI Asset Management Company (P) Ltd. is a privately owned investment manager.

- UTI AMC is expanding its presence in Tier 2 and Tier 3 cities with 68 new branches, targeting investor acquisition in these regions at net zero cost addition, which could boost the company's AUM and drive future revenue growth.

- The company is embracing technology with tools like Salesforce marketing automation and digital platform UTI HART to enhance investor engagement and streamline operations, likely improving efficiency and profit margins.

- Despite market volatility, UTI AMC has seen a positive shift from negative to positive net sales in equity and hybrid funds, with expectations that regulatory easing (e.g., ₹250 monthly SIP) will increase retail participation, benefiting revenue streams.

- Strategic global expansion, including a new office in New York, aims to capture international investment opportunities, potentially increasing AUM and international revenue.

- UTI AMC's increased focus on environmental, social, and governance (ESG) compliance and responsible investing could attract more investors, enhancing inflows and AUM, positively impacting earnings and revenue growth.

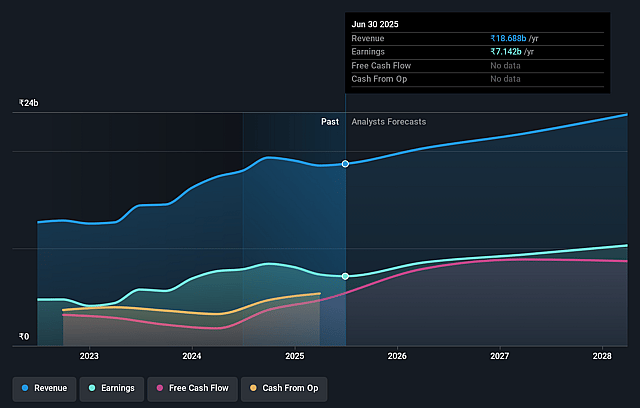

UTI Asset Management Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UTI Asset Management's revenue will grow by 9.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 38.2% today to 45.3% in 3 years time.

- Analysts expect earnings to reach ₹11.0 billion (and earnings per share of ₹78.89) by about September 2028, up from ₹7.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹8.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, down from 24.2x today. This future PE is lower than the current PE for the IN Capital Markets industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.68%, as per the Simply Wall St company report.

UTI Asset Management Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Moderation in equity inflows due to market correction and volatility suggests potential dips in revenue growth and fluctuations in earnings.

- Rising operating expenses, driven by branch expansion and marketing activities, could compress net margins if revenue growth does not keep pace.

- Decline in market share within certain segments and need for sustained fund performance indicate risks to revenue growth and profitability if market trends do not align.

- Regulatory changes, such as removal of indexation benefits, impacting tax rates may affect overall earnings stability.

- Growing reliance on international operations and ETF/index fund increases could lead to yield dilution and impact overall revenue and margins if not managed carefully.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1402.312 for UTI Asset Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1650.0, and the most bearish reporting a price target of just ₹965.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹24.3 billion, earnings will come to ₹11.0 billion, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1349.4, the analyst price target of ₹1402.31 is 3.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on UTI Asset Management?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.