Narratives are currently in beta

Key Takeaways

- Geographic expansion into northern states is designed to diversify market risks and increase revenue stability across diverse regions.

- Shifting to a weekly microfinance repayment model and tighter credit guidelines aims to enhance loan recovery and reduce delinquencies, boosting profitability.

- Elevated branch staff attrition and increased credit stress risk revenue and margins, with additional challenges in collection, geographical performance, and regulatory changes.

Catalysts

About Spandana Sphoorty Financial- Engages in the microfinance business in India.

- Spandana Sphoorty's strategic geographic expansion into northern states like Bihar, Uttar Pradesh, and Rajasthan aims to reduce business risks associated with geographic concentration, potentially increasing revenue stability in diverse markets.

- The shift towards a weekly microfinance repayment model could enhance customer engagement and potentially improve loan recovery rates, positively impacting net margins and profitability as repayment pressures on borrowers decrease.

- Implementing tighter credit guidelines and the upcoming industry-wide guardrail 2 could instill greater repayment discipline among customers, potentially reducing delinquencies and improving net income.

- Increased focus on recovery from the delinquent pool through a dedicated recovery team could lead to substantial cash inflows from previously written-off loans, enhancing earnings as recoveries contribute directly to the bottom line.

- The board's approval to raise up to ₹750 crores in confidence capital positions the company to capitalize on future growth opportunities once the market environment stabilizes, potentially boosting revenue growth and long-term profitability.

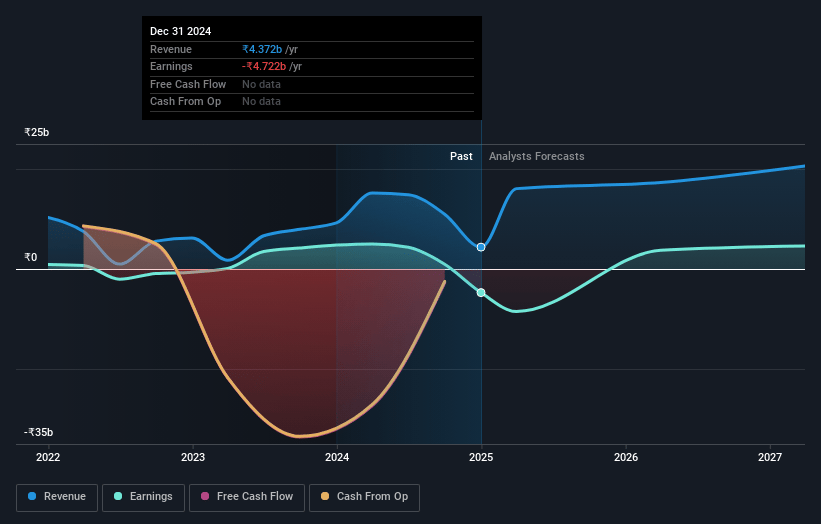

Spandana Sphoorty Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Spandana Sphoorty Financial's revenue will grow by 84.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -108.0% today to 31.9% in 3 years time.

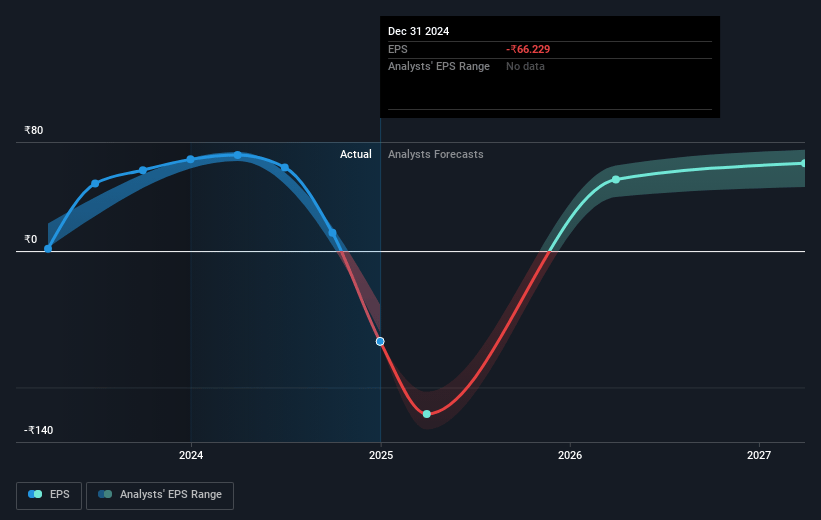

- Analysts expect earnings to reach ₹8.8 billion (and earnings per share of ₹123.4) by about January 2028, up from ₹-4.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.9x on those 2028 earnings, up from -4.8x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 20.6x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.31%, as per the Simply Wall St company report.

Spandana Sphoorty Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The financials of Spandana are being impacted by elevated levels of branch staff attrition, which can disrupt operations and lower borrower discipline, ultimately affecting their revenue and net margins.

- Increased borrower delinquencies and stress due to widespread availability of credit from multiple institutions can continue to risk collections, thus impacting net earnings adversely if this trend continues.

- Declined customer center meeting attendance post-COVID is increasing individual door knock collections, placing additional pressure on staff and increasing operational costs, negatively affecting margins.

- There's acute geographical risk as the company's recent expansion in Northern India, which has not performed as well internally as anticipated, may limit regional earnings potential.

- Structural changes in security norms (guardrails) limiting the number of lenders could slow down loan disbursement in the short term, impacting revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹490.86 for Spandana Sphoorty Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹925.0, and the most bearish reporting a price target of just ₹335.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹27.6 billion, earnings will come to ₹8.8 billion, and it would be trading on a PE ratio of 6.9x, assuming you use a discount rate of 20.3%.

- Given the current share price of ₹314.9, the analyst's price target of ₹490.86 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives