Key Takeaways

- Trading growth fueled by exceptional volatility is unlikely to persist, exposing revenue to declines as market conditions normalize and one-off events subside.

- High technology and compliance costs, combined with concentration in key commodities and regulatory headwinds, threaten both margins and long-term competitive strength.

- Strong volume growth, product innovation, and technology leadership enhance MCX's market position, while rising global and retail participation underpin long-term earnings resilience.

Catalysts

About Multi Commodity Exchange of India- A commodity derivatives exchange, provides a platform to facilitate online trading of commodity derivatives in India.

- Growth in trading volumes and revenues has been driven by exceptional levels of global volatility and macro events such as tariff-related spikes, which are unsustainable over the long term; as these one-off events subside and market volatility normalizes, MCX could see growth rates in transaction revenue sharply revert, directly affecting top line expansion.

- Despite investments in technology upgrades, ongoing and escalating technology costs-including continuous tech refresh, regulatory-mandated capacity expansions, and unplanned maintenance-are expected to pressure operating expenses for several years, negating operating leverage and leading to compressed net margins.

- MCX's future volumes and revenue remain highly concentrated in a narrow set of commodities like crude oil, natural gas, and gold; a structural shift away from carbon-intensive commodities due to accelerating climate policies-and investor migration toward digital assets or alternative investment vehicles-could lead to a sustained decline in trading activity on the core platform, eroding the company's earnings base.

- New product launches, such as electricity futures and index options, are facing regulatory delays with no timeline certainty; any further setbacks, or the entry of new competitors (such as other exchanges obtaining approval for key products first), could result in lost market share, directly threatening both MCX's topline and its long-term competitive position.

- Rising regulatory scrutiny, including the risk of higher compliance costs and potential fragmentation or commoditization of exchange services, threatens to undermine MCX's pricing power and margin structure, leading to a diminished profit outlook even if volumes remain elevated.

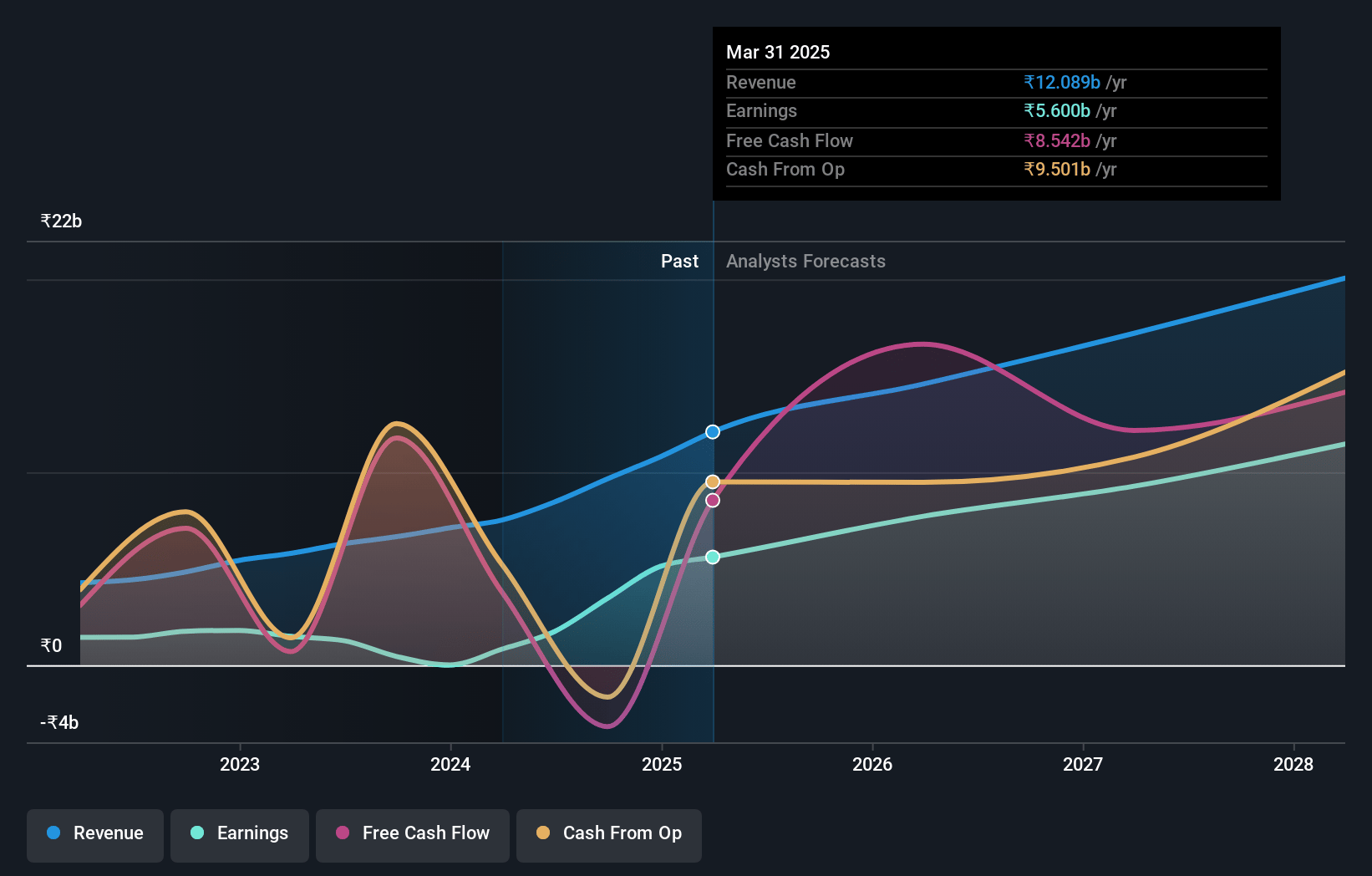

Multi Commodity Exchange of India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Multi Commodity Exchange of India compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Multi Commodity Exchange of India's revenue will grow by 17.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 46.3% today to 52.1% in 3 years time.

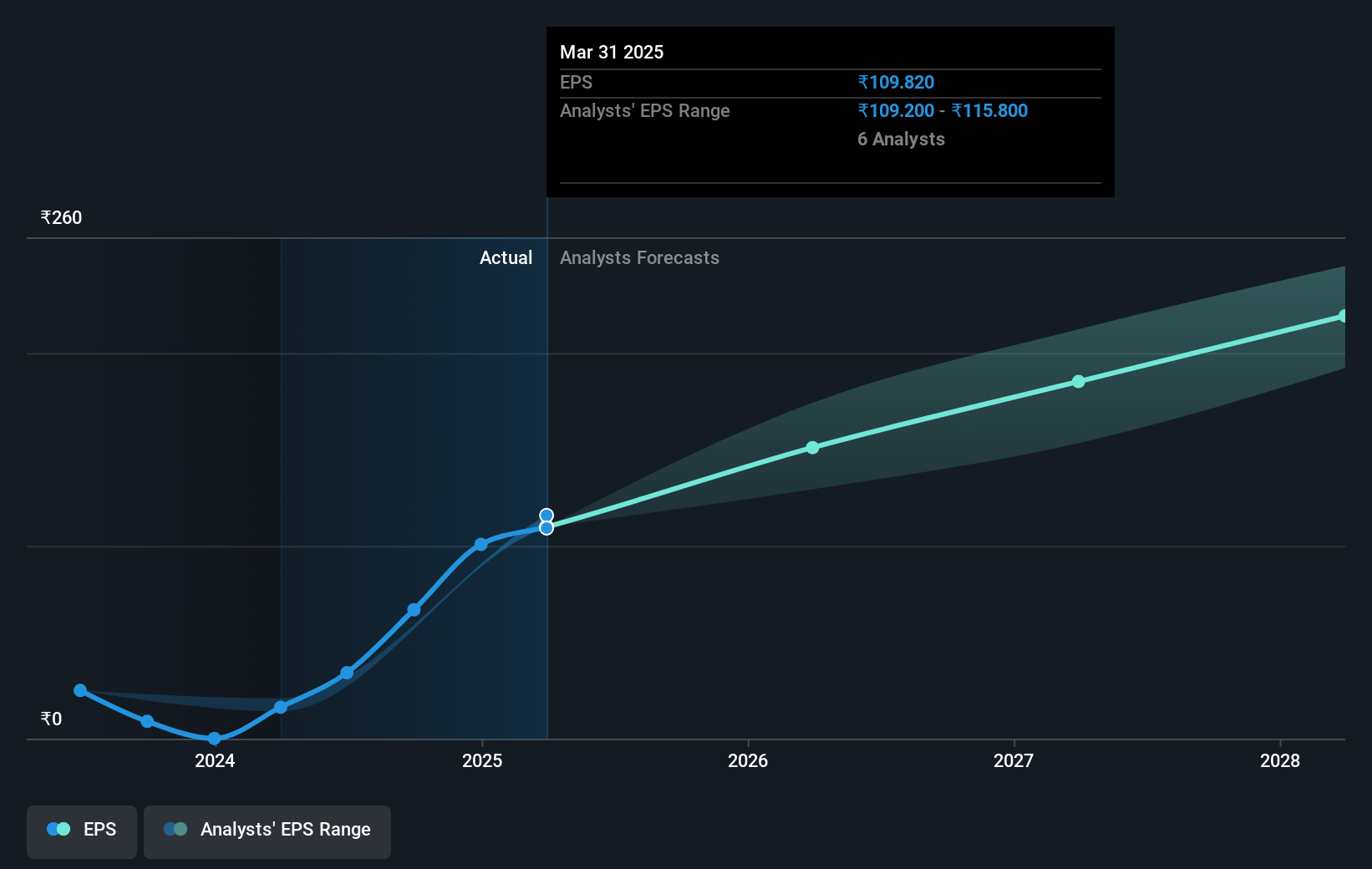

- The bearish analysts expect earnings to reach ₹10.3 billion (and earnings per share of ₹201.62) by about July 2028, up from ₹5.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.8x on those 2028 earnings, down from 75.2x today. This future PE is greater than the current PE for the IN Capital Markets industry at 25.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.52%, as per the Simply Wall St company report.

Multi Commodity Exchange of India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MCX has demonstrated exceptional growth in both revenue and earnings, reporting a 59% year-on-year increase in consolidated income and maintaining a robust profit after tax at a 46% margin, indicating strong secular momentum that may support future financial performance.

- The company is experiencing a surge in average daily throughput, with both futures and options volumes more than doubling, suggesting a broadening and deepening of its participant base across commercial, retail, and international investors, which could underpin sustained revenue growth.

- MCX is aggressively investing in new products such as index options, electricity futures, and micro contracts in silver and gold, alongside enhancing its base metal offering; these initiatives, once regulatory approvals are obtained, have the potential to create incremental and diversified revenue streams.

- The exchange is positioning itself as a technology leader by maintaining and scaling its proprietary platform, which supports higher participant connectivity, operational scalability, and readiness for growth; this could boost both top-line and margin efficiency as the business expands.

- Increasing participation from foreign portfolio investors (FPIs), expanding retail growth (reported 13 lakh traded clients), and MCX's global prominence as the world's largest commodity options exchange all indicate growing brand strength and international relevance, which can contribute to higher volumes and long-term earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Multi Commodity Exchange of India is ₹5750.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Multi Commodity Exchange of India's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹10000.0, and the most bearish reporting a price target of just ₹5750.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹19.7 billion, earnings will come to ₹10.3 billion, and it would be trading on a PE ratio of 42.8x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹8261.5, the bearish analyst price target of ₹5750.0 is 43.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.