Key Takeaways

- Rapid expansion in digital adoption, innovative product pipeline, and regulatory shifts could drive sustained outperformance and transform MCX's revenue streams and market reach.

- Strategic tech investments and a widening retail and global base are set to enhance margins, boost trading activity, and solidify long-term growth leadership.

- Greater competition, regulatory headwinds, dependence on a narrow product base, higher tech spending, and shifting investor trends threaten revenue growth and long-term profitability.

Catalysts

About Multi Commodity Exchange of India- A commodity derivatives exchange, provides a platform to facilitate online trading of commodity derivatives in India.

- While analyst consensus expects strong growth in trading volumes to boost earnings, the reality could be far more pronounced given that MCX has become the world's largest commodity options exchange and has more than doubled its average daily turnover over the past year-with India's rapid adoption of digital financial platforms still in its early stages, this positions MCX's revenues and profitability for potentially several years of outperformance versus current expectations.

- Analyst consensus believes product launches will drive incremental growth, but the upcoming pipeline-including index options, cash-settled contracts, micro and retail-friendly silver/gold products, and the high-potential electricity futures for India's vast power market-could transform MCX's revenue mix and open unprecedented addressable markets domestically and globally, with a step-change in top-line and margins if regulatory approvals align.

- Long-term formalization and financialization of household savings in India, with consumers shifting toward regulated financial assets, is set to materially expand MCX's retail customer base and increase participation depth, driving sustainable increases in transaction fees and boosting total revenue.

- The integration of international participants, especially a potential broadening of product access for FPIs and institutional investors as regulatory reforms continue, could unlock a new layer of high-frequency, higher-value trading activity, accelerating revenue growth and enhancing net fee-based margins.

- MCX's strategic investments in technology infrastructure and early adoption of innovative asset classes such as energy transition metals and carbon credits position it to lead as new commodities emerge, capturing outsized growth in a fast-evolving industry while maintaining strong operating leverage and superior long-term earnings growth.

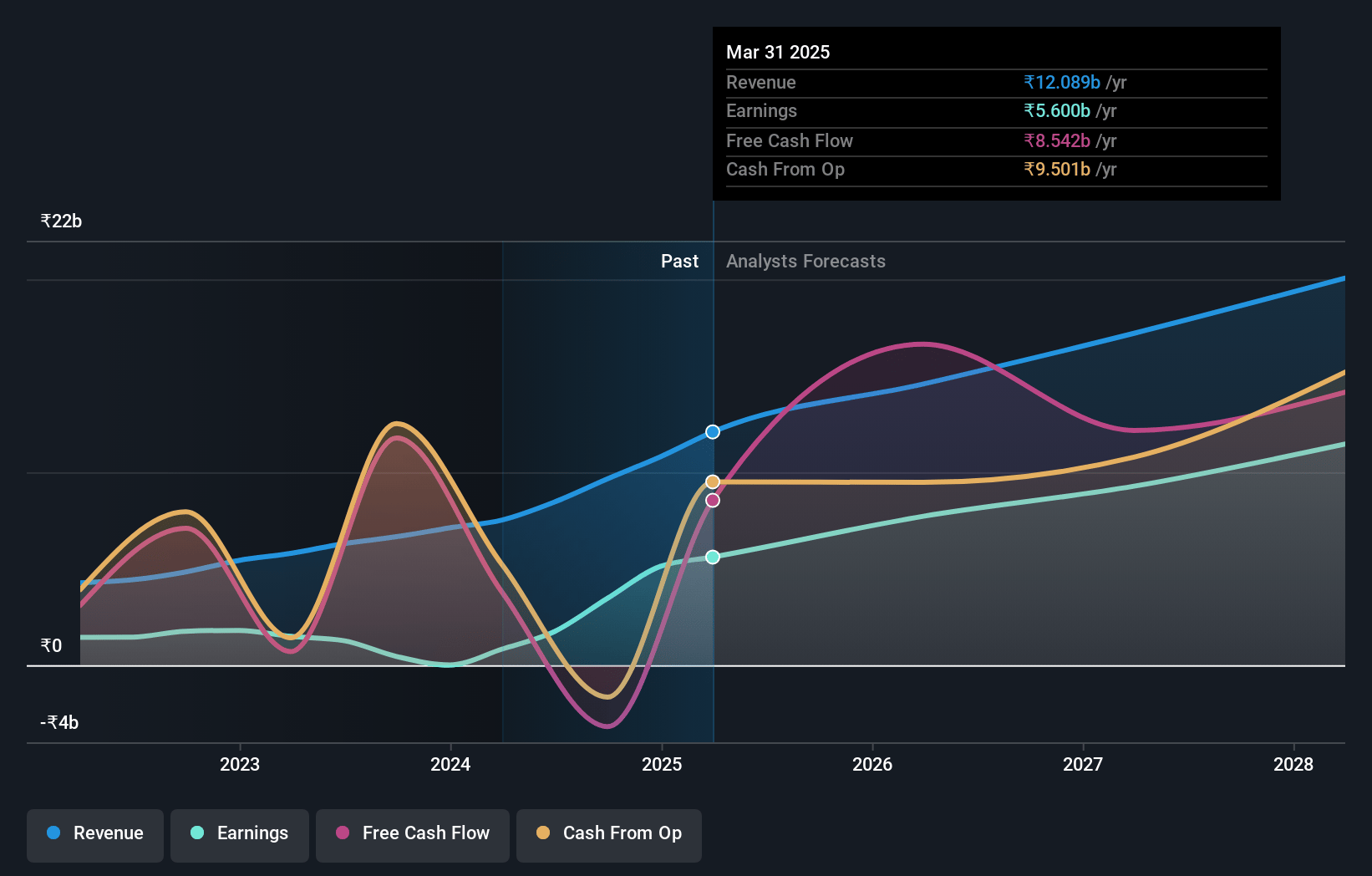

Multi Commodity Exchange of India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Multi Commodity Exchange of India compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Multi Commodity Exchange of India's revenue will grow by 21.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 46.3% today to 60.5% in 3 years time.

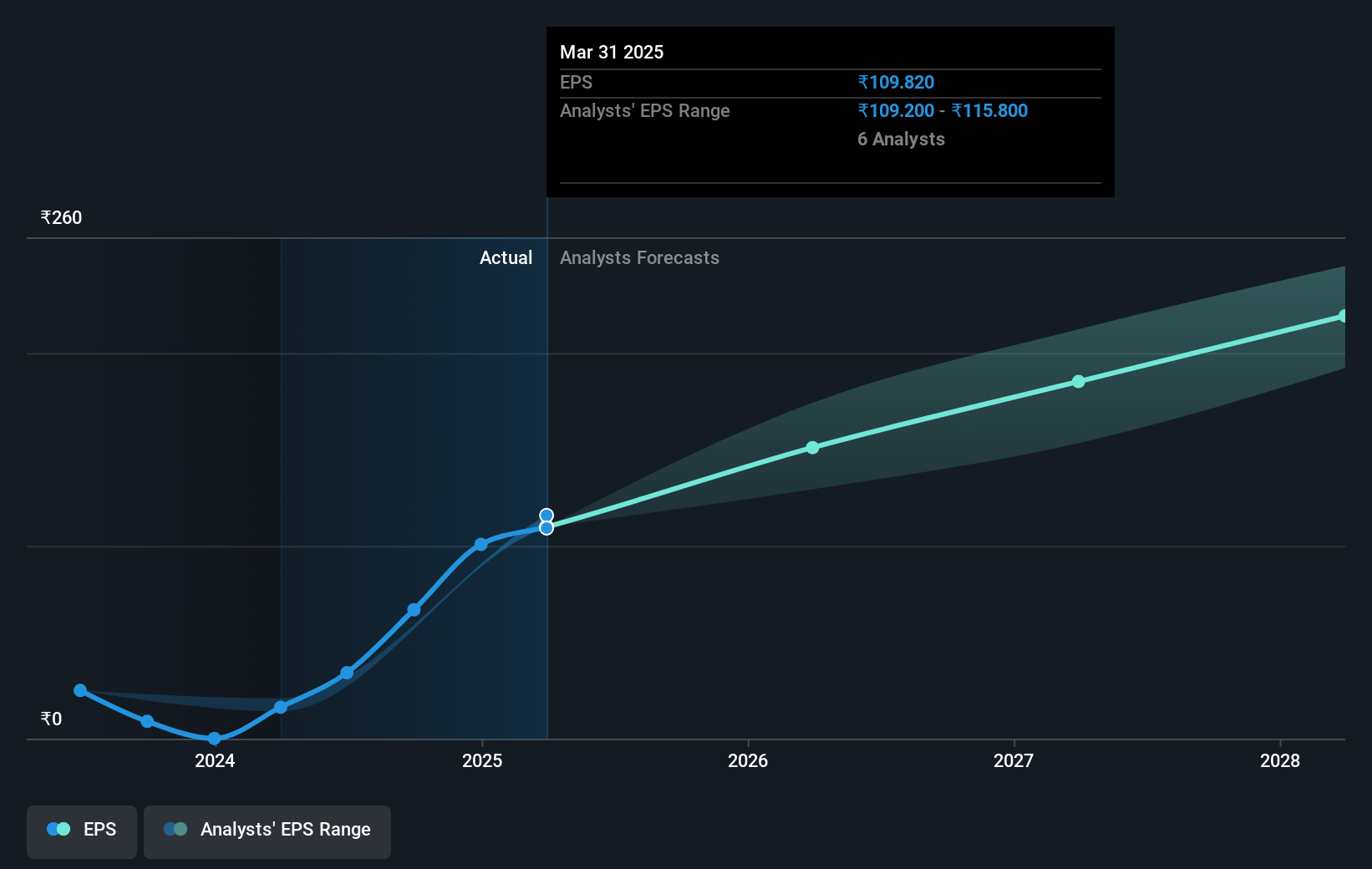

- The bullish analysts expect earnings to reach ₹13.1 billion (and earnings per share of ₹255.95) by about July 2028, up from ₹5.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 58.6x on those 2028 earnings, down from 73.3x today. This future PE is greater than the current PE for the IN Capital Markets industry at 24.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.46%, as per the Simply Wall St company report.

Multi Commodity Exchange of India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from established players like the National Stock Exchange entering commodity derivatives, as seen with discussions around electricity futures, could erode MCX's market share and pricing power, potentially impacting both revenue growth and net margins.

- Rising regulatory scrutiny, increasing compliance requirements, and ongoing uncertainty around regulatory approvals-evident in delayed green lights for new product launches and co-location facilities-may drive up operational costs and restrict MCX's ability to innovate, adversely affecting earnings and long-term profitability.

- Persistent reliance on a concentrated product mix, with a heavy dependence on bullion and energy contracts (as highlighted by questions around contribution shifts between gold, crude, and silver), leaves MCX vulnerable to demand shocks, lower premium realization, or regulatory changes targeting specific commodities, threatening revenue stability.

- The need for continuous, significant investments in technology infrastructure, including capacity building, tech refresh cycles, and preparedness for growth and regulatory change, signals structurally higher expenses that may weigh on margins and depress future profit growth even if top-line expands.

- The global trend toward decentralized finance (DeFi), alternative digital platforms, and ESG-driven investing may reduce traditional exchange volumes in commodities-especially if regulatory or investor sentiment shifts away from non-green commodities-posing a structural risk to MCX's future transaction-based revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Multi Commodity Exchange of India is ₹10000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Multi Commodity Exchange of India's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹10000.0, and the most bearish reporting a price target of just ₹5750.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹21.6 billion, earnings will come to ₹13.1 billion, and it would be trading on a PE ratio of 58.6x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹8048.0, the bullish analyst price target of ₹10000.0 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.